HLBank Research Highlights

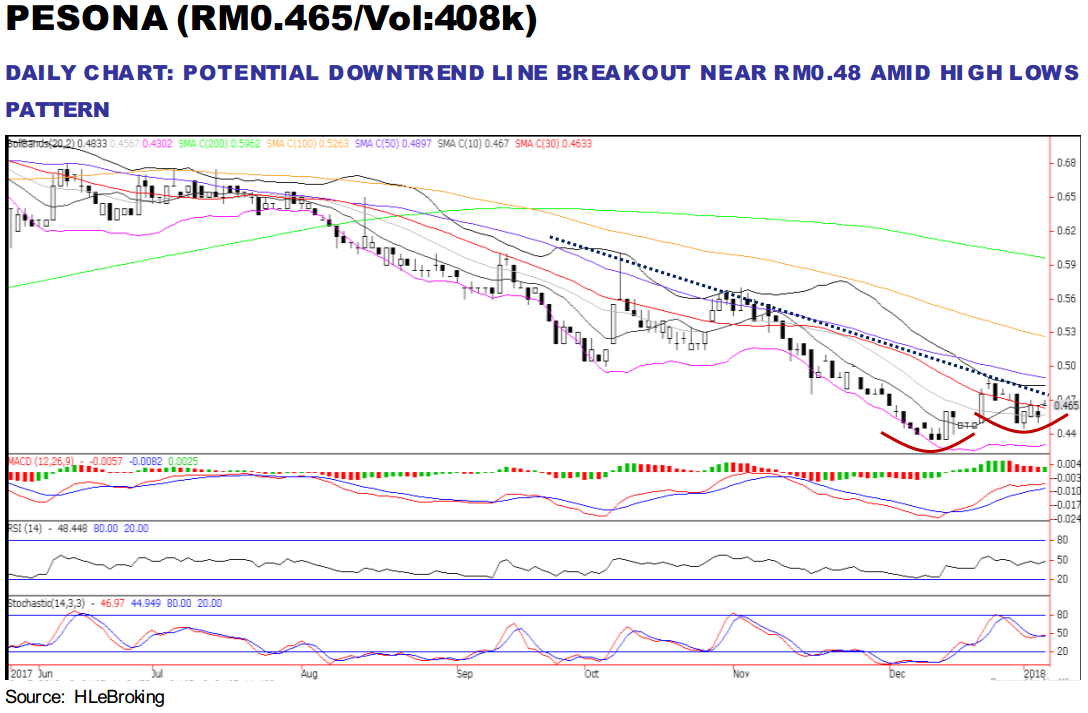

PESONA – Playing catch-up against its peers; Potential downtrend line breakout

HLInvest

Publish date: Mon, 08 Jan 2018, 10:07 AM

- Small but resilient: Pesona’s (listed in Oct 2012 via the RTO of Mithril) core business activities are the construction of residential and commercial buildings and infrastructure works, as well as produces polyurethane products and modular partition panels commonly known as PM2 panels which is an IBS certified product. Its key projects portfolio includes the construction of high-rise luxury residential buildings, commercial buildings for offices and malls, infrastructure works for the construction of highways as well as rehabilitation and beautification of rivers.

- Pesona also derives stable income from the acquisition of SEP, the eventual concessionaire of the completed UNIMAP hostel. Pesona’s acquisition of its 1 st tranche (70% stake) in SEP (concessionaire of UNIMAP hostel) was completed in end-Sept. As such, 4Q should begin to see contribution from UNIMAP which we estimate will amount to RM2m. The 2 nd tranche acquisition (balance 30% stake), this is targeted for completion by March 2018.

- HLIB institutional research has a BUY rating with SOP TP of RM0.70, or 50% upside. Pesona offers investors exposure to a pure construction play with an incoming stream of recurring earnings. Its orderbook stands at a healthy RM1.6bn, translating to a 4.2x cover on FY16 construction revenue (sufficient to last the group for the next 2 to 3 years), supported by robust earnings growth of ~30% from FY17-19.

- Potential downtrend reversal? Pesona has been a laggard (+6.9% vs 15.9% against its peers from 3M low) during the recent construction stocks’ run-up in anticipation of strong momentum of contract flows to be sustained over the next 1-2 years which will be driven by several mega rail jobs such as the ECRL, MRT3 and HSR.

- At RM0.465, Pesona is trading at 7.9x FY18 P/E, which is 45% below its peers (excluding outlier, MRCB), respectively. We see limited downside risks amid undemanding valuations and early signs of bottoming up in technical indicators coupled with the higher lows pattern. A successful downtrend line breakout above RM0.48 will spur prices higher towards RM0.53 (50% FR) before reaching our LT target at RM0.58 (38.2% FR). Key supports are situated near RM0.435 (12-14 Dec low) and RM0.425 (76.4% FR). However, failure to hold near RM1.66 levels may weaken share prices lower towards RM0.35-0.40 zones. Cut loss at RM0.415.

Source: Hong Leong Investment Bank Research - 8 Jan 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on HLBank Research Highlights

Technical tracker - HLIB Retail Research –19 July 2024 (Short-Selling)

Created by HLInvest | Jul 19, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments