HLBank Research Highlights

PTRANS – Defensive play with high entry barrier; Poise for a consolidation breakout

HLInvest

Publish date: Fri, 12 Jan 2018, 10:41 AM

- Company profile. Perak Transit Berhad (PTRANS) owns and operates a strategic transportation hub, Amanjaya Terminal, the only gazetted bus terminal in Ipoh. Its main revenue generator came from: (i) The Integrated Public Transportation Terminal (IPTT) which makes up 78% of gross profit due to its high margins of 87%, followed by (ii) Public Bus Services (19% of gross profit), and (iii) Petrol Station Operations (3% of gross profit). As PTRANS has fulfilled the Main Board transfer criteria, we think that it could attract investors from different segments.

- Terminal replication within Perak and Malaysia. Following the success of running Terminal Amanjaya, the company is building a lifestyle-centric bus terminal in Kampar (slated for completion by 2H18 and has a net lettable area 400k sq ft vs 49k sq ft at Amanjaya) to cater to the demography and rising status as an education hub.

- Defensive play with stable earnings and high entry barrier. We believe Amanjaya Terminal stands to dominate due to its monopolistic business nature and the high barriers. Also, we think the increased traffic flow during the Visit Perak Year 2017 and the Animation Theme Park, which was opened in June 2017 (about 5km from Amanjaya Terminal) should provide support for earnings growth catalyst in FY17 and, FY18- 19’s earnings impetus may derive from the operation of Kampar terminal.

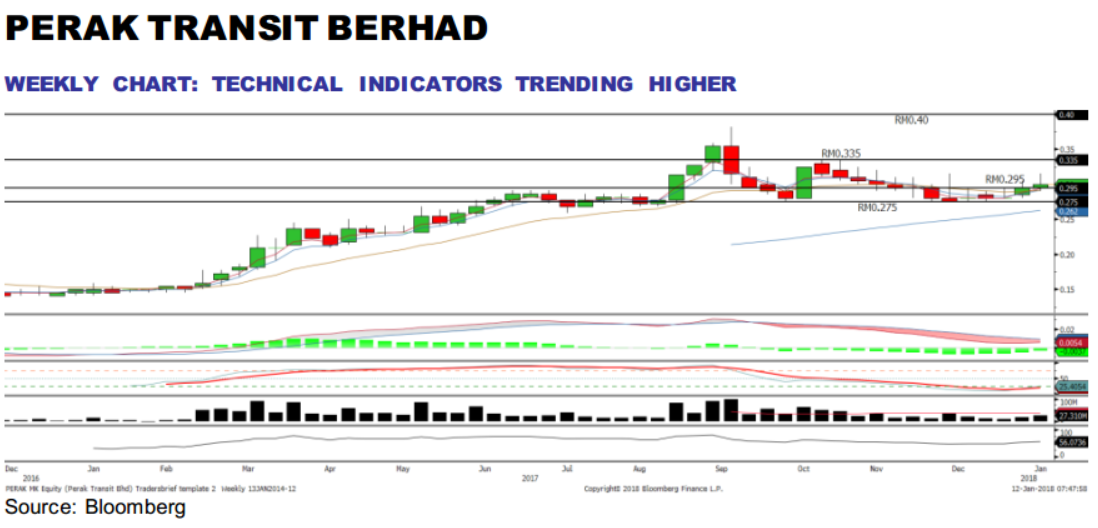

- Tail-end consolidation phase, poise for a breakout. PTRANS has retraced from the recent peak of RM0.35, forming a healthy support around RM0.275 over the past four months. We think PTRANS could be forming a flag formation after the mild retracement from the five-day high of RM0.31. Should there be a breakout above RM0.31, targeting RM0.335-0.345, followed by a LT target of RM0.40. Support will be set at RM0.285-0.295. Cut loss point will be at RM0.275.

Source: Hong Leong Investment Bank Research - 12 Jan 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on HLBank Research Highlights

Technical tracker - HLIB Retail Research –19 July 2024 (Short-Selling)

Created by HLInvest | Jul 19, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments