HLBank Research Highlights

CCMDBIO – A good defensive play in a volatile market; Potential downtrend reversal amid hammer pattern

HLInvest

Publish date: Thu, 08 Feb 2018, 05:16 PM

- Malaysia’s largest generic pharmaceutical manufacturer. CCMDBIO (the 1st pharmaceutical company being awarded with Halal Pharmaceuticals certification by JAKIM), is a pharmaceutical manufacturer and a key regional player that develops, manufactures and markets generic and Over-The-Counter (OTC) pharmaceutical products. They produce over 200 generic drugs, including award winning medications such as Omesec and Vascor whilst OTC brands such as CHAMPS, Flavettes, Proviton and Naturalle are well recognised and accepted by consumers in Malaysia and regionally.

- Boosting capacity by 50%. CCMDBIO would stay focused on its expansion in high value niche therapeutic products (via strategic partnerships with regional pharmaceutical companies) such as diabetes, renal, oncology and cardiology as well as vaccines. There are three manufacturing sites in Malaysia (Klang, Bangi & Glenmarie). In 3QFY17, CCMDBIO’s total sales were made up of 81% local market (government sector is the main contributor) vs. 19% export markets. The state-of-the-art facilities are currently progressing as planned and are targeted to be completed by 2018. The completion of this state-of-the-art plant will enable it to increase its production capacity by 50%.

- Positive earnings growth. According to consensus, CCMBIO is expected to grow at 8% EPS CAGR for FY17-19, driven by its capacity expansion, sustained increase in demand for pharmaceuticals from both the government and private sector as well as export markets. Moreover, margins are likely to improve amid greater traction from higher valued added specialty products (i.e. insulin and oncology) and recent RM strength as raw materials for the pharmaceutical industry are mainly imported and denominated in US$.

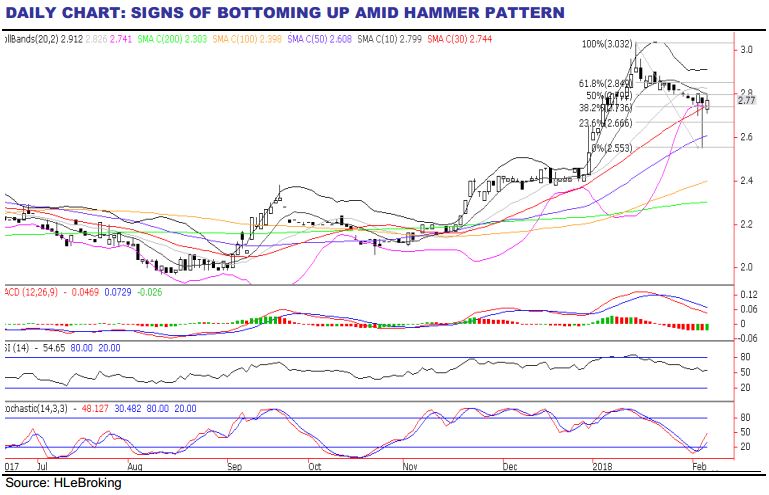

- Signs of bottoming up. In wake of ongoing market consolidation, CCMDBIO’s prices tumbled 16% from historical high of RM3.03 (6 Feb) to a low of RM2.55 (6 Feb) before closing at RM2.77 yesterday, as investors took profits after the completion of the demerger of CCMDBIO from CCM (investors have received 1.219 CCMDBIO shares for every 1 CCM shares). We see limited downside risks due to its earnings resilience and signs of bottoming up signals, following the formation of a hammer candlestick. A successful breakout above RM2.84 (61.8% FR) will spur prices higher towards RM2.91 (76.4% FR) and RM3.03 before reaching our LT target at RM3.14 (123.6% FR). Key supports are situated near RM2.60-2.70 levels. However, failure to hold near RM2.60 may weaken share prices lower towards RM2.50 zones. Cut loss at RM2.58.

Source: Hong Leong Investment Bank Research - 8 Feb 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on HLBank Research Highlights

Technical tracker - HLIB Retail Research –19 July 2024 (Short-Selling)

Created by HLInvest | Jul 19, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments