Bioalpha Holdings - Steady Growth Ahead; Poised for a Bullish Flag Breakout

HLInvest

Publish date: Mon, 22 Oct 2018, 10:02 AM

BIOHLDG has grown to become an integrated biotechnology company with businesses comprising all segments of the supply chain (eg in-house cultivation of raw materials, R&D, ODM, distribution and pharmacy chains). Valuations are undemanding at 9.6x FY19 P/E and 1.5x P/B (34% and 20% lower than its bigger cap peers), supported by a strong 63% EPS CAGR for FY17-19 and net cash of RM7.7m or 1sen/share. More synergies are coming from the recent proposed NWE’s acquisition to distribute its products to hotels all across the country as well as the MOU with Jinrui Fortune Group, China to jointly develop “Thousand Medicinal Hall” platform and herbal farms in China.

Company profile. BIOHLDG has grown to become an integrated biotechnology company with businesses comprising all segments of the supply chain, including the upstream cultivation of herbal plants as a source of raw materials for the in-house production of its products, R&D, Original Design Manufacturing (ODM), distribution and operating a downstream retail pharmacy chain under the brand “Constant”.

BIOHLDG is also the operator of the largest herbal parks in Malaysia. It has so far developed 260 acres at the Pasir Raja (Terengganu) herbal park. It has another 744 acres that would be fully planted by 2020F. At the Johor Desaru herbal park, some 100 acres have been developed so far, while the remaining 200 acres would be developed by year-end.

All of BIOHLDG’s health supplement products are Halal certified and are sold in Malaysia (71% to 1H18 revenue), with Indonesia (20%) and China (9%) as main export markets. Overall, about 60% of its revenue is from the manufacturing division with the balances from retail pharmacy segment. Its best sellers include cordyceps sinensis, tongkat ali and collagen beauty products.

Strong earnings growth and cheap valuations will cushion downside. At RM0.255, BIOHLDG is trading at consensus 9.6x FY19 P/E (about 34% below its bigger market cap peers), supported by strong FY17-19 EPS CAGR of 63% and attractive average net profit margins of 23% for FY18-19, underpinned by accelerating growth in domestic ODM sales and higher proportion of house brand sales through the retail arm’s contributions, with more opening of Constant pharmacy outlets beyond Klang Valley to Perak, Kelantan, Terengganu and Johor. The company targets to have 25 pharmacies in total by year-end (from 16 as at Sep 2018), and plans to add a further 15 outlets in 2019F.

For the exports segment, both Indonesia and China revenue dropped 5% and 17% respectively in 1H18 but management believe that FY19 should experience stronger sales when Bioalpha expects full necessary approvals for its food and health supplement products from authorities by year-end.

More synergies. By 2HFY19-FY20, BIOHLDG is expected to reap synergies from the recent proposed North West Enterprise S/B (NWE’s) acquisition (1 Oct) to distribute its products to hotels all across the country. NWE (likely to be funded by a 10% proposed placement announced on 1 Oct) is involved in the manufacture, trading and supply of hotel amenities, personal care products and instant beverage in sachets for major hotels and other establishments in the hospitality industry and it has a track record of more than 30 years (such as Shangri-La, Resorts World, Berjaya Hotels, Eastin Hotels, Sunway Resort Hotel & Spa, Hard Rock Hotels, Pullman Hotel & Resorts, Hotel Equatorial, Mahkota Hotel Melaka etc).

In additional, BIOHLDG has signed a MOU (18 Oct) with Jinrui Fortune Group, China to jointly develop “Thousand Medicinal Hall” platform and herbal farms in China. This is positive for BIOA as it can leverage on JFRH’s distribution network to promote the use of its traditional herb products in China.

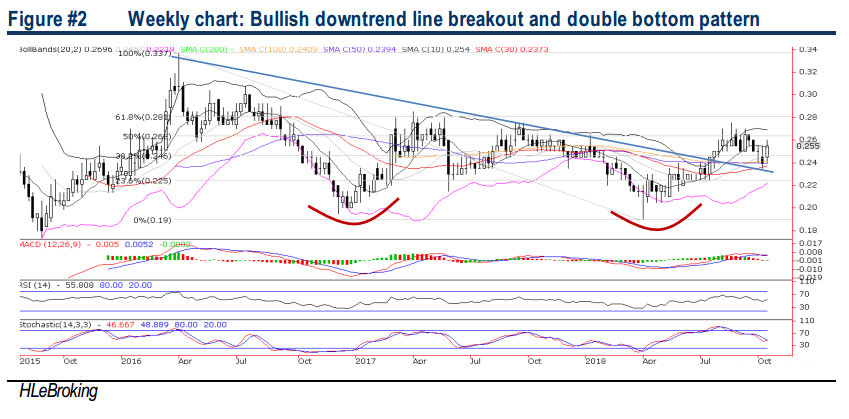

Poised for a bullish flag breakout. Following the weekly bullish LT downtrend line breakout and double bottom formation, we expect more upside pending a flag breakout. A successful breakout above daily upper Bollinger band near RM0.26 will spur greater upside towards 52-week high at RM0.275 (24 Aug) and RM0.30 psychological barrier before reaching our LT objective at RM0.335 (29 Mar 2016). Key supports are situated at RM0.245 (38.2% FR) and RM0.225 (23.6% FR). Cut loss at RM0.215.

Source: Hong Leong Investment Bank Research - 22 Oct 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024