Traders Brief - KLCI’s downside risk located around 1,658

HLInvest

Publish date: Mon, 29 Oct 2018, 09:05 AM

MARKET REVIEW

Despite the strong rebound on Wall Street on Thursday, Asia’s stock markets were mostly down, after trading a short-lived rebound on Friday. Investors were still cautious given the rising concerns over trade war, future growth outlook, geopolitical tensions and the ongoing corporate earnings. The Shanghai Composite Index and Hang Seng Index 0.19% and 1.11%, respectively.

In tandem with the regional sell down, the FBM KLCI ended lower at 0.21%, while market breadth remained negative with 470 decliners vs. 373 gainers. Market traded volumes came in below the 2.00bn mark at 1.82bn, worth RM1.68bn. Selected export-oriented companies such as Kossan, Top Glove and Vitrox traded higher amid weaker ringgit outlook.

Wall Street stayed volatile on Friday with the Dow and S&P500 declined 1.19% and 1.73%, respectively as market participants were disappointed by softer revenue and outlook guidance by Amazon and Alphabet, which overshadowed strong economic data (US GDP grew at 3.5% in 3Q18). Meanwhile, the Nasdaq dived 2.07%.

TECHNICAL OUTLOOK: KLCI

The FBM KLCI traded near the post-GE14 support of 1,658-1,670 and we opine that the downside could be limited as the key index has corrected more than 100 points since the downward violation of 1,800 psychological level, coupled with both the RSI and Stochastic oscillator flashing the oversold status. The resistance will be pegged along 1,700-1,743.

Despite the sell down on Wall Street, we believe the sentiment on the local equities will be cautious and trading activities may turn tepid ahead of the Budget 2019 that will be held on 2nd November to gauge the future growth outlook for Malaysia. Hence, the trading range of the KLCI will be located within 1,658-1,700. Nevertheless, selected stocks within export-driven will be focused.

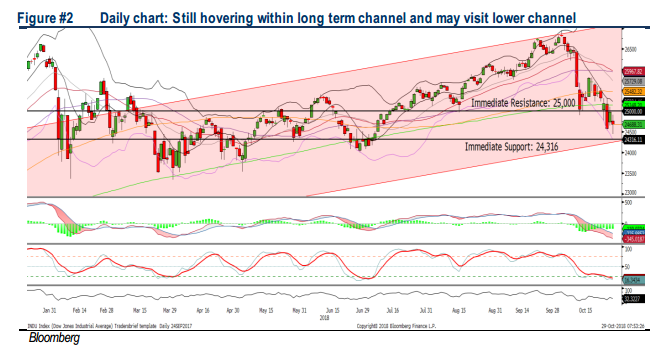

TECHNICAL OUTLOOK: DOW JONES

Following the few volatile sessions throughout the week, the Dow may have stabilised near the 24,500 level and the next support is located around the lower band of the long term upward channel. Although the MACD Indicator is still negative, the Stochastic is suggesting that the Dow is oversold. Hence, we may anticipate a short term technical rebound over the near term. Resistance will be envisaged around 25,000.

On Wall Street, investors may have already priced in part of the negative catalysts in the recent selling activities, which contributed to the correction phase on the Dow and S&P500. While we believe there could be further cautious sentiment on the markets, Wall Street could be due for a technical rebound amid oversold status.

Source: Hong Leong Investment Bank Research - 29 Oct 2018

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024