Traders Brief - Sentiment to stay tepid ahead of Budget 2019

HLInvest

Publish date: Tue, 30 Oct 2018, 12:29 PM

MARKET REVIEW

Key regional benchmark indices ended mostly lower following the weaker outlook guidance from technology companies in the US, coupled with the unresolved US-China trade disputes. The Nikkei 225 and Shanghai Composite Index fell 0.16% and 2.18%, respectively, but Hang Seng Index rose 0.38%.

The FBM KLCI fluctuated between the negative and positive territories before ending marginally higher by 0.04% to 1,683.73 pts. Market breadth was still negative with decliners outpaced the gainers by a ratio of near to 5-to-2. Market volumes stood at 1.85bn, worth RM1.43bn.

Wall Street continues to trade on a choppy session led by tech sell offs amid rich valuations as well as rising concerns over the upcoming trade discussions between US President Trump and Chinese President Xi. The Dow and S&P500 decline 0.99% and 0.66%, respectively, while Nasdaq plunged 1.63%.

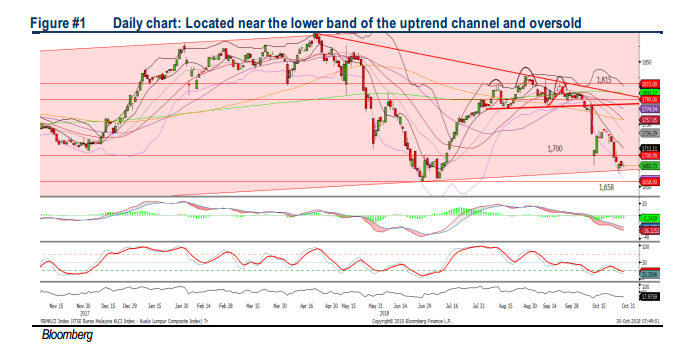

TECHNICAL OUTLOOK: KLCI

The FBM KLCI is still hovering below the 20D SMA and the negative momentum remains intact for the near term. The MACD Line is hovering below zero, but both the RSI and Stochastic oscillators are in the oversold region. Hence, based on the technical readings, the FBM KLCI could be due for a technical rebound and the KLCI’s upside will be located around 1,700. Meanwhile, support will be set along 1,673, followed by 1,658.

On the local bourse, we believe the trading activities will remain subdued ahead of the widely anticipated Budget 2019 on this Friday to understand a clearer picture on Malaysia’s future growth outlook. Hence, the KLCI could be ranging between the 1,673-1,700 levels. Meanwhile, with the softer outlook guidance on tech companies in the US, we expect selling pressure to be seen on technology stocks in Malaysia.

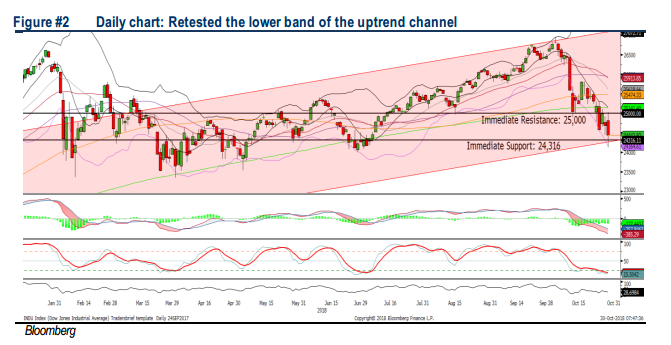

TECHNICAL OUTLOOK: DOW JONES

Another volatile session has pushed the Dow lower, retesting the support around 24,316 (lower band of the uptrend channel) and the MACD Line stayed below zero. However, the Stochastic oscillator is in the oversold region and could be anticipating a short recovery of the Dow towards the resistance along 25,000. Further support will be anchored around 24,000.

With the sentiment staying soft on the back of potential slowdown in corporate earnings and the rising concerns over global outlook amid the prolonged trade war situation, we may anticipate further selling pressure on Wall Street. Meanwhile, investors will be focusing on the corporate results from Facebook and Apple later this week.

Source: Hong Leong Investment Bank Research - 30 Oct 2018

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024