Traders Brief - Market May Trend Higher Amid Positive Technicals

HLInvest

Publish date: Thu, 17 Oct 2019, 09:21 AM

MARKET REVIEW

Asian markets ended mildly higher, led by strong US corporate earnings and a potential breakthrough in Brexit deal negotiations. These positives helped soothe concerns as scant details about the partial US-China trade deal uncertainty following news that China demanded further talks before signing the so-called “phase one" deal as well as Beijing’s criticism of new US legislation seen as supportive of pro-democracy protest in HK.

Tracking higher regional markets, KLCI jumped 8.7 pts to close at intraday high 1574.9, led by gains in PETGAS, IOI, HLBANK, DIGI, IHH and CIMB. Trading volume increased to 3.06bn shares worth RM2.23bn as compared to Tuesday’s 2.62bn shares worth RM1.73bn. Market breadth was positive with 458 gainers as compared to 426 losers.

Following the 5% rally from Oct low of 25743 (3 Oct) to 27025 (15 Oct closing), the Dow eased 21 pts at 27004 overnight on profit taking after US Sep retail sales fell for the first time in seven months, offsetting a good set of results by Bank of America and United Airlines. An angry response from China to legislation passed by the US House of Representatives in support of Hong Kong pro-democracy protesters also cast doubt on prospects for the future of the trade deal between the two countries announced last Friday.

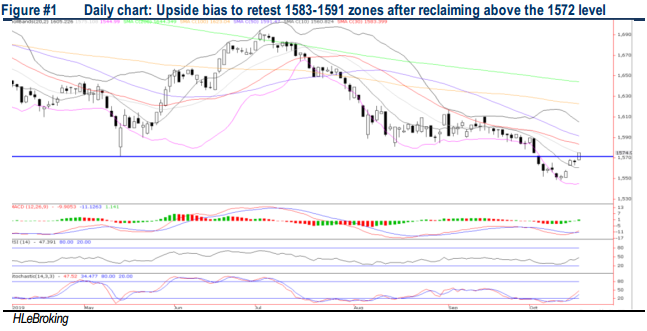

TECHNICAL OUTLOOK: KLCI

On the back of the “mini” US-China trade deal optimism and less austerity sounding Budget 2020, KLCI finally staged a 27-pt or 1.7% oversold rebound from 52W low of 1548 (10 Oct) to end at 1575 yesterday, a tad above the crucial neckline support-turned-resistance of 1572 (14 May low). Technically, the rebound from 1548 remains intact towards 1583 (SMA 30D) and 1591 (SMA 50D) zones, supported by bullish technicals and a reclaim above 1572. Key supports are 1560 (SMA10D) and 1545 (low BB) levels.

Following the start of upbeat US corporate earnings and on hopes of a Brexit deal breakthrough coupled with a less austerity sounding Budget 2020, KLCI is likely to resume its upward trajectory to retest 1583-1591 zones in the short term, supported by bottoming up technical indicators. However, the index should encounter stiff barriers near 1600 zones amid earnings woes and unattractive valuations, exacerbated by still unresolved US-China trade disputes. Key supports are pegged at 1560/1545 territory.

TECHNICAL OUTLOOK: DOW JONES

The Dow has regained its upward footing again following the rebound above the SMA200D levels near 26000. Despite an overbought slow stochastic, the MACD golden cross coupled with the rising RSI still auger well for further advance to retest all-time high of 27398 (18 Jul) and 27600 (weekly upper BB) territory. Key supports are set around 26700/26500.

Despite a relatively good start in the 3Q19 reporting season, sentiment could stay tepid due to the return of trade-deal scepticism. President Donald Trump said a trade deal with China probably will not be signed until he meets with Chinese President Xi at the APEC summit in Chile (11-17 Nov). Nevertheless, we believe any small steps forward could increase business confidence and spark capital investment, lifting corporate profits. We remain hopeful that further significant downside risk is limited (supported by the strong 200D SMA near 26000), cushioned by expectations of another round of Fed rate cut during the 30-31 Oct FOMC meeting. For the Dow, the trading range is set around 26500-27400.

Source: Hong Leong Investment Bank Research - 17 Oct 2019