AWC Bhd (7579) - An emerging undervalued data centre play? A share price...doubling on the horizon...

Axcapital

Publish date: Tue, 03 Sep 2024, 08:35 PM

Not all contracts are created equal. There are contracts, and there are CONTRACTS! AWC just announced a RM20m contract plumbing contract from Gamuda for a data centre project for 1-year from Sep 2024-Nov 2025. It is clear from other news announcements that this plumbing sub-contract is for the construction of Sime Darby’s RM1.74bn hyperscale data centre at Elmina Business Park for Google.

This announcement took Axcapital by total surprise because we had viewed the plumbing segment to be operating in an intensely competitive landscape and had not counted this division as a growth-division. The most recent high-profile project completed by the division was Merdeka 118.

This is a potential game-changer for the company, in addition to its already impressive array of STREAM potential and mega concessions in facilities management. Given the short-turnaround time, there is potential upside for FY25-profits not yet accounted for in consensus earnings estimates, potentially lifting profits by about RM2m (6-7%)

https://www.thestar.com.my/business/business-news/2024/05/30/google-commits-rm94bil-for-google-data-centre-and-cloud-region-in-malaysia

Outlook

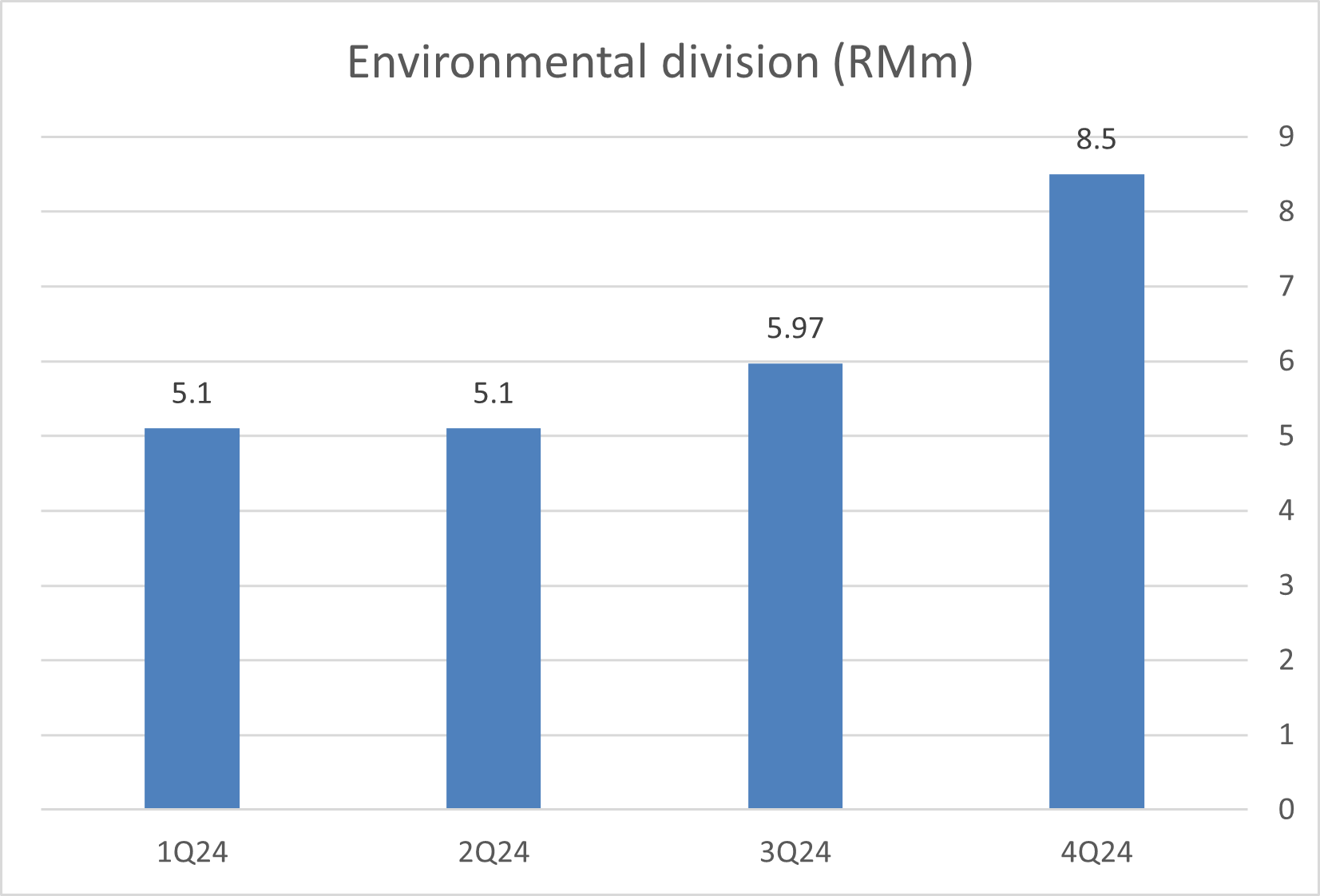

AWC reported full-year FY24 net profit of RM19.7m, beating consensus expectations by 13%. The most noteworthy observation of 4QFY24 results were the impressive turnaround in the facilities division and the continued growth momentum in STREAM’s profits. PBT from facilities skyrocketed 700% qoq, while STREAM’s PBT grew 42% qoq!

A full turnaround and tripling in profits from FY23-26 is expected, underpinned by full consolidation of STREAM’s earnings, new projects for STREAM post-acquisition as it embarks on an aggressive expansion path, while maintaining stable cashflows in its facilities division. New contract/concession wins in the healthcare space could be a positive surprise, leading to a CAGR in net profits of 85% from FY23-26F, according to Axcapital estimates. This does not include potential new contract-wins in the data centre space, now that AWC has won its maiden contract from Gamuda.

AWC’s business model is low-capex and generates strong operating cashflows, leading to net cash to rise to 32sen/share by end FY26, making up 30% of its current market cap by Axcapital’s estimates, translating to an ex-cash FY26F P/E of only 4.8x. The unencumbered cash, exceeding operational needs, opens avenues for rising dividends and share buybacks.

Catalysts

What catalysts could realise this upside potential?

1. In Axcapital’s experience, as AWC’s quarterly net profit trend continues delivering consistently, it will attract analysts’ attention in the sector. The latest announcement of AWC winning a contract in the data centre space could spark a massive share price re-rating.

2. Axcapital believes that the market has under-appreciated the message that 4Q financials paint about the growth prospects for AWC in FY25, given the muted response to its share price post earnings-release. PBT from facilities skyrocketed 700% qoq, while STREAM’s PBT grew 42% qoq! There is plenty of scope for AWC to beat consensus estimates in FY25.

3. Axcapital believes that AWC has the potential to double in the coming year based on very conservative valuation assumptions of 14x (10% discount to UEM Edgenta). However, if the market is excited about its data-centre potential and re-rates AWC to 20x, then AWC could see its share price rise to even RM2.50.

Happy investing.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Axcapital's investment blog

Created by Axcapital | Aug 21, 2024

(“Be greedy when others are fearful” – Warren Buffett)

Created by Axcapital | Oct 17, 2021

Created by Axcapital | Sep 25, 2021