Traders Brief - Heading for a Positive Move

HLInvest

Publish date: Mon, 16 Dec 2019, 05:02 PM

MARKET REVIEW

Despite the uncertain status on the trade front as market participants were still waiting for the phase one trade deal, coupled with the concerns over the scheduled tariffs to be imposed on Chinese goods on 15th Dec, Asia’s stock markets traded higher for the session. The Shanghai Composite Index and Nikkei 225 rose 0.43% and 0.23%, respectively, while Hang Seng Index added 1.07%. Tracking the regional stock markets, the FBM KLCI gained 0.31% to 1,568.44 pts. Market breadth was positive with 497 gainers vs. 355 losers. Market traded volumes stood at 2.49bn, worth RM1.54bn. We also observed that most of the plantation-related stocks such as WTK, JTIASA, SIMEPLT and TSH traded actively higher on the back of stronger crude palm oil prices. In the US, stocks managed to trend higher on the back of stronger than expected US jobs data; the US economy added 266k (vs. consensus of 187k) jobs in November, according to US Labour Department. In addition, the unemployment rate fell to 3.5%, its lowest level since 1969. The Dow and S&P500 advanced 1.22% and 0.91%, while Nasdaq increased 1.01%.

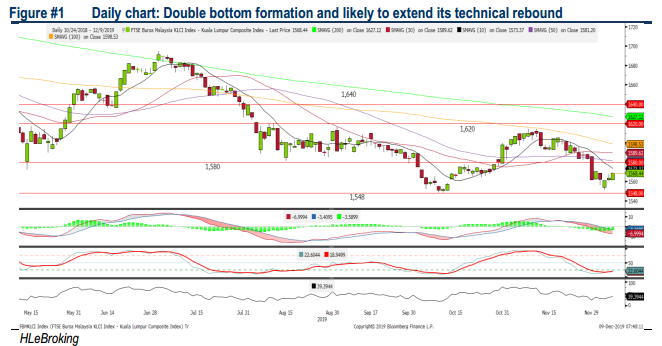

TECHNICAL OUTLOOK: KLCI

After forming a double bottom formation around the 1,550 level, the FBM KLCI managed to recover mildly over the past 3 sessions. The MACD Indicator has stabilised and the MACD Histogram has shown some decent rebound over the past 2 sessions. Also, both the RSI and Stochastic oscillators have been gradually trending higher after hitting the oversold region last week. Hence, we believe the FBM KLCI could revisit resistance along 1,580-1,600. Meanwhile, support is anchored around 1,550, followed by 1,530.

Following the improved sentiment on the global trade front as well as the positive performances on regional markets, we expect the buying interest to follow through on Bursa, supporting the FBM KLCI at least above the 1,550 level over the near term. Traders could focus in technology and plantation stocks - the rally on the latter may sustain given the decent rally in FCPO prices. Also, O&G stocks should be traded actively following the production cuts from OPEC members from 1.7m barrels a day to 1.2m barrels a day.

TECHNICAL OUTLOOK: DOW JONES

After forming a hammer candle along 27,400 last week, it has further rebounded, closing above 28,000 on Friday. The MACD Line turned flattish and MACD Histogram recovered. Meanwhile, both the RSI and Stochastic oscillators have rebounded strongly, indicating that the momentum is positive at this juncture. Hence, we opine that the Dow may trend higher over the near term, retesting the recent high around 28,200. Next resistance is envisaged around 28,400. Support is located around 27,400.

Despite the ongoing uncertainty on the trade environment (without any trade resolution), coupled with the scheduled 15% tariff on about USD160bn worth of goods from China, the stronger-than-expected US jobs data will be able to support the equities at least for the near term. However, should any disappointments arise from the phase one trade deal, we expect profit taking activities could emerge. The Dow’s trading range will be set around 27,400- 28,400.

Source: Hong Leong Investment Bank Research - 16 Dec 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|