Traders Brief - Choppy Markets and Downside Risk Likely to Persist

HLInvest

Publish date: Wed, 19 Feb 2020, 09:10 AM

MARKET REVIEW

Asia’s stock markets ended mostly in the negative region after Apple issued revenue warning that it does not expect to meet its quarterly revenue forecast amid lower iPhone supply globally and lower Chinese demand on the back of the Covid-19 outbreak. The Hang Seng Index and Nikkei 225 fell 1.54% and 1.40%, respectively, while Shanghai Composite Index (+0.05%) closed flat.

Meanwhile, sentiment on the local front was negative following the Apple’s revenue warning statement; technology stocks such as GTRONIC and INARI traded actively lower. The FBM KLCI traded flat for the day, while FBM Small Cap and FBM ACE trended more than 1% lower for the session. Market breadth was negative with 598 decliners vs. 254 gainers, accompanied by overall traded volume of RM2.78bn, worth RM2.06bn.

Wall Street ended mostly lower following Apple’s statement that its business could potentially slowdown on the back of Covid-19 outbreak and investors were having the same view that most of the companies that have exposure in China are likely to face a short term challenge in 1Q2020. The Dow and S&P500 slipped 0.56% and 0.29%, respectively, while Nasdaq (+0.02%) ended flat for the session.

TECHNICAL OUTLOOK: KLCI

The FBM KLCI ended lower but formed a small hammer candle. The MACD indicator is still hovering below zero; suggesting that the downside move may persist. Meanwhile, both the RSI and Stochastic oscillators are still hovering below 50. Resistance is set around 1,550, while support is anchored at 1,515.

Given the potential slowdown in Apple amid the ongoing Covid-19 outbreak, which affected the sentiment on technology sector globally, we believe technology sector may trade towards the downside over the near term with an expectation of potential slowdown in earnings moving forward. Based on the technical reading on FBM KLCI, the trading range will be located around 1,515-1,560. Traders may look out for high divvy stocks and solid fundamental companies with net cash position to sail through this current cloudy situation.

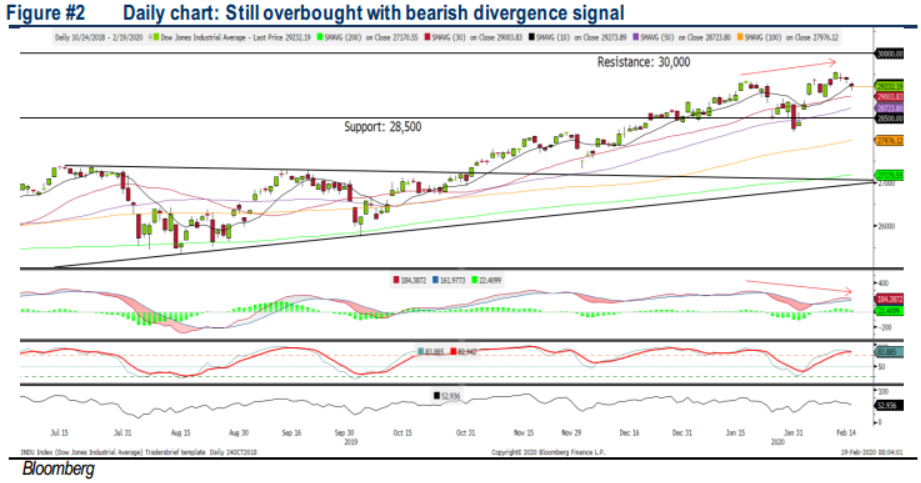

TECHNICAL OUTLOOK: DOW JONES

The Dow gapped down and ended lower for the second trading day after hitting the all-time high region last week. The MACD indicator has flashed a potential bearish divergence that may result in a potential extension in profit taking activities. The Stochas tic oscillator is hovering in the overbought region. The Dow’s resistance is located around 30,000, while support is anchored at 28,500.

Although Apple managed to rebound and closed intraday higher, we believe market participants will monitor and reassess the potential fallout of Covid-19 incident as it has partially disrupted the supply chain amid factories shutdown in China as well as softer demand from the outbreak. Traders will monitor the upcoming reporting season in the US for further actions. The Dow’s trading range will be located around 28,500-30,000.

Source: Hong Leong Investment Bank Research - 19 Feb 2020

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024