Traders Brief - Market to Remain Sideways Awaiting Fresh Leads

HLInvest

Publish date: Fri, 21 Feb 2020, 09:21 AM

MARKET REVIEW

Asia’s stock markets ended mostly higher led by Mainland Chinese stocks after PBoC announced a reduction in the lending benchmark rate on Thursday; the 1Y and 5Y loan prime rates (LPR) were reduced by 10 and 5 basis points, respectively. Shanghai Composite Index and Nikkei 225 rose 1.84% and 0.34%, respectively, but Hang Seng Index slipped 0.17%.

Meanwhile, the FBM KLCI (+0.05% to 1,534.98 pts) managed to recoup earlier losses amid last minute buying support on selected index heavyweights such as Tenaga, Public Bank and CIMB. Market breadth was fairly negative with 436 decliners as compared to 405 advancers. We noticed technology (MYEG, INARI) and O&G (CARIMIN, ARMADA) stocks were traded actively for the session.

Wall Street ended mostly lower as market participants reassessed the impact of Covid-19 outbreak on global growth amid the partial supply chain disruptions and potential slowing demand moving forward. Meanwhile, news reports of sharp uptick in infections in Beijing and South Korea dampen the sentiment as well. The Dow and S&P500 fell 0.44% and 0.38%, respectively while Nasdaq declined 0.67%.

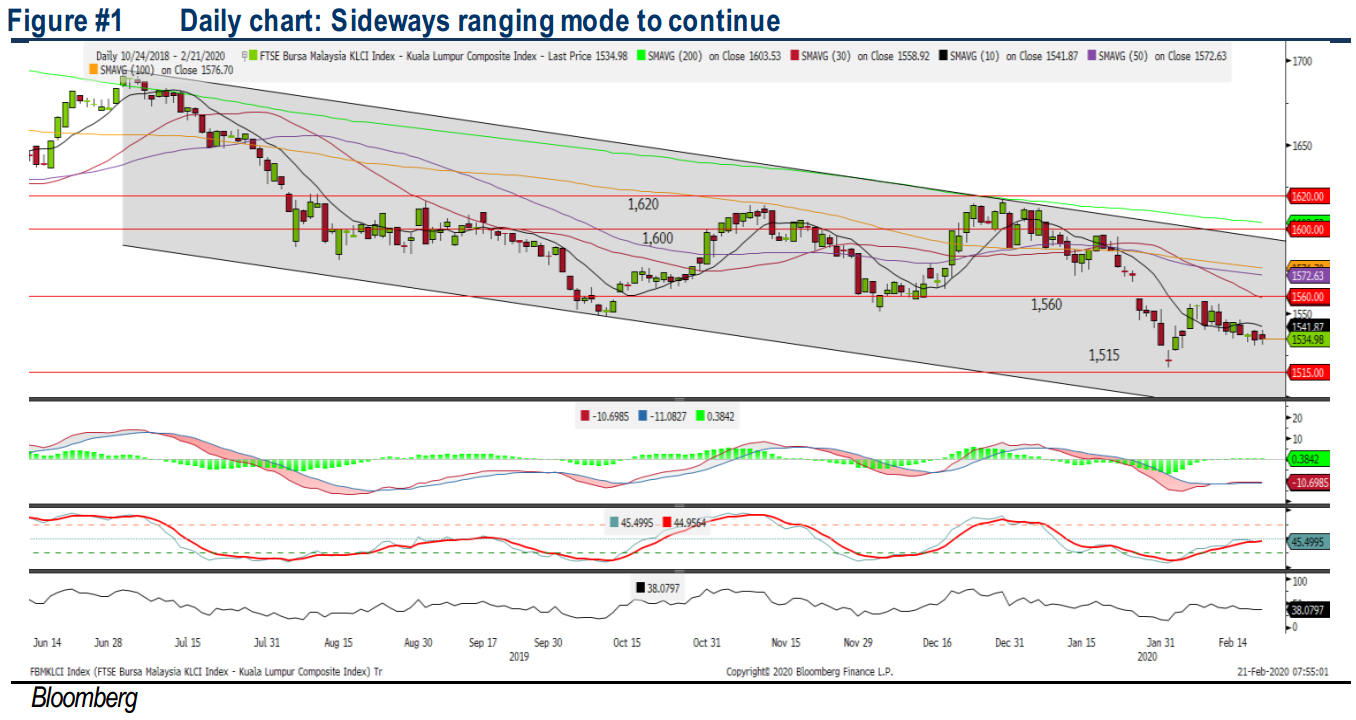

TECHNICAL OUTLOOK: KLCI

The FBM KLCI consolidated (past two days) within the narrow range between 1,531-1,540 and the MACD Indicator is hovering below zero level. Meanwhile, both the RSI and Stochastic oscillators are trending higher near the 50 level. We think the KLCI could consolidate further with a trading range located around 1,515-1,560.

On the local front, we opine that KLCI’s consolidation phase may still persist in the near term, tracking the performance on overnight Wall Street. Should the Covid-19 situation prolong, it may pose downside risk towards global economic activities, capping the upside potential on the KLCI. However, we think traders may monitor stocks under plastic and paper packaging segments as we noticed trading volumes spiking up over the past week, as well as the stimulus measure announcement by the government on 27 Feb.

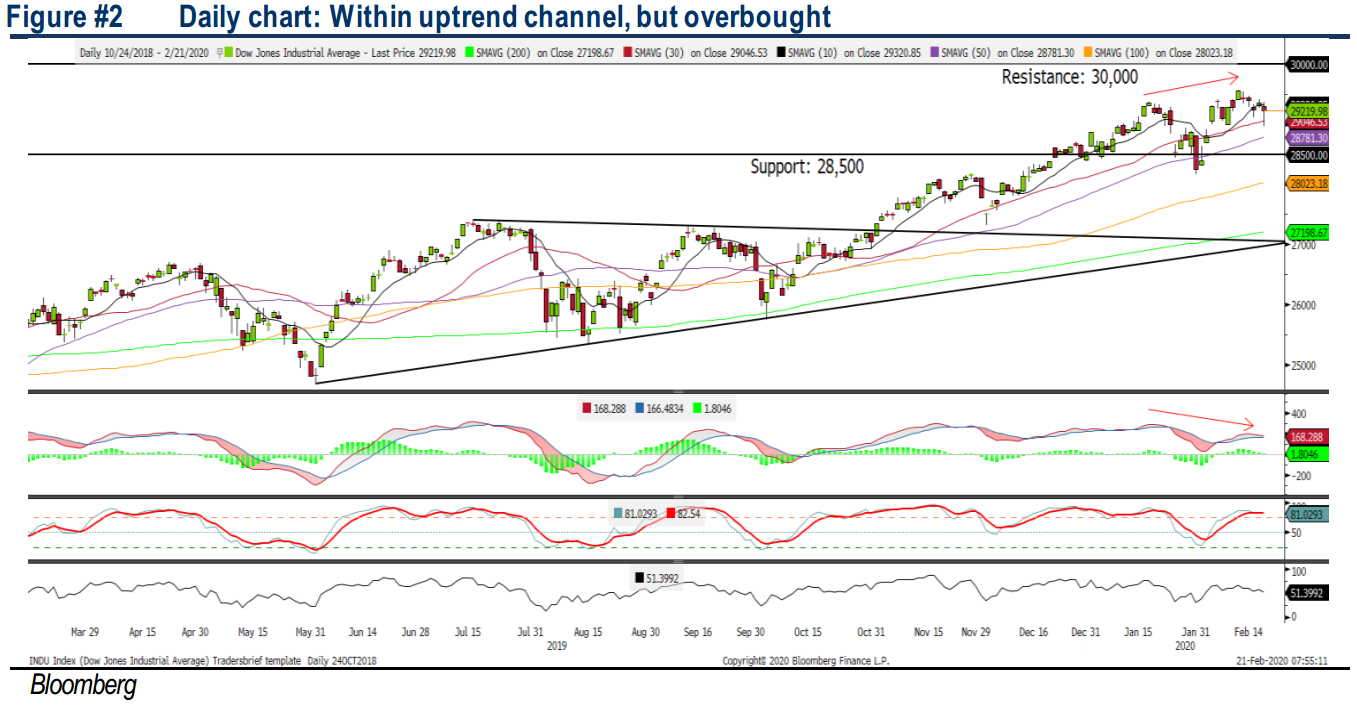

TECHNICAL OUTLOOK: DOW JONES

The Dow pulled back yesterday but managed to form a hammer candle near the SMA30. The MACD Indicator however is turning lower and flashing with a bearish divergence signal. Meanwhile, the Stochastic oscillator is overbought. Hence, with the current technic al readings, we believe upside could be capped near 30,000. Support is set around 28,500.

In the US, we believe markets will remain choppy near the all -time-high zone under the Covid- 19 episode as investors will continue to assess the real impact of the Covid -19 outbreak, which may weaken the global economy amid the ongoing trade war environment. Should more companies in the US comes out with warning statements of the coronavirus impact, we believe trading sentiment may turn negative and the Dow’s upside should be capped around 30,000.

Source: Hong Leong Investment Bank Research - 21 Feb 2020

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024