Traders Brief - KLCI to Rebound Amid Positive Sentiment From Wall Street

HLInvest

Publish date: Tue, 03 Mar 2020, 09:10 AM

MARKET REVIEW

Regionally, stock markets managed to rebound strongly despite the released of a weaker - than-expected China’s official PMI over the weekend (declined to 35.7 in February vs. 50.0 in January) as well as softer Markit/ Caixin manufacturing PMI of 40.3 (vs. consensus of 45.7), which was reported on Monday. The Shanghai Composite Index jumped 3.15%, while Hang Seng Index and Nikkei 225 rose 0.62% and 0.95%.

Meanwhile, stocks on the local front trended lower following the political developments over the weekend; the FBM KLCI traded towards an intraday low of 1,456.08 pts before ending around 1,466.94 pts (-1.06%). Market breadth was negative with 651 decliners as compared to 341 gainers. Market traded volume stood at 4.34bn, worth RM3.28bn. E-government services related stocks such as MYEG, DSONIC and HTPADU were seen traded actively higher for the session.

Wall Street traded significantly higher, rebounding off their worst week since the financial crisis on the back of expectations that the Federal Reserve would cut rates moving forward. Although China manufacturing PMI came in weaker-than-expected US stocks managed to rebound; the Dow and S&P500 advanced 5.09% and 4.60%, respectively, while Nasdaq added 4.49%.

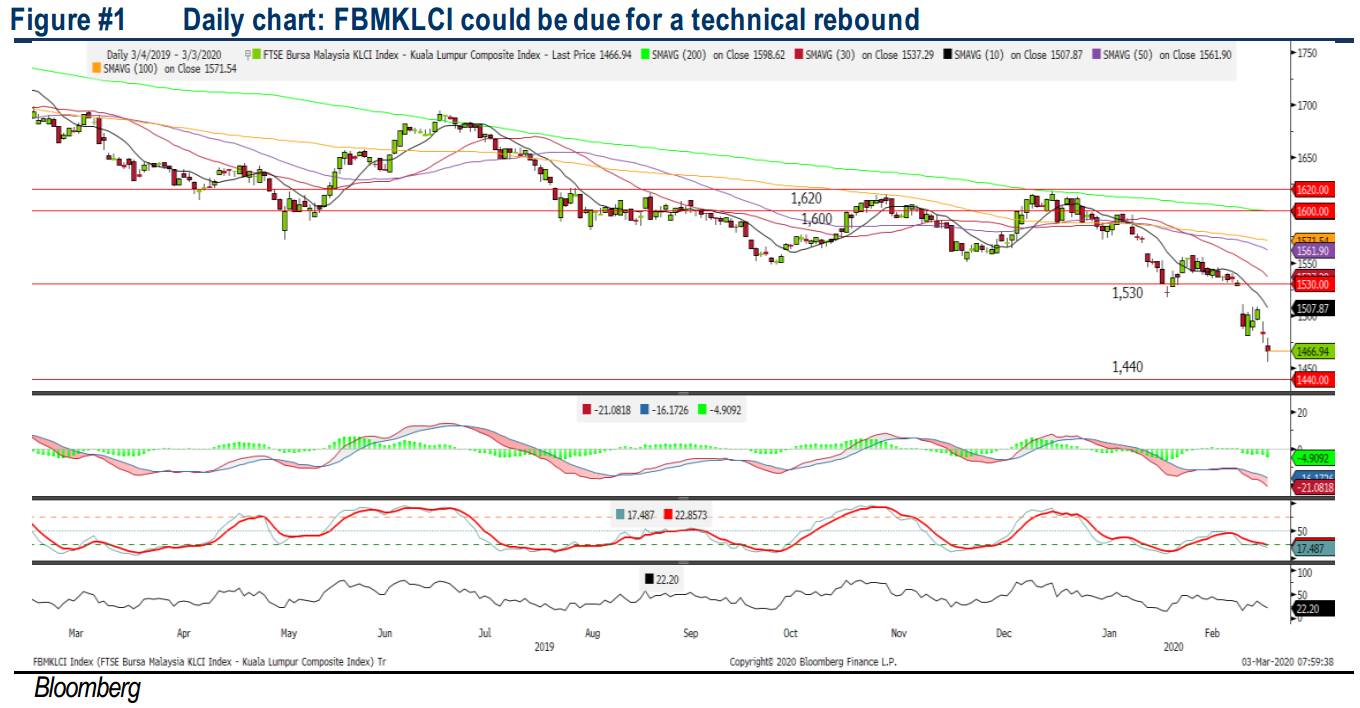

TECHNICAL OUTLOOK: KLCI

The FBM KLCI has trended lower, but forming another Doji candle near the 1,460 level. The MACD Indicator expanded negatively yesterday, but both the RSI and Stochastic oscillators are in the oversold region. Hence, with the technical readings, we expect the FBM KLCI could be due for a mild rebound, targeting 1,480-1,500. Key supports will be located around 1,444- 1,450.

Tracking the strong rebound on Wall Street, we believe buying interest could spillover to stocks on the local exchange, lifting the FBM KLCI towards 1,480-1,500 levels. Meanwhile, support will be set along 1,444-1,450. Besides, market participants will be monitoring on policies crafted by the new administration for investment decisions moving forward.

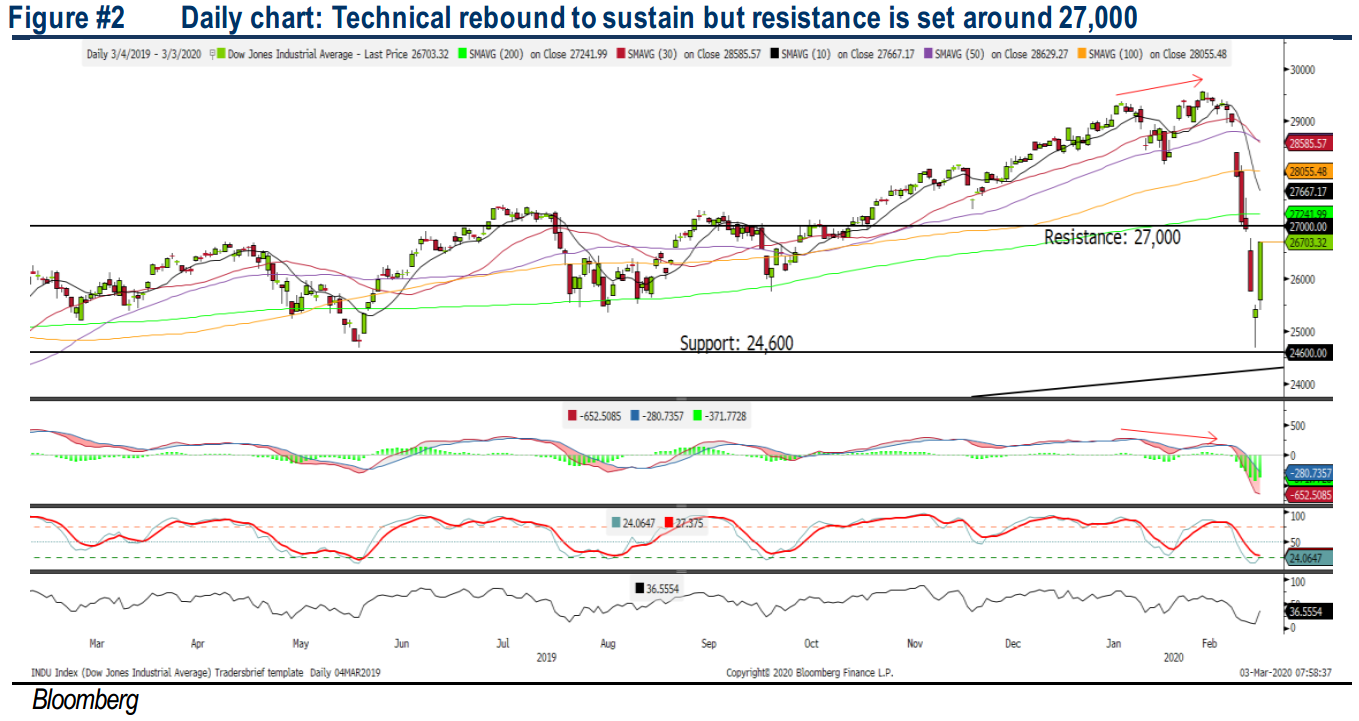

TECHNICAL OUTLOOK: DOW JONES

The Dow has rebounded significantly after forming a hammer candle and the MACD Histogram has recovered (but the MACD Line is below zero). Meanwhile, both the RSI and Stochastic have hooked up after hovering in the oversold region last week. The resistance is envisaged around 27,000, while support is set along 24,600.

In the US, after falling more than 12% from the peak across the indices on Wall Street on the back of the coronavirus episode, coupled with the expectations of another rate cut by the Federal Reserve moving forward, it could have hit a bottom for the recent correction and the support is located around 24,600. On the side note, should any of the headlines point towards increasing concerns over Covid-19 situation, upside could be limited around 27,000.

TECHNICAL TRACKER: CLOSED POSITION

Yesterday, we had squared off our 1Q2020 quarterly stock pick, MBL (5.8% loss) amid weakening technicals.

Source: Hong Leong Investment Bank Research - 3 Mar 2020

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024