Traders Brief - Downward Bias Tone to Prevail Over the Near Term

HLInvest

Publish date: Wed, 04 Mar 2020, 09:59 AM

MARKET REVIEW

Asia’s stock market ended mostly mixed as investors anticipate for further rate cuts from central banks across the globe to combat the potential slowdown in economic growth outlook amid the ongoing Covid-19 outbreak. The Reserve Bank of Australia announced Tuesday a cut in the cash rate by 25 basis points to 0.5%, a new record low. The Nikkei 225 fell 1.25%, while Shanghai Composite Index rose 0.74% and Hang Seng Index ended flat.

Bucking the mixed regional trend, stocks on the local front managed to trend higher with the FBM KLCI rising 0.80% to 1,478.64 pts following another rate cut (second time in 2020) by BNM to 2.5%. Market breadth was positive with 456 gainers vs. 410 losers, accompanied by 3.09bn, worth RM2.49bn. We noticed that gloves-related stocks (RUBEREX and COMFORT) were traded actively higher for the session.

Following a one-day rebound on Wall Street, trading tone remained volatile after a surprise rate cut by the Federal Reserve amid the ongoing Covid-19 outbreak and the 10-year Treasury yield was pushed below 1% at one point of trading. The rate cut decision came after the G7 meeting which commented they will use policy tools to curb an economic slowdown. The Dow briefly touched the 27,000 level before reversing into the negative territory and closed 2.94% lower for the session, while S&P500 and Nasdaq dived 2.81% and 3.00%, respectively.

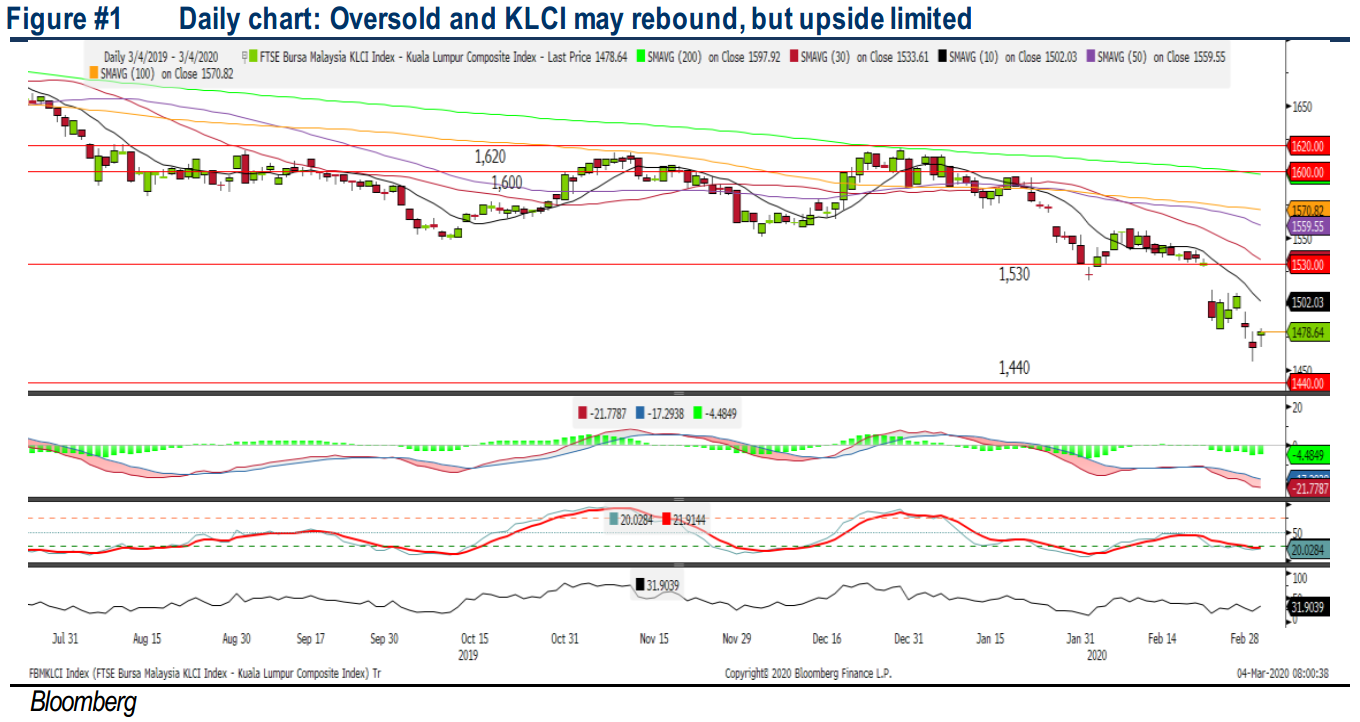

TECHNICAL OUTLOOK: KLCI

The FBM KLCI rebounded sharply after a steep decline on Monday and the MACD Histogram has recovered mildly. The RSI and Stochastic oscillators have rebounded, trending out of the oversold region. However, we believe the FBM KLCI short term technical rebound could be short-lived and upside will be capped along the resistance at 1,500. Support is located around 1,444-1,450.

Tracking the negative performance on Wall Street overnight, we expect the near term trading momentum would be downward bias (albeit with a short-lived rebound). Also, the sudden interest rate cut by the policy makers could be signalling that further uncertainty and downside risk to be expected under the Covid-19 situation. Hence, the upside on the FBM KLCI would be limited along 1,500 and KLCI’s support will be located around 1,444-1,450.

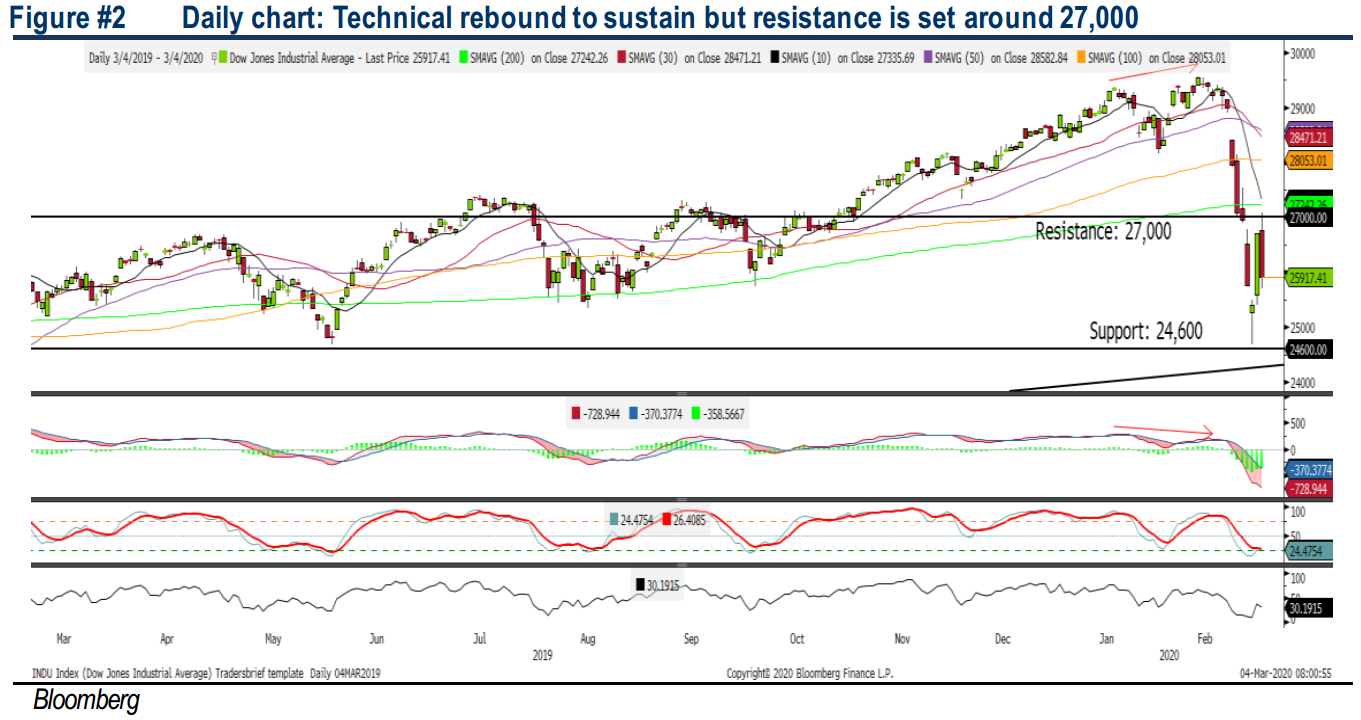

TECHNICAL OUTLOOK: DOW JONES

The Dow has revisited the 27,000 level and quickly reversed, forming a negative candle yesterday. The MACD Indicator has expanded negatively, while both the RSI and Stochastic have hooked downwards. Despite the oscillators are suggesting that the Dow could be oversold, but the upside is likely to be capped amid the uncertain Covid-19 situation. Stiff resistance will be envisaged along 27,000, while support is located around 24,600.

In the US, the decision to cut rates by half a percentage point came earlier than expected in an unscheduled Fed’s meeting (where the next FOMC will be on 17-18 March) amid coronavirus fears; this rare move has given a booster after the opening bell on Wall Street, but traders took it negatively as policy makers could be sending signals that the situation could be much weaker than anticipated. With that, we believe the near term trading tone will be downward bias with the resistance set along 27,000, while support is located around 24,600.

Source: Hong Leong Investment Bank Research - 4 Mar 2020

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024