Traders Brief - Cautious Mood Ahead of the New Cabinet Line-up and Spiking COVID-19 Cases

HLInvest

Publish date: Fri, 06 Mar 2020, 09:24 AM

MARKET REVIEW

In wake of an overnight 4.5% surge on Dow and the IMF’s US D50bn aid package to combat the impact of the coronavirus, Asian markets mostly clocked up positive gains, as investors hope coordinated stimulus from global central bankers and governments would roll out more fiscal measures to prop up the economy. Top gainers were HSI (+2.1%), SHCOMP (2%), KOSPI (+1.3%) and NIKKEI 225 (+1.1%).

Tracking higher Dow and regional markets, KLCI jumped as much as 7.3 pts before reducing the gains to 1-pt at 1491, pending the annoucement of new cabinet line-up and persistent worries on the adverse impact from the coronavirus epidemic following a spike in new cases over the past two days. Trading volume decreased to 2.78bn shares valued at RM2.07bn against 3bn shares worth RM2.37bn on Wednesday but market breadth was positive with 516 gainers as compared to 350 losers.

Wall Street plunged as anxieties about the worldwide spread of COVID-19 lingered and concerns about the ability of governments to control the impact of the disease on their economies sent the benchmark US Treasury note yield to a fresh all-time low of 0.92% (- 0.07%). The Dow pummeled 3.6% or 969 pts at 26121 (-11.7% from all-time high 29569) while the S&P 500 plummeted 3.4% or 106 pts at 3024 (-10.9% from all-time high 3393). Meanwhile, the Nasdaq slid 3.1% or 279 pts to 8739 (-11.2% from all-time high 9838).

TECHNICAL OUTLOOK: KLCI

After correcting 10% or 161 pts from 1617 (30 Dec high) to a low of 1456 (2 Mar low), KLCI staged a 35-pt or 2.4% relief rebound to end at 1491 yesterday. The MACD Histogram continues to recover, but the MACD Line is still hovering below zero. Meanwhile, both the RSI and Stochastic oscillators are ticking up from the oversold region. Given the external and internal uncertainties, we expect consolidation to prevail and only a successful rebound towards refilling the 1510-1527 gap (24 Feb) would spur greater upside to revisit the support turned-resistance 1548 levels. Conversely, a breakdown below 1479 could reignite further selling spree towards 1456/1440 territory.

Given the bearish Dow’s outlook, we expect KLCI to lock in near term consolidation (range bound within 1456-1517) amid domestic political turmoil and pending the new cabinet line-up. Also, the COVID-19 fears due to a spike in new cases in Malaysia has overshadowed the RM20bn economic stimulus package and YTD 0.5% OPR reductions (-0.25% each on 22 Jan & 3 Mar) meant to cushion the adverse impact from COVID-19. The elevated risks and uncertainty mean that, in the near term, the priority for equity investors should be the preservation of capital, with core holdings in defensive and resilient high-yield stocks.

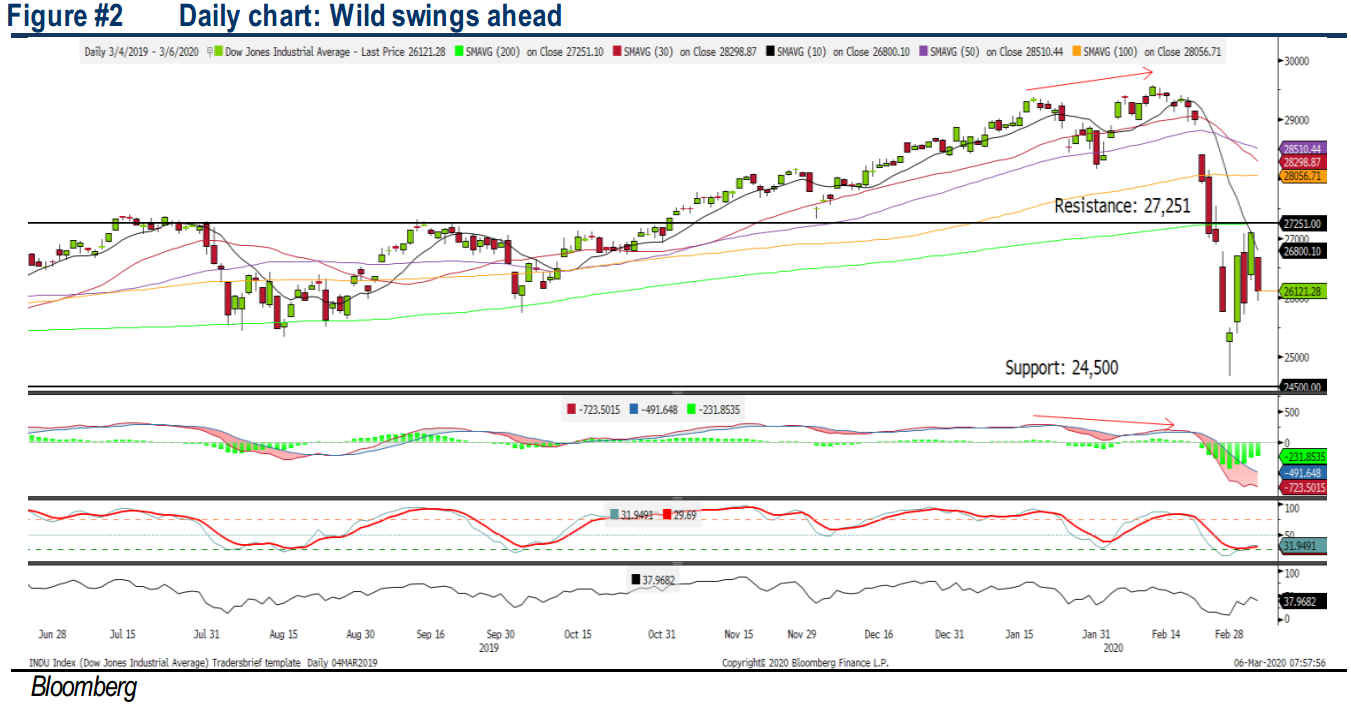

TECHNICAL OUTLOOK: DOW JONES

The Dow sank 969 pts overnight to 26121, extend its wild swings after hitting a bottom at 24681 (28 Feb). The MACD indicator continues to extend its bearish decline and both the RSI/Stochastic oscillators are consolidating below 50%, signalling an extended consolidation unless the Dow can successfully reclaim above 200D SMA resistance near 27251. Further downside supports are 25800/25000/24500 levels.

We are likely to witness an extended wild swings consolidation on Dow (24500 -27200 levels) in the near term as on the back of the COVID-19 outbreak has the potential to become a pandemic and is at a decisive stage, significantly affecting global trades and travels as well as US corporate earnings and economic growth in the mid to long term. Nevertheless, the pre emptive 0.5% rate cut by Fed and a USD8bn emergency fund being passed by the lawmakers to combat COVID-19 outbreak in the US are likely to cushion further sharp correction, barring further coronavirus outbreak in US.

Source: Hong Leong Investment Bank Research - 6 Mar 2020

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024