Traders Brief - No Refuge

HLInvest

Publish date: Tue, 10 Mar 2020, 09:05 AM

MARKET REVIEW

Asian markets ended in huge losses amid plunging oil prices due to fears of a price war after OPEC failed to strike a deal with its allies on production cuts. Sentiment was also dampened by worries surrounding the COVID-19 epidemic. Major losers were SET (-8.0%), ASX200 (- 7.3%), PSEI (-6.8%) and JCI (-6.6%).

Ahead of the new cabinet line-up at 5pm, KLCI corrected 58.9 pts or 4% to 9Y low at 1424.2 (- 16% from 52w high of 1695), as a full-blown oil price war rattled financial markets already on edge over the spreading coronavirus coupled with ongoing domestic political crisis. Trading volume ballooned to 6.66bn shares worth RM3.27bn as compared to last Friday’s 2.65bn shares worth RM2.29bn. Market breadth was bearish with 120 gainers as compared to 1139 losers.

Wall Street closed near bear-market territory, as the eruption of an oil -price war between OPEC and Russia and rising coronavirus fears sparked heavy losses across global equity markets. The Dow tanked 2013 pts or 7.8% at 23851 (-19.3% from all-time high 29569) while the S&P 500 dived 226 pts or 7.6% at 2746 (-19.1% from all-time high 3393). Meanwhile, the Nasdaq Composite plunged 625 pts or 7.3% to 7951 (-19.2% from all-time high 9838). All three benchmarks suffered their biggest one-day percentage declines since 2008.

TECHNICAL OUTLOOK: KLCI

The 60-pt correction yesterday has seen KLCI closing below the long term downtrend channel to end at 9Y low of 1424.2 (-16% from 52w high of 1695). Technical indicators are oversold but still flashing any bottoming up signals. On the back of extended bearish view on Dow and oil prices, KLCI is likely to engage in downward consolidation mode with next supports at 1370- 1400 before staging a technical rebound. Stiff resistances are near 1460-1480 territory.

Given the bearish Dow’s outlook, we expect KLCI to lock in an extended consolidation as investors continue to monitor the new cabinet line-up and domestic political situation ahead of the Parliament sitting on 18 May coupled with the widely spreading COVID-19 outbreak. Meanwhile, worries over the implementation of Budget 2020 as well as the RM20bn economic stimulus package resurface due to sinking oil prices (-54.6% from 52w high of USD75.6 and - 44.6% lower than average USD62 petroleum-related revenue crude oil price assumption by MOF).

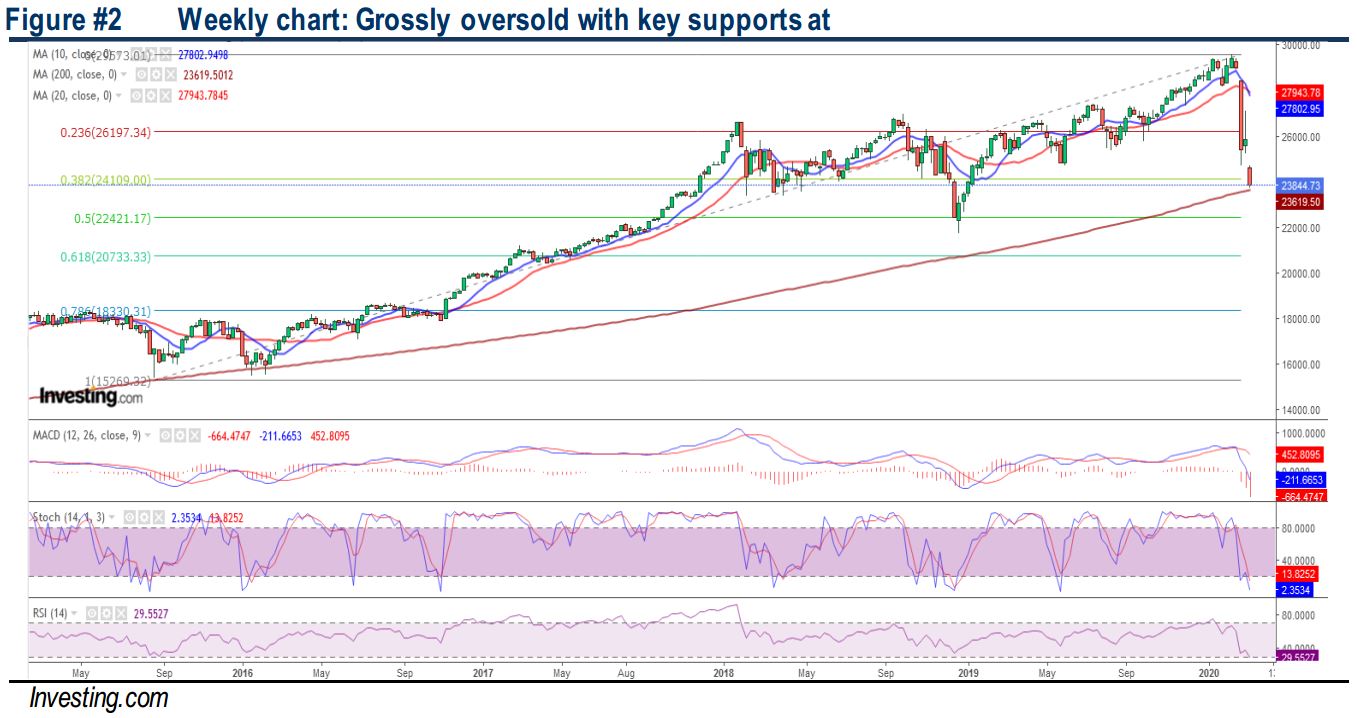

TECHNICAL OUTLOOK: DOW JONES

Following the 19.3% or 5718 pts correction from all -time high of 29568, the Dow is grossly oversold. Nevertheless, as the daily and weekly technical indicators are still not flashing any bottoming up signals, the Dow is envisaged to engage in further consolidation, probably towards 22400-23000 before staging a relief rebound. Upside targets are near 24679-25226 (gap down on 9 March) and 26000 zones. The current downtrend will only end when the Dow can successfully reclaim above 200D SMA resistance near 27240.

We are likely to witness an extended wild swings with downward consolidation on the Dow in the near term amid lingering concerns about the economic impact as the COVID-19 outbreak has the potential to become a pandemic, significantly affecting global trades and travels as well as US corporate earnings and economic growth in the mid to long term. Key supports are near 22400-23000 whilst resistances fall on 24679-25226 (gap down on 9 March) and 26000 zones. The current downtrend will only end when the Dow can successfully reclaim above 200D SMA resistance near 27240.

TECHNICAL TRACKER: CLOSED POSITIONS

Yesterday, we had squared off our positions on CHINHIN (7% loss) and GTRONIC (4.2% loss).

Source: Hong Leong Investment Bank Research - 10 Mar 2020