Traders Brief - Selling pressure remains intact

HLInvest

Publish date: Thu, 12 Mar 2020, 09:03 AM

MARKET REVIEW

Despite overnight Wall Street rebounded higher, coupled with several stimulus measures unveiled by Australia (USD1.56bn) and Japan (USD4bn) to tackle the Covid-19 impact on economic activities, Asia’s stock markets ended mostly lower. Investors continued to focus on the developments over the ongoing Covid-19 outbreak, which has increased sharply in regions outside of China. The Shanghai Composite Index and Hang Seng Index declined 0.94% and 0.63%, respectively, while Nikkei 225 ended lower by 2.27%.

Bucking the regional trend, the FBM KLCI ended higher at 1,443.83 pts (+0.93%) amid rebound on energy stocks. Market breadth was positive with 510 gainers as compared to 397 decliners. Market traded volume stood at 4.47bn, worth RM2.86. We noticed most of the O&G stocks trended higher after being bashed down on Tuesday on the back of rebounding crude oil prices during Asia’s session.

Again, Wall Street’s selloffs were driven by the ongoing Covid-19 outbreak, which has intensified outside of China and selling pressure intensified after WHO declared the outbreak an official global pandemic (affecting more than 120 countries with the total confirmed cases shot up above 126k, with more than 4.6k death tolls). The Dow and S&P500 dived 5.86% and 4.89%, respectively, while Nasdaq lost 4.70%.

TECHNICAL OUTLOOK: KLCI

The FBM KLCI ended on a positive note for the second trading day, but the MACD Line is still hovering below zero. However, both the RSI and Stochastic oscillators are oversold. Resistance is envisaged around 1,460-1,480. Meanwhile, support is located around 1,415- 1,420.

Taking cues from the negative performance on overnight Wall Street, coupled with the declaration of the Covid-19 a pandemic situation by WHO, we believe selling pressure could resume on the local exchange. Nevertheless, we opine selected sectors such as healthcare related will benefit under this environment. Traders may lookout for gloves, sanitizer and masks related stocks for opportunities.

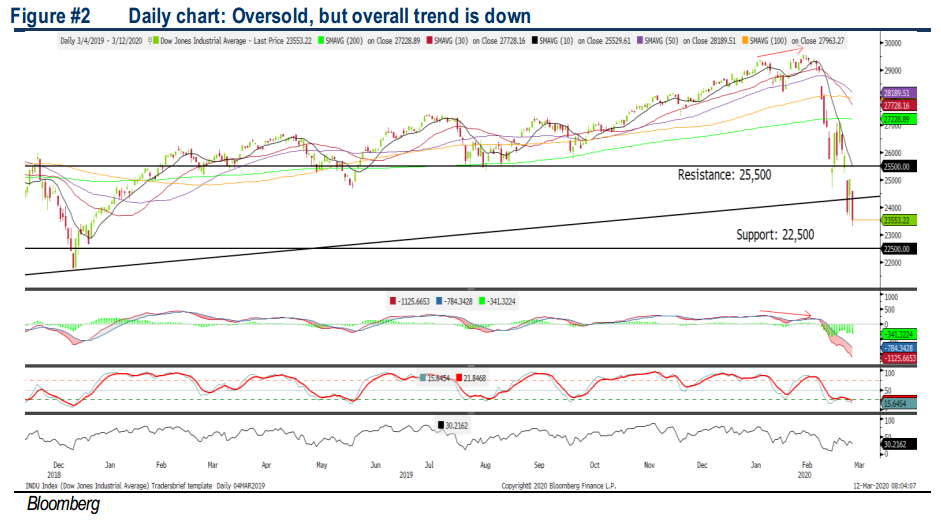

TECHNICAL OUTLOOK: DOW JONES

After violating the SMA200 on 25th Feb, the Dow remains negative bias and continues to trend lower, falling into bear territory as of yesterday. The MACD indicator is below zero, while both the RSI and Stochastic oscillators are oversold. Resistance will be envisaged around 25,500, while support is located around 22,500.

In the US, market participants are likely to stay on a negative bias for now given the worsening situation of Covid-19 in regions outside of China. Also, the lack of details and timeline of the stimulus measure from White House could dampen the trading tone. Hence, we believe the upside would be limited on Wall Street and the Dow’s upside will be capped around 25,500, with a support located around 22,500.

Source: Hong Leong Investment Bank Research - 12 Mar 2020