Traders Brief - Selling Interest to Spillover Towards KLCI

HLInvest

Publish date: Fri, 13 Mar 2020, 09:11 AM

MARKET REVIEW

Following the Dow plunging into bear territory, coupled with President Trump giving a speech on Wednesday banning travelers to the US from Europe for the next 30 days, Asia’s stock markets ended into the negative territories. Also, the rising concerns on the global growth outlook amid the ongoing Covid-19 outbreak have sent the Nikkei 225 down 4.41%, entering the bear territory, while Hang Seng Index and Shanghai Composite Index declined 3.66% and 1.52%, respectively.

Similarly, stocks on the local front were broadly traded in the negative zones; the FBM KLCI dropped 1.69% to 1,419.43 pts. Market breadth was negative with 923 decliners vs. 167 gainers, accompanied by 3.79bn, worth RM3.07bn. Meanwhile, O&G stocks traded actively lower for the session amid declining crude oil prices.

Wall Street tanked again for another round hitting second circuit breaker for the week after 7% drop on the most of the indices. Sentiment was weak as President Trump and the Fed’s measures failed to ease the concerns over the economic slowdown stemming from the Covid - 19 episode. The Dow and S&P500 dived 10% and 9.51%, respectively, while Nasdaq dropped 9.43%.

TECHNICAL OUTLOOK: KLCI

The FBM KLCI remains within the downward channel and the MACD indicator continues to hover below zero. Both the RSI and Stochastic oscillators are oversold. The resistance is located around 1,440, while support is anchored around 1,400. Should the KLCI reclaim above 1,440, next target is set around 1,460.

Tracking the sharp negative decline on Wall Street, coupled with the rapid increase of confirmed Covid-19 cases outside of China, we believe market participants will look further into selling opportunities on the local front. Upside on the KLCI should be capped along 1,440, while support is anchored around 1,400.

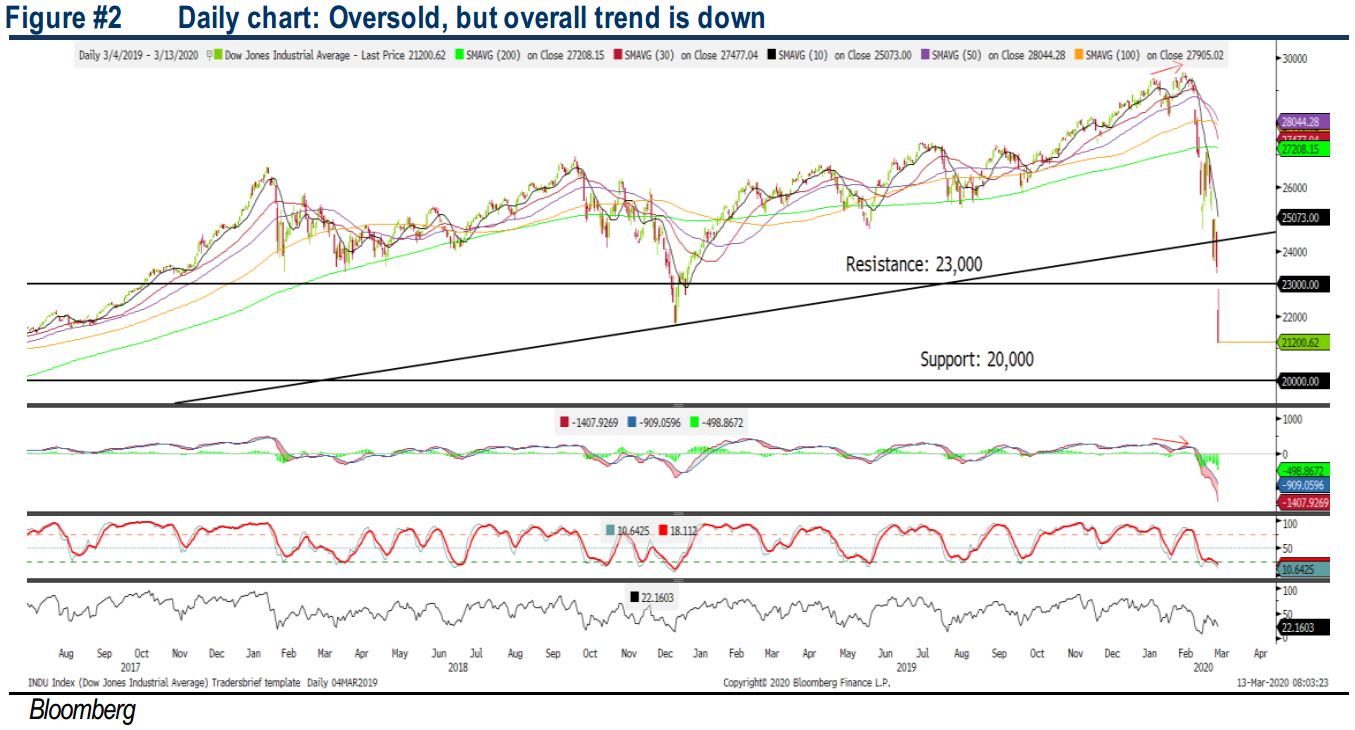

TECHNICAL OUTLOOK: DOW JONES

The Dow has fallen more than 20% from the peak (~29,500 level) recently and it is currently hovering in the bear market territory. The MACD indicator remains negative, while both the RSI and Stochastic oscillators are oversold. However, we opine that the selling tone would persist over the near term. The Dow’s upside is capped along 23,000, while support is set along 19,000.

Despite the Fed and President Trump calming the markets with some measures, investors remain negative in the global economic outlook amid the Covid-19 pandemic situation and investors are likely to further offload as it is in the bear territory at this juncture. Hence, we think the Dow could revisit the range around 18,000-20,000.

TECHNICAL TRACKER: CLOSED POSITION

Yesterday, we have closed position for Dayang with a loss of 9.1% after hitting our stop loss at RM1.20.

Source: Hong Leong Investment Bank Research - 13 Mar 2020