Traders Brief - Selling Tone to Extend Amid Uncertain Covid-19 Impact

HLInvest

Publish date: Mon, 16 Mar 2020, 09:58 AM

MARKET REVIEW

Following the sharp drop on Wall Street, Asia’s stock markets ended most lower as trading tone were affected by the spike in confirmed Covid-19 cases outside of China, but investors re assesed the stimulus measures declared by several countries and managed to recoup some losses throughout the trading session on Friday. The Shanghai Composite Index and Hang Seng Index declined 1.23% and 1.14%, respectively, while Nikkei 225 dived 6.08%.

Similarly, the FBM KLCI ended lower at 1,344.75 pts (-5.26%) after hitting an intra-day low of 1,320.96 pts. Market breadth was negative with 986 decliners vs. 158 gainers. Market traded volume stood at 5.68bn, worth RM4.90bn. For the second session of the day, we noticed some bargain activities have emerged amongst O&G and technology stocks, but the relief rally was short-lived and most of the stocks still ended in the red.

Wall Street rebounded sharply on Friday, making a comeback from the previous session – the worst since the “Black Monday” market crash in 1986. The sentiment turned positive in the anticipation of stimulus measure from the US government and other countries. Meanwhile, Treasury Steven Mnuchin commented that White House and Congress were nearing a deal also contributed to the buying support on Wall Street; the Dow increased 9.36% and 9.29%, respectively, while Nasdaq rose 9.35%.

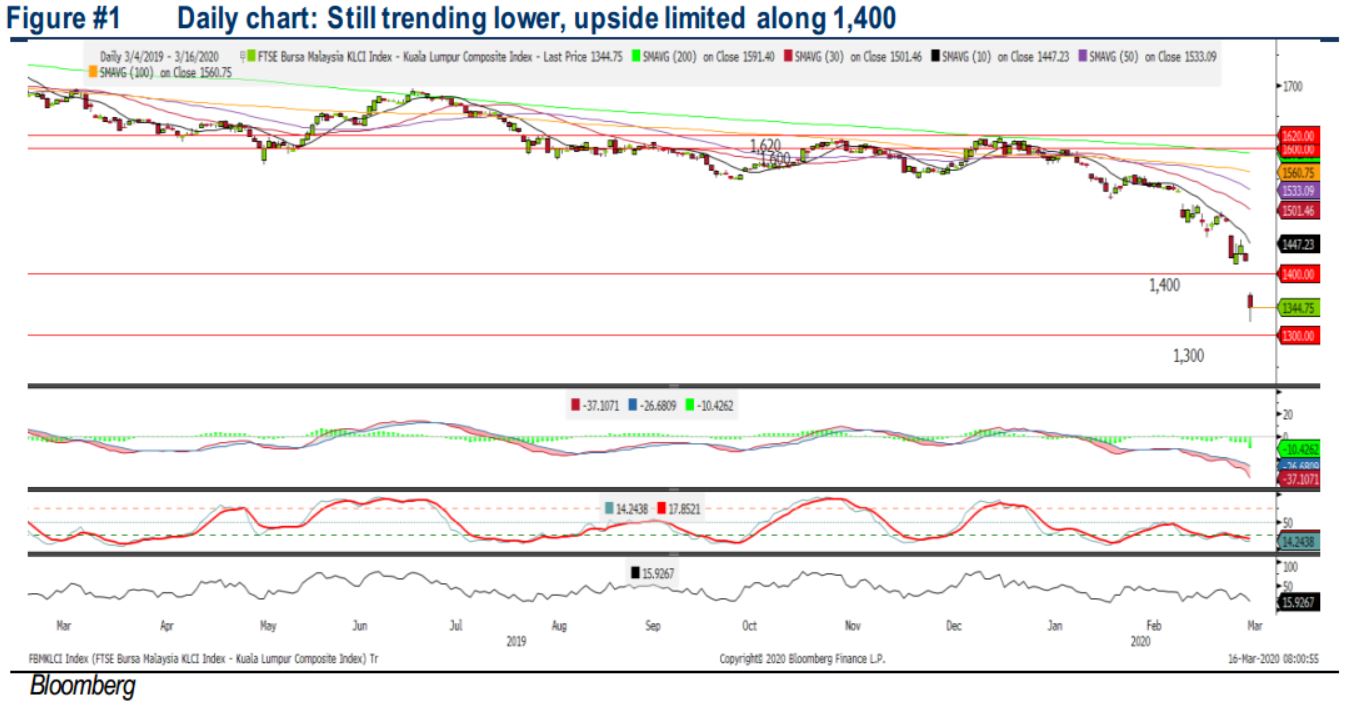

TECHNICAL OUTLOOK: KLCI

The FBMKLCI has declined more than 9% last week and the MACD indicator has expanded negatively. The RSI and Stochastic oscillators are in the oversold region. Despite the oversold status on KLCI, we believe the upside is likely to be limited given the overall trend is down. Resistance is pegged along 1,400, while support is anchored around 1,300.

The Dow futures are declining at this juncture after a surprise move by the Fed cutting the interest rates amid the ongoing worries over Covid-19 impact on economic activities globally. Hence, we believe the trading tone for Asia’s stock markets will be negative and anticipate selling pressure to persist on the local front. Should the KLCI breach support along 1,300, next support is located around 1,250.

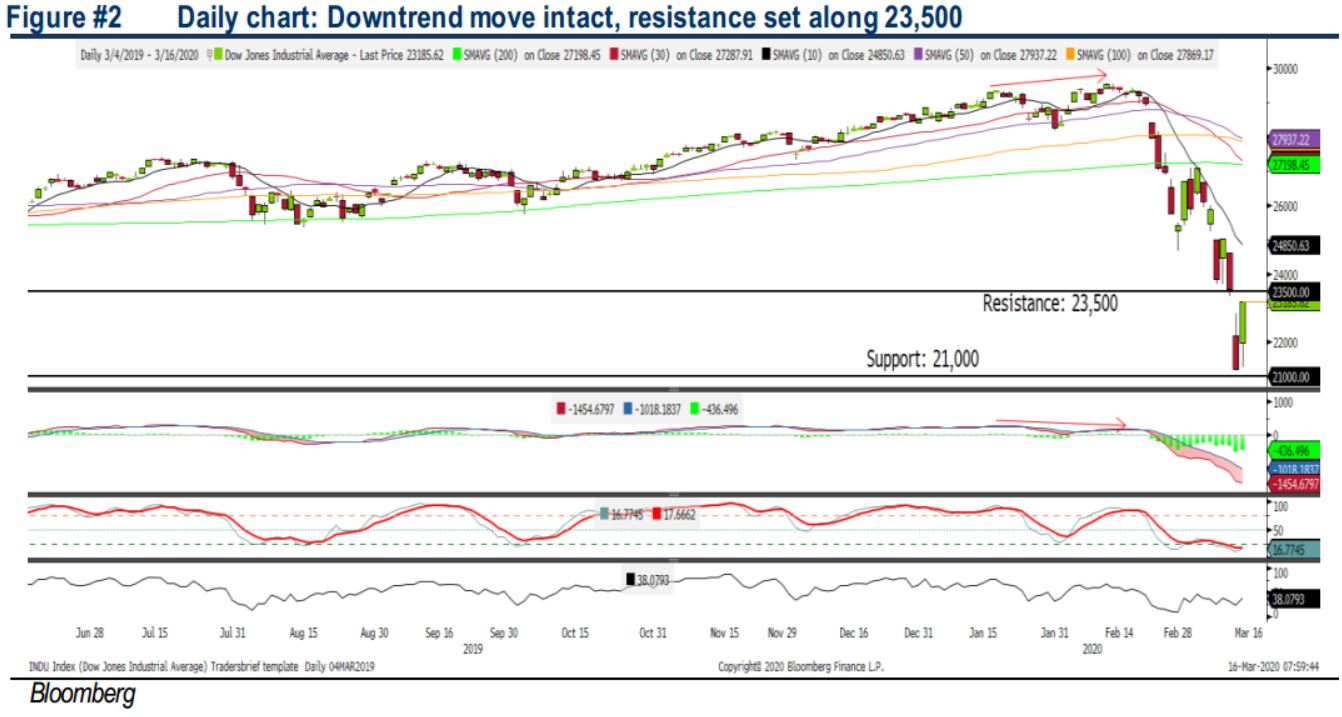

TECHNICAL OUTLOOK: DOW JONES

The Dow has rebounded last Friday above 23,000 level but the MACD Indicator is hovering below zero. Meanwhile, both the RSI and Stochastic are hovering in the oversold region. Given that the trend still pointing downwards, the Dow’s upside is likely to be limited around 23,500, while support is located around 21,000.

Despite a sharp rebound move on Wall Street last Friday, we anticipate selling pressure to resume after the Fed announced over the weekend another round of surprise cut of its benchmark interest rate to zero and launching a new round of QE program worth US D700bn amid increasing worries over the coronavirus that will slow down the economic growth moving forward. In our view, Dow’s upside could be limited around 23,500.

Source: Hong Leong Investment Bank Research - 16 Mar 2020

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024