Traders Brief - KLCI’s Upside Limited Amid Movement Control Order

HLInvest

Publish date: Tue, 17 Mar 2020, 09:14 AM

MARKET REVIEW

Asia’s stock markets ended on a negative tone following an emergency move of cutting interest rates and launching a massive QE program by the Fed over the weekend. The surprise move has caused traders to resume selling pressure across the region; the Shanghai Composite Index and Hang Seng Index dropped 3.40% and 4.03%, respectively, while Nikkei 225 declined 2.46%.

Similarly, the FBM KLCI ended significantly lower by 4.77% to 1,280.63 pts. Market breadth was negative with decliners leading advancers by a ratio of 10-to-1. Market traded volumes stood at 4.47bn worth RM3.69bn. Most of the active gainers were seen within the index put warrants amid the sell down in regional markets.

Although the Fed has done another round of surprise cut and launched a new QE program over the weekend, investors remain cautious and concerned over the impact of the Covid-19 outbreak on the economic activities moving forward. Hence, the selling pressure resumed on Wall Street causing the Dow falling 12.9%, worst daily performance since 1987. Also, the S&P500 and Nasdaq declined sharply 12.0% and 12.3%, respectively.

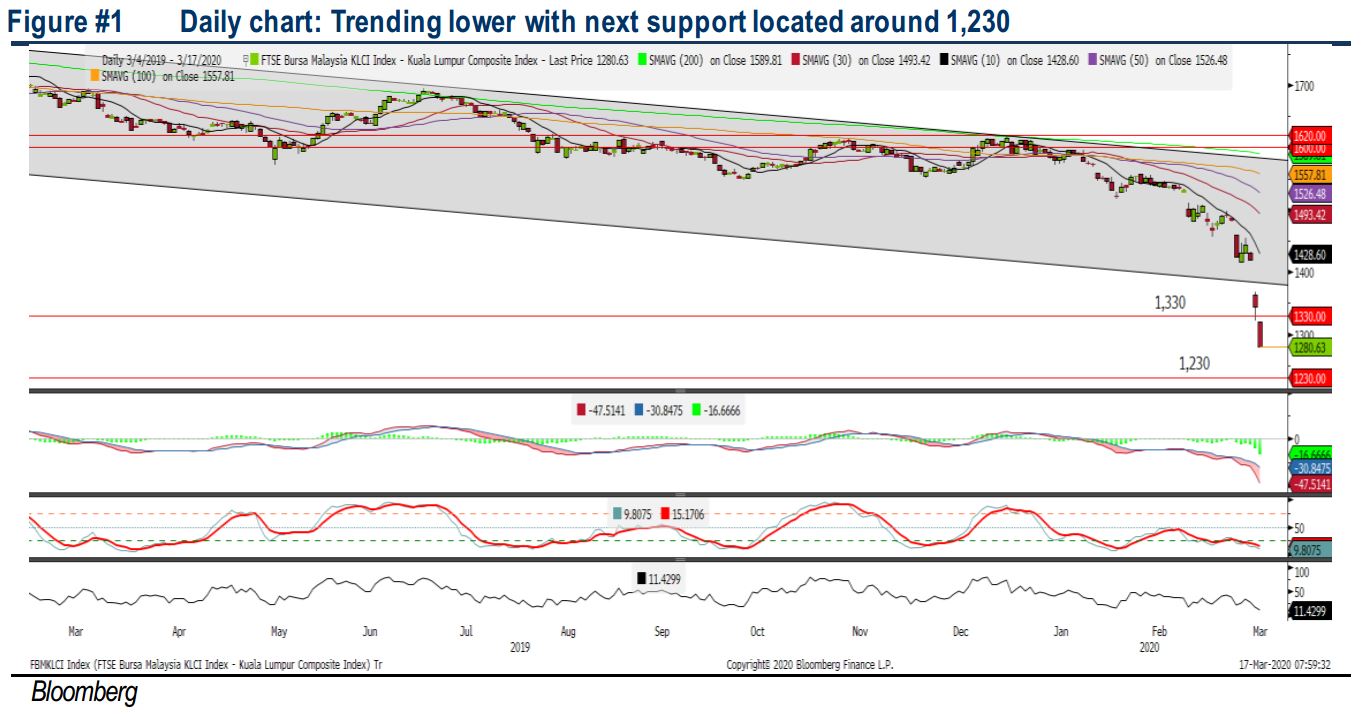

TECHNICAL OUTLOOK: KLCI

The FBM KLCI ended below 1,300 yesterday and the MACD indicator continues to expand negatively below the zero level. Meanwhile, both the RSI and Stochastic oscillators remain in the oversold territory. Resistance is set around 1,330, while support is anchored along 1,230.

With the selling pressure persisted on Wall Street, coupled with PM’s announcement yesterday on the movement control order that will be implemented from 18-31 Mar, we anticipate selling tone to remain heightened on the local exchange. Meanwhile, traders may take opportunities within the put or call warrants given the increased in volatility of global stock markets. Meanwhile, trading range of the FBM KLCI are located around 1,230-1,330.

TECHNICAL OUTLOOK: DOW JONES

The Dow continues to violate below the previous support of 21,000 and MACD indicator is still pointing negatively for now. Meanwhile, both the RSI and Stochastic are severely oversold. Resistance is set along 21,000, while support is anchored around 19,500.

We believe the Covid-19 is likely to affect most of the businesses around the globe given the rising lockdown in cities, which could slow down the economic activities moving forward. Meanwhile, with President Trump acknowledges that the US “may be” headed for a recession, we anticipate a downward bias mode may persist on Wall Street. The Dow’s resistance is envisaged around 21,000, while support is located around 19,500.

TECHNICAL TRACKER: CLOSED POSITIONS

We had squared off our remaining technical trackers positions on RUBEREX (3.1% loss), COMFORT (7% loss), CAREPLS (5.1%) and HEXZA (8.2% loss) yesterday amid bearish technicals.

Source: Hong Leong Investment Bank Research - 17 Mar 2020

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024