Traders Brief - KLCI Could be Due for Technical Rebound

HLInvest

Publish date: Fri, 20 Mar 2020, 10:02 AM

MARKET REVIEW

Global: Still, investors continue to watch developments on the coronavirus pandemic situation and Asia’s stock markets ended mostly lower led by Korean Stock Exchange as it hit circuit breaker for the session after Kospi dropped 8%. Over in the Europe, shares managed to rebound mildly on the back of the Pandemic Emergency Purchase Programme, worth €750bn to tackle the Covid-19 impact. Similarly, Wall Street managed to gain traction erasing all of the intraday losses to rebound higher led by tech and energy stocks - the latter was higher on the back of strong rally in crude oil price, which jumped more than 20% overnight.

Malaysia: Meanwhile, the FBM KLCI ended lower by 1.56% to 1,219.72 pts. Market breadth was negative with 849 decliners as compared to 170 gainers. Market traded volume stood at 4.17bn, worth RM2.87bn. Still, gloves-related stocks such as Hartalega and Topglove were traded actively higher for the day.

TECHNICAL OUTLOOK: KLCI

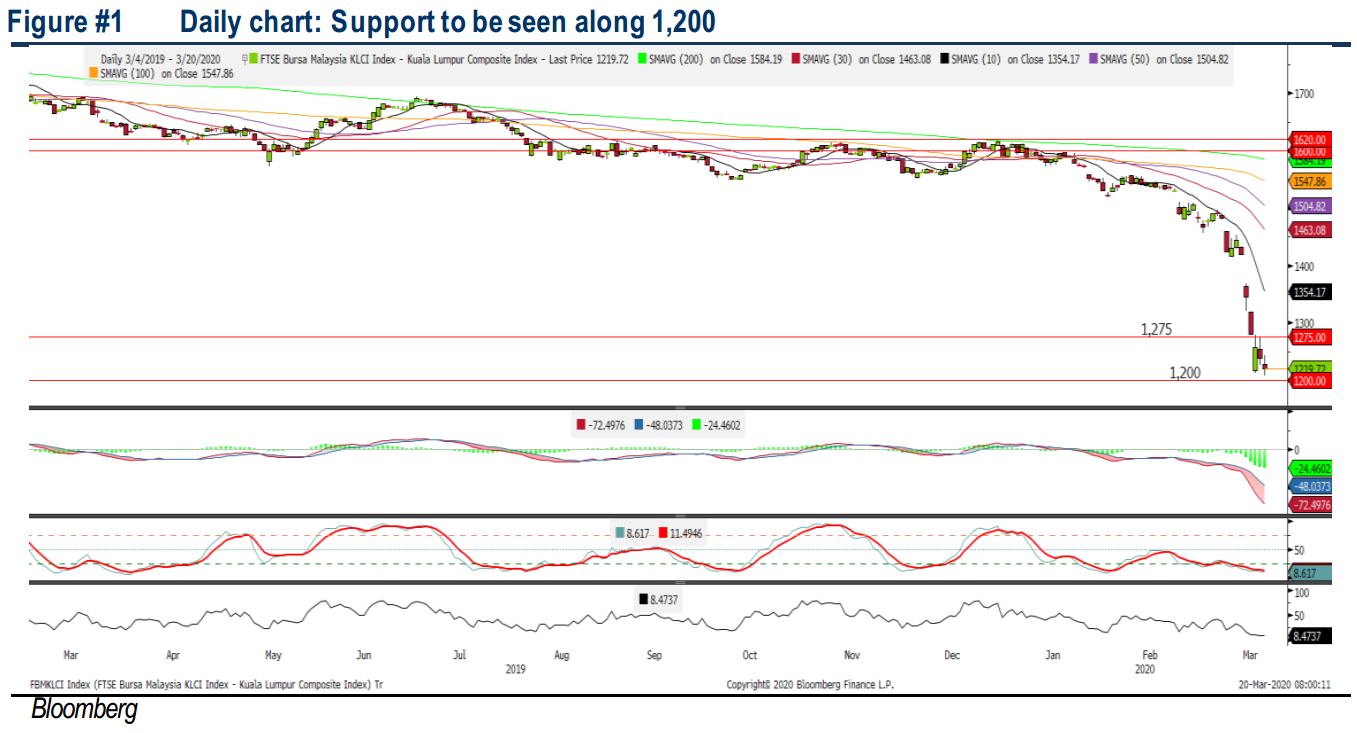

The FBM KLCI has closed lower for the second consecutive day and the MACD Indicator has expanded negatively below the zero level. However, both the RSI and Stochastic oscillators are severely oversold and may be suggesting that the downside could be limited at this juncture. Resistance is set around 1,250-1,275, while support is pegged around 1,200.

MARKET OUTLOOK

Taking cues from Wall Street and European stockmarkets, we expect the FBM KLCI could stabilise near the 1,200 level over the near term. However, any upside will be limited given the Dow futures are falling at this juncture of writing. Hence, we expect the trading range of the FBM KLCI will be located around 1,200-1,270. Traders could also pick up O&G stocks amid the recent spike in crude oil prices.

Source: Hong Leong Investment Bank Research - 20 Mar 2020

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024