Economics & Strategy - On to Round 3

HLInvest

Publish date: Mon, 20 Apr 2020, 09:07 AM

The MCO has been extended by another 2 weeks (15-28 Apr) but selected sectors will be allowed “restricted operations” (within our coverage, this broadly includes aerospace, auto, machines & equipment, construction (IBS), O&G and optical). We cut 2020 GDP from -2.0% to -4.0% and maintain our view for another -50bps OPR cut this year to 2.0%. Despite the KLCI rebounding 11% from its recent low, we still expect a W-shaped trajectory to play out, bottoming around 1,000 before closing in on our year-end target of 1,350.

NEWSBREAK

On Fri, PM Tan Sri Muhyiddin Yassin announced that the MCO will be extended another round (15-28 Apr). He shared that the Covid-19 situation in Malaysia is still under control: (i) positive cases at 7%, below WHO’s benchmark of 10%, (ii) death rate of 1.6% vs 5.8% globally and (iii) 43% of cases have recovered. Despite so, the PM said that the war on Covid-19 is far from over. To soften the negative ramifications of the MCO on the economy, several selected sectors would be allowed to resume operations in stages under strict guidelines (discussed below). MITI has reviewed the additional sectors based on the following considerations: (i) importance in the global value chain and the country's exports to ensure the stability of export activities, (ii) those with high value-added multiplier, (iii) impact on the sustainability of SMEs in the economic sector, particularly in manufacturing and services and (iv) size of workforce involved.

HLIB’s VIEW

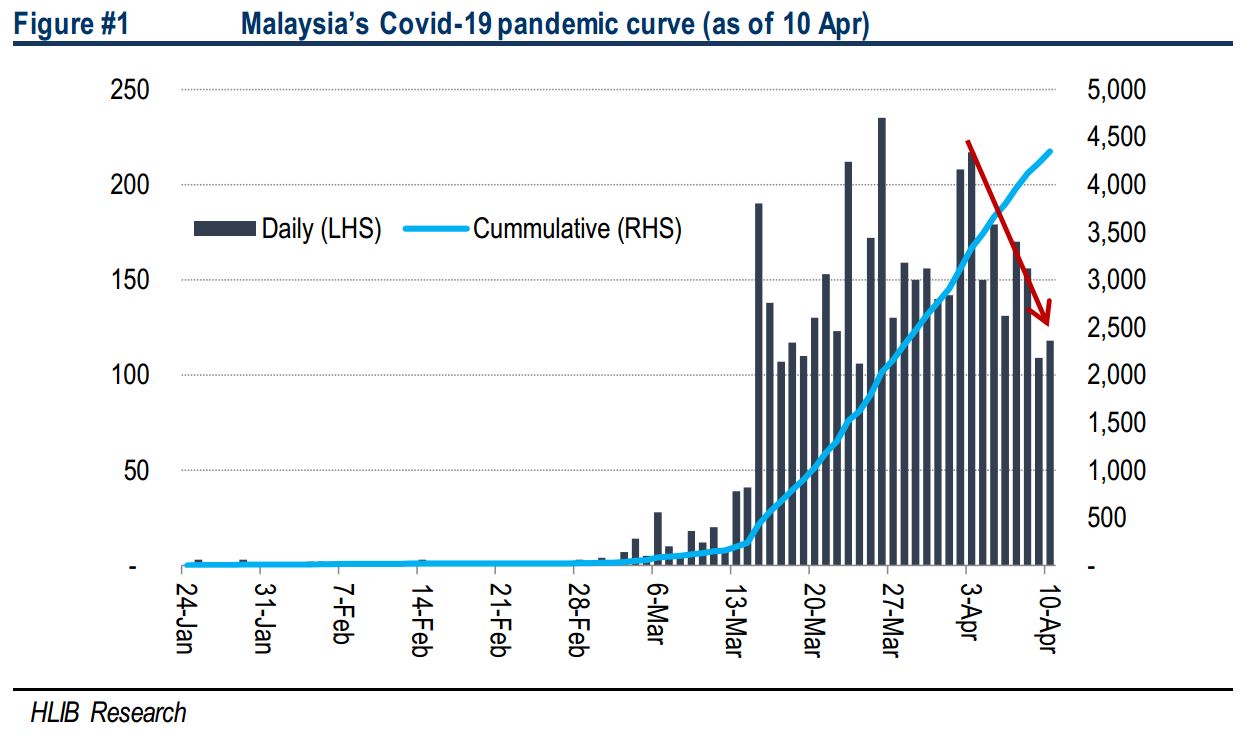

Not surprising. This decision marks the 2nd extension to the MCO which began on 18 Mar and was previously supposed to end on 14 Apr. The extension is unsurprising as new daily cases since the MCO started continued to exceed 100; we reckon that a greater degree of relaxation will only happen when it sustainably falls below 50. Still, there are some encouraging signs; since the near peak on 3 Apr (we predicted the peak to be on 4 Apr), new cases have shown some decreasing signs. We reckon Malaysia’s Covid-19 situation will possibly subside to contained levels sometime in May (1st or 2nd week).

Lowering 2020 GDP to -4.0%. Following the MCO extension, we downgrade our 2020 GDP forecast to -4% (previous: -2%). This is premised on the assumption that there will be very limited reopening of economic activity from 40-45% to 50-55% of GDP over a very gradual pace. The opening of more economic sectors may be in response to Federation of Malaysian Manufacturers (FMM)’s plea to allow essential product manufacturers to operate at 100% capacity and non-essential at 50%. They also shared that in a recent FMM survey involving 1,120 respondents, revealed that only 71% of them can withstand up to 4-weeks of non-operation. We expect GDP to experience a trough in 2Q20 due to expected peak of infections and gradually improve towards the end of 2020. We maintain our expectation for BNM to reduce the OPR by -50bps in 2020.

Breathing space for some. Despite the “restricted operations” accorded to some sectors, the impact of the MCO still remains widespread. Within our coverage, sectors that are allowed to resume operations under strict guidelines include:

- Aerospace: DRB via CTRM and UMW via UMW Aerospace.

- Automotive: Limited to exports of CBU (Mazda; BAuto) and equipment and components (Pecca).

- Machines & equipment: This seems rather broad but could likely encompass tech related companies (names like UWC and Vitrox have been operating at sub optimal levels since MCO day-1) and EMS (understand that VSI will soon recommence limited operations).

- Construction: Listed contactors do not fall under the G1-G2 category (paid up capital <RM25k) which has been allowed to operate. Buildings with IBS score of >70 can recommence works; positive for IBS players like Kimlun. Jobs that are >90% complete can also proceed, offering a mild reprieve to contractor’s orderbook execution.

- Services related to science, professional and technical: O&G is one of the 4 areas that falls under this category but no further details provided.

- Shops involved in hardware, E&E and optical: Think FocusP.

- Others: Social health services, barber shops and full-service laundry.

W-shaped trajectory. Since its low of 1,220 (19 Mar), the KLCI has rebounded by 11.3%. With this “Covid-19 recession” likely to be worse than the GFC (but not as bad as AFC, hopefully), we reckon that this reprieve will be short-lived; past bear markets have all seen a “dead cat bounce” ranging 10-13%. We continue to envisage a W shaped trajectory for the market and our bottom estimates for the KLCI ranges 1,089 to 1,029 (see our 2Q20 Outlook dated 31 Mar); we would only turn buyers closer to those levels. Possible triggers to those levels include: (i) another MCO extension beyond 28 Apr, (ii) May reporting season with weaker-than-expected corporate results and 1Q20 GDP (vs BNM’s 2020 range of -2.0% to +0.5%), and (iii) risk of US-China trade war reescalation, noting the less than cordial statements by President Trump on China.

Year-end target of 1,350. Continuing from our W-shaped trajectory expectations, we maintain our 2020 KLCI year-end target at 1,350. This is based on 14.6x PE (GFC mean) pegged to mid-2021 EPS. No changes to top picks.

Source: Hong Leong Investment Bank Research - 20 Apr 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-15

BAT2024-11-15

KPJ2024-11-15

SUNWAY2024-11-15

SUNWAY2024-11-15

TENAGA2024-11-15

TENAGA2024-11-15

TENAGA2024-11-15

TENAGA2024-11-15

TOPGLOV2024-11-14

BURSA2024-11-14

BURSA2024-11-14

KPJ2024-11-14

KPJ2024-11-14

KPJ2024-11-14

SUNWAY2024-11-14

SUNWAY2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TOPGLOV2024-11-13

AXREIT2024-11-13

KPJ2024-11-13

KPJ2024-11-13

SUNWAY2024-11-13

SUNWAY2024-11-13

TENAGA2024-11-13

TENAGA2024-11-13

TENAGA2024-11-13

TENAGA2024-11-13

TENAGA2024-11-13

TOPGLOV2024-11-12

AXREIT2024-11-12

KPJ2024-11-12

KPJ2024-11-12

KPJ2024-11-12

KPJ2024-11-12

SUNWAY2024-11-12

SUNWAY2024-11-12

SUNWAY2024-11-12

SUNWAY2024-11-12

SUNWAY2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA2024-11-11

BURSA2024-11-11

KPJ2024-11-11

KPJ2024-11-11

KPJ2024-11-11

SUNWAY2024-11-11

SUNWAY2024-11-11

SUNWAY2024-11-11

SUNWAY2024-11-11

TENAGA2024-11-11

TENAGA2024-11-11

TENAGA2024-11-11

TOPGLOV2024-11-11

TOPGLOV2024-11-08

AXREIT2024-11-08

BURSA2024-11-08

KPJ2024-11-08

KPJ2024-11-08

SUNWAY2024-11-08

SUNWAY2024-11-08

SUNWAY2024-11-08

TENAGA2024-11-08

TENAGA2024-11-08

TOPGLOV2024-11-08

TOPGLOV2024-11-07

BURSA2024-11-07

BURSA2024-11-07

KPJ2024-11-07

KPJ2024-11-07

KPJ2024-11-07

SUNWAY2024-11-07

SUNWAY2024-11-07

SUNWAY2024-11-07

TENAGA2024-11-07

TENAGA2024-11-07

TOPGLOV2024-11-07

TOPGLOV2024-11-07

TOPGLOV2024-11-07

TOPGLOV2024-11-06

BURSA2024-11-06

KPJ2024-11-06

KPJ2024-11-06

KPJ2024-11-06

KPJ2024-11-06

SUNWAY2024-11-06

SUNWAY2024-11-06

TENAGA2024-11-06

TENAGA2024-11-06

TENAGA2024-11-06

TOPGLOV2024-11-06

TOPGLOV2024-11-05

BURSA2024-11-05

BURSA2024-11-05

KPJ2024-11-05

KPJ2024-11-05

KPJ2024-11-05

SUNWAY2024-11-05

SUNWAY2024-11-05

SUNWAY2024-11-05

SUNWAY2024-11-05

SUNWAY2024-11-05

SUNWAY2024-11-05

SUNWAY2024-11-05

TENAGA2024-11-05

TENAGA2024-11-05

TENAGA2024-11-05

TIMECOM2024-11-05

TOPGLOV2024-11-04

BURSA2024-11-04

KPJ2024-11-04

KPJ2024-11-04

KPJ