UEM Edgenta- Strong Earnings Visibility and Sound Balance Sheet to Ride on Storms

HLInvest

Publish date: Tue, 09 Jun 2020, 04:30 PM

Edgenta’s risk-reward profile is increasingly attractive after sliding 40% from a 52-week high of RM3.52 to RM2.12. Current valuation is undemanding at 12.2x FY21 P/E (-28% vs 5Y mean and -14% vs peers), supported by an attractive 5.8% DY and strong orcerbook ~RM13bn. Inevitably, Edgenta’s short term outlook remains challenging given the Covid-19 pandemic and margin compression. However, we continue to remain positive on Edgenta’s long term prospects due to its defensive earnings profile and pivot towards healthcare support services regionally. Technically, share price is likely to bottom up following the Morning Star formation and re-challenge the RM2.25-2.60 upside targets in the short to medium term.

The region's leading asset management & infrastructure solutions company. Edgenta’s Core Expertise Includes:

1) Healthcare Support (contributed 48% to FY19 revenue) - This division covers over 300 hospitals in Malaysia, Singapore, Taiwan & India, providing non-clinical healthcare support and technology solutions to public and private healthcare institutions;

2) Property & Facility Solutions (8% to FY19 revenue) - One of the largest energy performance contracting players in Malaysia (managing over 50 buildings), offering technology-driven green building solutions and asset optimisation, with a focus on enhancement and energy solutions;

3) Infrastructure Services (38% to FY19 revenue) covering Expressways and Rail, including project management & engineering design capabilities, and

4) OPUS consultants (7% to FY revenue) provides multi-disciplinary infrastructure consultancy services and project management in roads and rails, with over RM100bn worth of projects delivered in Malaysia. Overall, the group has operational presence in Malaysia, Singapore, Indonesia, Taiwan, India and United Arab Emirate

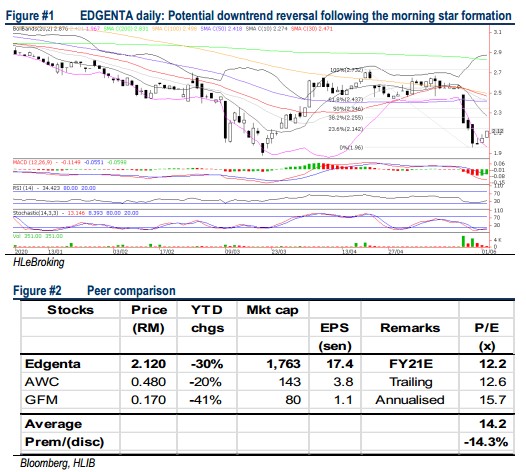

Potential downtrend reversal following the morning star formation. Following a subdued 1QFY20 results (21 May), Edgenta share prices tumbled 28% from a high of RM2.73 (21 Apr) to RM1.96 (28 May) before recovering at RM2.12, establishing a bullish morning star candlestick formation. The stock is ripe for further rebound as technical indicators are on the mend. A successful breakout above RM2.14 (23.8% FR) will lift prices towards RM2.26 (38.2% FR) and RM2.43 (61.8% FR) before reaching our LT target at RM2.60 (30W SMA) levels. Supports are pegged at RM2.03 (Weekly low BB) and RM1.96. Cut loss at RM1.93

Source: Hong Leong Investment Bank Research - 9 Jun 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024