Traders Brief - More choppiness ahead

HLInvest

Publish date: Mon, 15 Jun 2020, 12:23 PM

Global: Asian markets slid last Friday on profit-taking after massive rally from coronavirus bottom as investors were spooked by rising fears of a 2nd wave of the Covid-19 amid the re opening economy. Sentiment was also dampened by Powell’s dire US economic outlook and suggested the pandemic could inflict longer-lasting damage on the economy. The Dow closed higher last Friday in choppy trading in an attempt to recover from Thursday’s 1861-pt rout, as the fear of a resurgence of Covid-19 has punctured bubbling optimism that a quick economic recovery was already underway. The Dow jumped 1.9% or 477 pts to 25606 (-5.6% WoW) after touching an intra-session peak of 25966 (+837 pts) and a low of 25183 (+55 pts).

Malaysia: In line with sluggish Dow and regional markets, KLCI plunged as much as 48 pts to intraday low at 1509.2 before narrowing the losses to 11.2 pts at 1546, a tad above 1540 (LT downtrend resistance-turned-support). Trading volume decreased to 8.03bn shares worth RM4.77bn as compared to Thursday’s 9.16bn shares valued at RM5.91bn. Market breadth was negative with 283 gainers as compared to 803 losers.

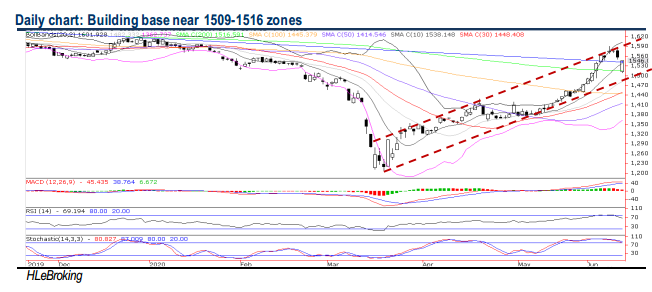

TECHNICAL OUTLOOK: KLCI

In sync with overnight slide on Dow and sluggish regional markets, KLCI tumbled as much as 48 pts to 1509 before paring the losses to 11.2 pts at 1546, a tad above the 1540 (LT downtrend resistance-turned-support) and comfortably above the 200D SMA (now at 1516). This week, we expect KLCI to trap in an extended volatile fashion with crucial supports at 1509-1516 levels. Failure to hold at 1509 would trigger more damage, with KLCI likely to slip below 1500 and 1470 (uptrend line support from 1208) zones. Key resistances remain at 1562 (30H SMA), 1591 (9 June peak), 1600 and 1612 (YTD high) levels.

MARKET OUTLOOK

After rallying 28% from Covid-19 bottom of 1208, KLCI should extend profit-taking pullback due to overbought positions and bleak economic outlook warned by Fed and IMF last week. Key weekly support is situated near 1509 (last Friday’s low). Failure to hold at 1509 would trigger more damage, with the index likely to slip below 1500 and 1470 (uptrend line support from 1208) zones. Weekly resistances are near 1562, 1590 and 1600 levels. In wake of ongoing uncertainty, we advocate investors to stay prudent and accumulate companies backed by solid earnings and/or balance sheet. HLIB top BUYs are TENAGA, TOPGLOVE, RHB, TM, GENTING, SUNWAY and BURSA.

Source: Hong Leong Investment Bank Research - 15 Jun 2020