Traders Brief - Consolidating Well Near 1545-1550 Territory

HLInvest

Publish date: Tue, 11 Aug 2020, 05:48 PM

MARKET REVIEW

Global: Shrugging off lingering US-China confrontation, Asian markets were higher amid hopes of a economic recovery in China due to upbeat industrial data and Trump’s executive orders to provide Covid-19 tax relief and stopgap unemployment benefits for Americans.

Despite a stalled US coronavirus aid talks, the Dow rallied 358 pts to 27791 whilst the Nasdaq eased 43 pts to 10968 as investors extended a rotation into value stocks from heavyweight tech-related names, encouraged by recent resilient 2Q20 earnings season and the bullish July economic data. Sentiment was also helped by early signs that the spread of the coronavirus appears to be abating as there were fewer than 47,000 new infections reported Sunday in the US (the lowest in about a week).

Malaysia. Led by selloff in the healthcare stocks, KLCI lost 6.5 pts to 1571.7 in a choppy session after traded within a range of 21 pts between an intra-day high of 1579 and a low of 1558. Trading volume decreased to 19.76bn shares worth RM7.55bn as compared to all time high record of 26.65bn valued at RM9.04bn last Friday. Market breadth was positive with 617 gainers as compared to 538 losers.

Yesterday, foreign (RM55m) and local retailers investors (RM297m) were the net buyers whilst local institutionals were the net sellers with RM352m. YTD, foreigners sold RM20.4bn shares compared with purchases by local institutional funds (RM9.8bn) and retailers (RM10.6bn).

TECHNICAL OUTLOOK: KLCI

After plunging 69 pts from a 7M peak from 1618 (28 July) to a low of 1549 on 4 Aug, KLCI has been trending sideways before ending at 1572 yesterday, and grossly neutralised previous overbought positions. We reiterate our view that unless a successful breakout above key rounding tops hurdles situated at 1591 (9 June) and 1618 (28 July), an extended range bound consoliation mode is likely to stay for a while in wake of the ongoing domestic political uncertainty and August reporting season, the increasing numbers of new Covid-19 clusters, and intensified US-China geopolitical tension. Key supports are situated at 1564 (lower BB) and 1549. Breaking below 1549 will confirm that the bears are in control to drive index lower towards 1511 (200D SMA) and 1500 zones.

MARKET OUTLOOK

Following the frenzy and irrational buying interests on penny stocks and lower liners last recently, broader market sentiment is likely to be affected by persistent profit taking consolidation but rotational sectoral buying (eg energy, financial services, heathcare, industrial, technology, property, ACE) will continue to keep overall trading volume buoyant. Technically, we reiterate our view that unless a successful breakout above key rounding tops hurdles situated at 1591 (9 June) and 1618 (28 July), an extended range bound consoliation mode is likely to stay for a while (1540-1620 levels) in wake of the ongoing domestic political uncertainty and August reporting season, the increasing numbers of new Covid-19 clusters, and intensified US-China geopolitical tension.

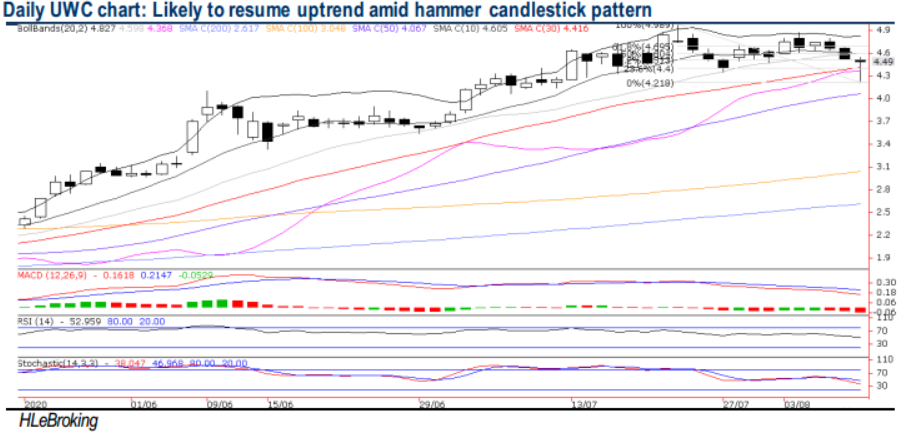

On stock selection, HLIB Research maintains a BUY rating on UWC (TP RM4.90) in anticipation of a strong set of 4Q20 results (likely in early Sep) driven by robust semiconductor sales and demand from life science customers coupled with benefitting from trade diversions in wake of escalating US-China tension. Technically, the stock is likely to resume its upward momentum after forming a hammer-like candlestick. A successful breakout above RM4.60 (20D SMA) will drive prices higher towards all-time high at RM4.98 and LT objective near RM5.27 levels. Supports are pegged at RM4.39-4.21. Cut loss at RM4.15

CLOSED POSITION (FIG1)

In wake of the extended market uncertainties, we had squared off our technical stock pick on TM (3.0% loss) yesterday.

Source: Hong Leong Investment Bank Research - 11 Aug 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-14

TM2024-11-14

TM2024-11-14

TM2024-11-13

TM2024-11-13

TM2024-11-13

TM2024-11-12

TM2024-11-12

TM2024-11-12

TM2024-11-12

TM2024-11-11

TM2024-11-11

TM2024-11-11

TM2024-11-11

TM2024-11-08

TM2024-11-08

TM2024-11-08

TM2024-11-08

TM2024-11-07

TM2024-11-07

TM2024-11-07

TM2024-11-07

TM2024-11-06

TM2024-11-06

TM2024-11-06

TM2024-11-06

TM2024-11-05

TM2024-11-05

TM2024-11-05

TM2024-11-05

TM2024-11-05

TM2024-11-05

TM2024-11-05

TM2024-11-05

TM2024-11-05

TM2024-11-05

TM2024-11-04

TM2024-11-04

TM