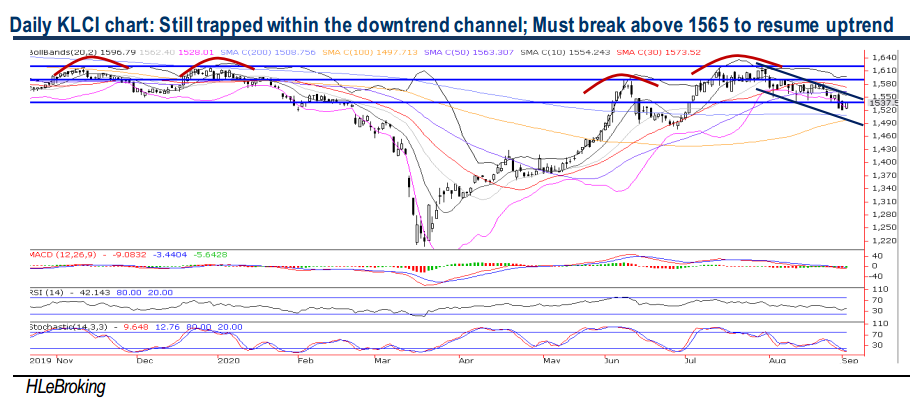

Traders Brief - Rotational Play From Covid-19 Themed To Recovery-Focused sectors To Boost Sentiment; Key Upside Targets Are 1565-1600 Levels

HLInvest

Publish date: Thu, 03 Sep 2020, 12:04 PM

MARKET REVIEW

Global. Most Asian markets ended higher, finding inspiration from breathtaking gains on Wall Street overnight as investors bet that the unprecedented fiscal and monetary stimulus from global central banks is going to provide the economy with a bridge. Sentiment was also boosted by the significant progress made in the development of Covid-19 vaccines and the rotation from high flying tech titans to defensive and value stocks could signal confidence in a broader economic recovery, overshadowed WHO’s warning of a possible new coronavirus wave this winter. The Dow surged 455 pts to 29100 (1.5% away from the record high o f 29551) and both the S&P 500 (+54 pts to 3581) and Nasdaq Composite (+116 pts to 12056) closed at fresh record highs, as investors shifted from the superb gains in the tech sector to value -oriented stocks in utilities, consumer staples, financials and healthcare, which have trailed the broader market YTD. Sentiment was also helped by Dr Fauci’s optimistic view that a Covid- 19 cure could come by the end 2020.

Malaysia. After digesting the subdued 2Q20 results, KLCI staged a strong 16.1-pt technical rebound to 1537.5, as investors await the possibility of another 0.25% OPR cut on 10 Sep and shifted from predominantly pandemic-themed to recovery-focused proxies in the financials, oil & gas and utility sectors. Trading volume increased to 11.6bn shares worth RM5.4bn against Tuesday’s 10.4bn shares valued at RM5.6bn. Market breadth stayed mildly positive with 552 gainers beat 537 losers.

Yesterday, local retailers were main buyers (+RM95m) whilst the foreigners (selling reduced to -RM26m from a 3M high of -RM380m) and local institutional investors (-RM69m) were major sellers. YTD, foreigners net sold RM20.7bn shares compared with net purchases by local institutional funds (RM10.1bn) and retailers (RM10.5bn).

TECHNICAL OUTLOOK: KLCI

KLCI is currently trapped in a downtrend channel after sliding 81 pts from the YTD peak of 1618 (28 July) to 1537 yesterday. Tracking the bullish Wall St overnight, KLCI may continue its technical rebound today towards the 1554 (10D SMA) and 1565 (upper channel) resistance zones. Only a decisive breakout above these hurdles will spur greater upside towards 1573 (30D SMA) and 1600 psychological levels. Conversely, a fall below 1520 (1 Sep low) will trigger further retreat to 1508 (200D SMA) and 1497 (100D SMA) levels.

MARKET OUTLOOK

Following the conclusion of 2Q20 reporting season, there could be a potential switch from predominantly pandemic-themed to a recovery-focused proxies in the near term as investors may start lightening their positions in glove stocks on the back of the significant progress made in the development of Covid-19 vaccines as well as treatment methodology lately.

We reiterate KLCI to extend its range bound consolidation mode (1500 -1600) in a seasonally weak September outing (KLCI tumbled ~1.7% from 2000-2019), compounded by domestic political uncertainty (ahead of the 26 Sep Sabah state election), the resurgence of Covid-19 cases in global hotspots coupled with escalating US-China geopolitical tension. However, downside risks are limited as the local financial system remains awash with liquidity over the short term and expectations of another 0.25% OPR cut on 10 Sep.

Source: Hong Leong Investment Bank Research - 3 Sept 2020

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024