Traders Brief - Crucial Support at 1503 (200D SMA) to Prevent Further Slide

HLInvest

Publish date: Fri, 18 Sep 2020, 10:35 AM

MARKET REVIEW

Global. Asian markets ended lower, tracking a sluggish Wall St overnight after Powell’s remarks over an uncertain economic rebound without further stimulus despite pledging to keep interest rates near zero until at least 2023. Overnight, the Dow tumbled as much as 385 pts to 27648 before reducing the losses to 130 pts at 27902, as investors digested Powell’s dour economic outlook along with lacklustre US Aug homebuilders and Sep Philadelphia manufacturing index reports. Sentiment was further dampened by the US Centers for Disease Control and Prevention’s statement that a vaccine would be in “very limited supply” at the end Dec against Trump’s comment that one would be ready for immediate use by the general public soon.

Malaysia. After soaring 41 pts in three days, KLCI slid 18.2 pts to 1513 on profit taking, triggered by selected selling spree on the glove (TOPGLOV), banking (MAYBANK, CIMB and PBBANK) and telcos (MAXIS and AXIATA) stocks. Trading volume decreased by 1.4bn shares to 7.5 bn shares worth RM6.2bn. Market breadth was negative with 376 gainers vs 768 losers.

Yesterday, local institutional (-RM59m) and foreign investors (-RM85m) were the net sellers while the retail (RM144m) investors remained the net buyers. YTD, local institutional and retail investors net bought RM9.38bn and RM11.31bn equities, respectively compared with a total of RM20.7bn sold by foreign investors.

TECHNICAL OUTLOOK: KLCI

Following a sharp pullback, KLCI outlook has turned mildly unfavourable following the breakdown below 1532 (mid BB) and 1521 (23.6% FR) levels. Further slide below the crucial 1504 (200D SMA) support will trigger another downleg to retest the lower downtrend channel near 1487 and 1474 (10 Sep low) supports. We still expect higher volatility in the days ahead, with the benchmark continues to trap in a downward consolidation as long as the stiff resistance near 1546 (upper downtrend channel) is not taken out.

MARKET OUTLOOK

Persistent profit taking consolidation and portfolio rebalancing by investors particularly on the glove and banking stocks are likely to witness further wild swings on KLCI, apart from lingering concerns triggered by: 1) domestic political uncertainty ahead of the Sabah polls on 26 Sep, 2) the expiry of 6M grace period for loan repayments by end Sep), 3) review on Malaysia’s position in the World Government Bond Index (WGBI) by end Sep and 4) concern over government’s major source of income following Petronas sluggish 1HFY20 results. Key supports are pegged at 1504-1487-1474 whilst key resistances fall on 1521- 1533-1546.

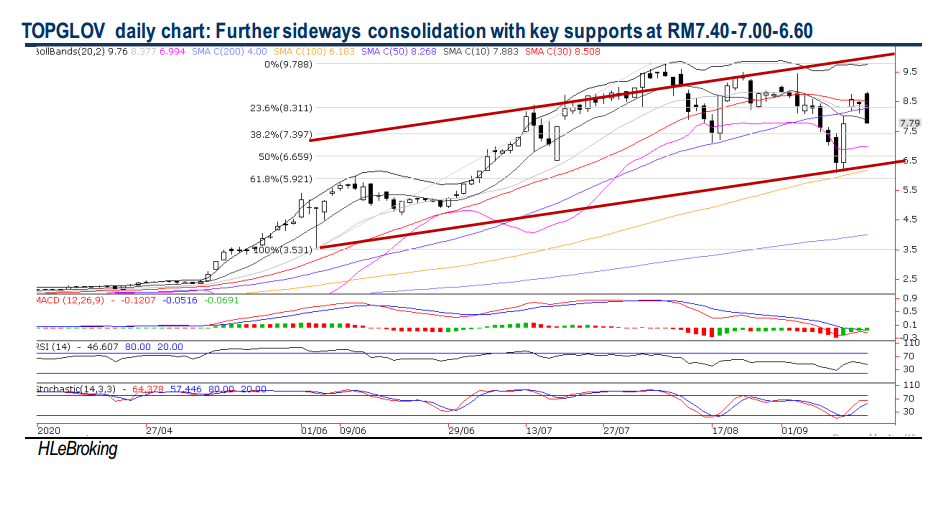

On stock selection, HLIB Research reiterates a BUY on TOPGLOV with a higher TP RM13.00 (from RM10.44 previously) in anticipation of further new earnings peaks ahead, driven by a surge in global gloves’ demand as post pandemic growth will be higher than pre-pandemic due to heightened awareness in medical and non-medical sectors, strong ASP and expectations that vaccine will take years to be available for everyone globally.

Technically, the stock could still face further consolidation ahead following the decisive breakdown below key 30D/50D SMA supports. As long as the key RM7.00 psychological support is not violated, the stock is likey to resume its uptrend from a low of RM3.53 (3 June) towards RM8.30-8.80-9.50 upside targets in the short to medium term. Cut loss at RM6.55.

Source: Hong Leong Investment Bank Research - 18 Sept 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024