Traders Brief - Further Relief Rebound Towards 1520-1530 Zones

HLInvest

Publish date: Tue, 29 Sep 2020, 12:00 PM

MARKET REVIEW

Global. Asian markets ended higher, taking cue from a rebound on Wall St amid hopes for a further coronavirus stimulus and a strong China’s industrial profits in August, overshadowed Washington’s sanction on China’s biggest chipmaker, SMIC due to risks of military use. Overnight, US stocks rallied ahead of the 3-day presidential debate (begins tonight) and Friday’s jobs report. The Dow surged 410 pts to 27584 to register its 3rd straight gain as investors embraced hopes of a new fiscal stimulus after Pelosi said that Democrats USD2.4 trillion aid package remains on the table after talking to Treasury Secretary Steven Mnuchin.

Malaysia. The KLCI rose 2.5 pts to 1511.7, notching its 3rd consecutive gain after staying between 1507 and 1519 levels, lifted mainly by selected bargain hunting on PPB, HARTA, DIALOG, IHH, MAYBANK and HLBANK in anticipation of 3Q20 window dressing. Sentiment was also boosted by the easing political uncertainties in Sabah following the victory of GRS in the Sabah elections on 26 Sep. Trading volume was RM5.2bn shares worth RM3.5bn whilst the market breadth was positive with 569 gainers beat 458 losers.

Yesterday, foreign investors (RM-292m) were the main sellers whilst local institutional investors (RM245m) and local retailers (RM47m) were the net buyers in equities. YTD, local institutional and retail investors were the major buyers with RM10.3bn and RM11.1bn, respectively whilst foreign investors net sold RM21.4bn in equities.

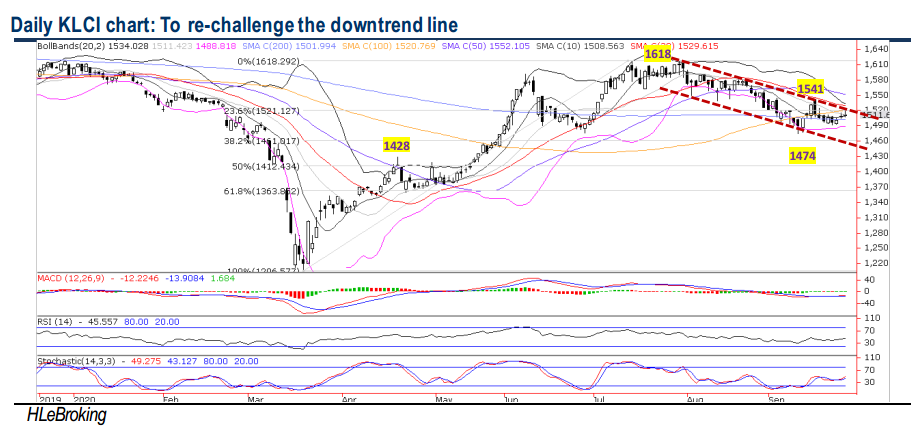

TECHNICAL OUTLOOK: KLCI

After rebounding from a low of 1474 (10 Sep) to a high of 1541 (17 Sep), KLCI is still trapped in the tug of war between bulls and bears but the bulls seems to have an upper hand right now following recent strong close above 1502 (200D SMA) to 1511 yesterday. Moving forward, a decisive close above 1525 (upper downtrend channel) is likely to lift the index out of the downtrend channel to retest 1541 and 1552 (50D SMA) zones. Conversely, a fall below 1502 will re-ignite a pullback towards 1488 (lower BB) and 1470 (lower downtrend channel) territory.

MARKET OUTLOOK

Tracking further relief rally on Wall St and expectation of further 3Q20 window dressing coupled with the easing political uncertainties in Sabah following the victory of GRS in the Sabah elections on 26 Sep and the appointment of Hajiji as the 16th Chief Minister, KLCI is expected to advance higher towards 1525-1541 zones. Nevertheless, further gains are likely to be capped due to lingering uncertainties such as 1) liquidity squeeze on the stock market amid the expiry of 6M grace period for loan repayments on 30 Sep, 2) the Anwar’s factor after he claimed to have 'formidable and convincing' support to form a new government on 23 Sep, and 3) surging Covid-19 cases and clusters in Malaysia (Putrajaya had announced that Lahad Datu, Tawau, Kunak and Semporna in Sabah will be placed under a targeted enhanced movement control order or TEMCO from 29 Sep to 12 Oct) and globally (WHO said the world will have to live with Covid-19 for a while and the official death toll is likely an underestimate of the true total). Major supp orts are pegged at 1500- 1490-1470 zones.

On stock pick, HLIB Research reiterates a BUY on FRONTKN with TP of RM3.96, ascribing a PE multiple of 40x to FY21 EPS. We justify this valuation based on its unique exposure to the world’s leading-edge semiconductor front-end supply chain which is currently in high demand on the back of national strategic and security interests. We like Frontken for its multi-year growth ahead on the back of (1) sustainable global semiconductor market outlook, (2) robust fab investment, (3) leading-edge technology (7nm and below), and (4) strong balance sheet (net cash of RM247m or 23.4 sen per share).

Technically, the stock’s upside remains bright following the flag breakout formation, supported by bottoming up indicators. Upside targets are situated at RM3.73 (76.4% FR) and RM3.95 (all-time high) before reaching our LT objective at RM4.16 (123.6% FR) levels. Key supports are pegged at RM3.49 (50% FR) and RM3.38 (61.8% FR) levels. Cut loss at RM3.33.

Source: Hong Leong Investment Bank Research - 29 Sept 2020