Tradersbrief - Not Out Of The Woods Yet Amid Worries Of Surging Local Covid-19 Transmissions And Lingering Political Uncertainty.

HLInvest

Publish date: Thu, 15 Oct 2020, 04:54 PM

MARKET REVIEW

Global. Asian markets ended mostly higher, taking cue from an upbeat Wall Street overnight, as partial Covid-19 stimulus deal optimism boosted investor sentiment. The Dow continued to rise higher (+122 pts at 28425) following 7 Oct 530-pt rally, as optimism has been building about the longer term prospects of another sweeping stimulus package from Washington post 3 Nov presidential election, overshadowed ongoing stimulus talk impasse.

Malaysia. On the back of foreign investors’ purchase after 7 Oct selloff, KLCI rallied 29.9 pts at the final minutes to finish at 1519t f.5 on bargain hunting activities after a 20-pt fall on 7 Oct, as the US partial Covid-19 stimulus deal optimism boosted sentiment. Trading volume increased to 6.29bn shares worth RM3.23bn as compared to Wednesday’s 5.25bn shares valued at RM3.61bn. Market breadth was negative with 469 gainers as compared to 503 losers. Yesterday, foreign investors were major net buyers (RM39m) in local equities against local retailers (+RM3m) and local institutional (-RM42m) investors.

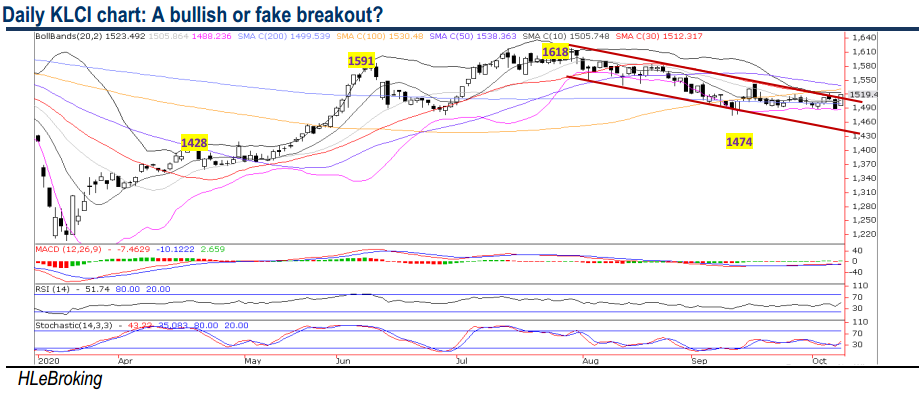

TECHNICAL OUTLOOK: KLCI

Following a 30-pt surge yesterday, near term outlook has turned mildly positive after successfully reclaiming above multiple key SMAs resistances and the downtrend line barrier near 1512. As yesterday’s rally happend during the final minutes, we need further confirmation and would only change our short term view to bullish if the index can close above the 100D SMA or 1530 levels in the coming sessions, whcih will lift the index higher towards 1538 (50D SMA) and 1580 (100W SMA) territory. Conversely, failure to defend the 1512 (downtrend channel resistance from 1618 high) and 1499 (200D SMA) levels will witness a prolonged downward consolidation to revisit 1474 (10 Sep low).

MARKET OUTLOOK

As yesterday’s rally happend during the final minutes, we need further confirmation and would only change our short term view to bullish if the index can successfully close above the 50D SMA near 1538 levels in the coming sessions, due to the heightened concerns of further potential restricted lockdowns amid surging Covid-19 cases and clusters locally, coupled with lingering political uncertainty (Anwar had been granted an audience with Agong on 13 Oct).

Source: Hong Leong Investment Bank Research - 15 Oct 2020

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024