Tradersbrief 16 Oct 2020 - Sideways Consolidation Amid Lack Of Fresh Catalysts

HLInvest

Publish date: Fri, 16 Oct 2020, 04:57 PM

Global. Asian markets ended lower as sentiment took a beating from the heightened US China trade tensions as Trump is considering adding Ant Group to a trade blacklist before the fintech giant is set for a huge dual listing in Shanghai and Hong Kong. Sentiment was also dampened by a surge in global Covid-19 cases and the deadlock over a US stimulus aid to boost the flagging economy.

The Dow tumbled as much as 333 pts at 28181 on the back of surging weekly jobless claims and renewed lockdowns in some hotspots in Europe due to a spike in Covid-19 cases. Sentiment was also dampened by a stimulus angst in Congress bill but an offer by Trump to raise the size of a stimulus package narrowed the losses to 20 pts at 28494.

Malaysia. KLCI fell 9.3 pts at 1514 as sentiment was dampened by a selloff in glove stocks following the US Department of Labour (DOL) has now put Malaysian-made rubber gloves on the list of products that use child or forced labour. Sentiment was also hurt by lingering worries over the CMCOs and domestic political wrangling coupled with the US stimulus deadlock. Yesterday, foreign investors were the major sellers (-RM48m) whilst the local retailers (+RM47m) and local institutional investors (+RM1m) were the main buyers.

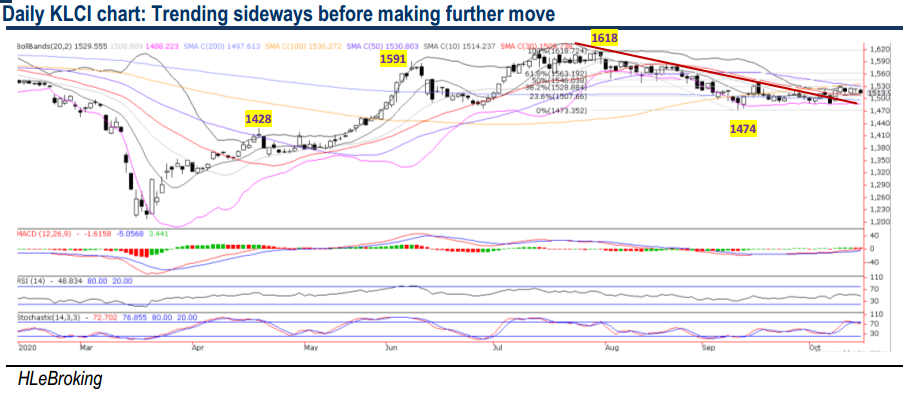

TECHNICAL OUTLOOK: KLCI

We reiterate our near term positive view on KLCI following a successful downtrend line breakout from the YTD high of 1618 (29 July) last week. Barring any sharp fall below the downtrend line again near 200D SMA (now at 1497), KLCI is still on course for a further march in the weeks ahead towards 1530 (50D SMA), 1546 (50% FR) and 1563 (61.8% FR) zones. However, failure to defend 1497 levels will favour the bears again, with an extended downward consolidation towards 1488 (lower BB) and 1474 (10 Sep low) levels.

MARKET OUTLOOK

Barring any sharp pullback below 1497 (the downtrend line from YTD high at 1618) levels, KLCI’s near term outlook remains positive, potentially heading towards 1530-1563 band next. However, the tug of war between bears and bulls could stay, considering the domestic political wrangling coupled with the uncertaity ahead of the 3 Nov election. Moreover, surging Covid-19 cases and clusters locally could pose downside economic risks, judging from the spiking cases in Klang Valley (which makes up ~41% of national GDP). Sectors wise, major beneficiaries from the imminent 3rd wave of Covid-19 in Malaysia are gloves, technology, telco and courier while sectors most vulnerable appeared to be aviation, retail, F&B, gaming, malls and hotels.

Source: Hong Leong Investment Bank Research - 16 Oct 2020

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024