Tenaga Nasional - Effective lower tariff in 1H21

HLInvest

Publish date: Wed, 30 Dec 2020, 05:10 PM

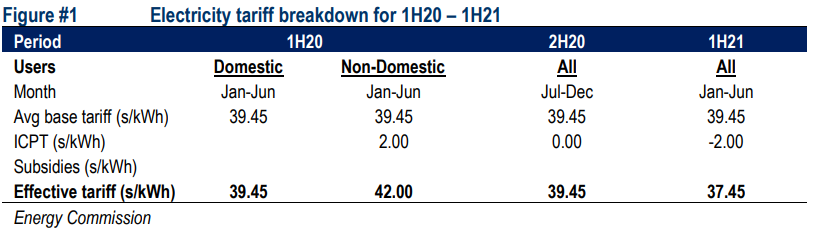

Energy Commission (EC) has announced the continuation of ICPT mechanism in 1H21 and IBR RP2 into 2021. There will be ICPT rebate of 2.00sen/kWh in 1H21, indicating effective lower effective tariff of 37.45s/kWh across the board to all users. We are neutral on the announcement as the ICPT rebate is to pass back the actual fuel cost savings (in 2H20) to end users while extension of RP2 is expected to have maintained almost all the existing perimeters (including the allowable return of 7.3%). Maintain BUY on Tenaga with unchanged TP of RM12.50 based on DCFE valuation.

NEWSBREAK

ICPT. Energy Commission (EC) has announced the continuation of the ICPT (Imbalance-Cost-Past-Through) mechanism for 1H21 with a 2.00s/kWh rebate on top of the unchanged average base tariff rate of 39.45s/kWh, effectively lower tariff to 37.45s/kWh. The rebate of ICPT for the period 1H21, is the result of lower actual fuel cost incurred during 2H20. The actual coal cost was USD58.6/mt (vs. benchmark USD75.0/mt) and gas cost was RM21.0/mmbtu (vs. benchmark RM27.2/mmbtu).

IBR. EC also announced the extension of 1-year to RP2 until 2021 (existing RP2 until 2020). The base tariff 39.45sen/kWh and the electricity tariff schedule are to be maintained during this period. We expect most of the perimeters under existing RP2 to be maintained with the allowable return at 7.3%. EC clarified the decision was made following the uncertainty in demand outlook for 2021 and the instability of the current global fuel markets following the COVID-19 pandemic.

HLIB’s VIEW

Neutral impact to Tenaga. We remain positive on the continuation of ICPT and extension of RP2 to 2021. Government seems to remain committed in the ICPT implementation, while the extension of RP2 is within our expectation as government would like to ensure long term sustainability of returns and earnings to Tenaga’s regulated business.

Maintain BUY, TP: RM12.50. We maintain BUY recommendation on Tenaga with unchanged DCFE-derived TP: RM12.50. Tenaga’s earnings and cash flow are expected to be stable under the IBR/ICPT mechanism. Dividend is expected to remain stable at 50-60sen/share.

Source: Hong Leong Investment Bank Research - 30 Dec 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-22

TENAGA2024-11-22

TENAGA2024-11-22

TENAGA2024-11-22

TENAGA2024-11-22

TENAGA2024-11-22

TENAGA2024-11-21

TENAGA2024-11-21

TENAGA2024-11-21

TENAGA2024-11-21

TENAGA2024-11-21

TENAGA2024-11-20

TENAGA2024-11-20

TENAGA2024-11-20

TENAGA2024-11-19

TENAGA2024-11-19

TENAGA2024-11-19

TENAGA2024-11-19

TENAGA2024-11-19

TENAGA2024-11-19

TENAGA2024-11-18

TENAGA2024-11-18

TENAGA2024-11-18

TENAGA2024-11-18

TENAGA2024-11-18

TENAGA2024-11-15

TENAGA2024-11-15

TENAGA2024-11-15

TENAGA2024-11-15

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-13

TENAGA2024-11-13

TENAGA2024-11-13

TENAGA2024-11-13

TENAGA2024-11-13

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA