Tek Seng Holdings - A New Lease of Life

HLInvest

Publish date: Mon, 04 Jan 2021, 10:17 AM

2020 would be a transformational year for TEKSENG after incurring steep losses in FY18-19 (driven by the impairment loss recognised at its solar division), premised on rising demand for PVC products on surging usage for household products, office and home furniture during Covid-19 WFH practice, timely capacity expansion (+150% to 820MT pa) to meet growing demand for PP non-woven products and diversification into PPE and medical industry. The stock is trading at 7.4x FY21 P/E (59% below its peers and 52% lower than its 5-year average), supported by a strong FY20-22 earnings CAGR of 18%, attractive FY21-22 DY of 4.5% and solid NCPS of RM10.5sen.

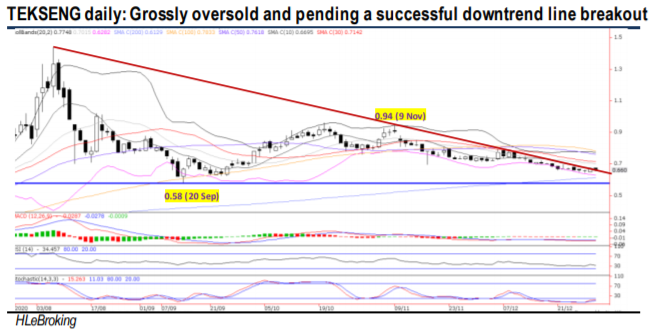

Pending a successful downtrend line breakout. From a high of RM1.44 (6 Aug 20), TEKSENG’s share price tumbled 54% to end at RM0.66 on 31 Dec (+135% YoY), mainly driven by strong profit taking pullback on Covid-19 stocks. Despite the slump, TEKSENG is still able to maintain its posture above the 200D SMA (near RM0.61). We believe once the sideways consolidation is over, the stock is likely to stage a successful breakout above RM0.67 (downtrend line) and RM0.70 levels. Crossing these barriers will lift the price higher towards RM0.76 (50D SMA) and our LT objective at RM0.80. Supports are situated at RM0.63 (lower BB) and RM0.61. Cut loss at RM0.595.

Source: Hong Leong Investment Bank Research - 4 Jan 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|