Traders Brief - Range Bound Mode Pending Further Fresh Catalysts

HLInvest

Publish date: Wed, 06 Jan 2021, 09:17 AM

MARKET REVIEW

Global. Asian markets ended on a mixed tone as investors braced for the outcome of a Georgia Senate runoff elections and concerns that the ever-rising number of Covid-19 cases would delay a global economic recovery. Pending the outcome of the Georgia election run-offs, the Dow rose 167 pts higher to 30391, boosted by energy stocks as Brent rallied 4.8% to USD53.6 amid a surprise Saudi production cut to offset a rise in output from OPEC+, led by Russia and Kazakhstan.

Malaysia. KLCI slid as much as 18.5 pts to 1589.8 as sentiment was hit by the resumption of RSS and elevated Covid-19 cases and clusters in Malaysia, before staging a strong rebound to end 5.8 pts higher at 1608.4, led by the recovery in glove companies, IHH, TENAGA and MAXIS. Overall, market breadth was still negative, with losers thumped gainers by 676-479 whilst a total of 6.25bn securities were traded for RM4bn vs 7.42bn shares valued at RM5.9bn on 4 Jan. After the net disposal of RM852m on 4 Jan, foreign investors turned into net buyers (RM42m) whilst the local institutional investors and retailers were the net sellers with RM20m and RM22m in equities, respectively.

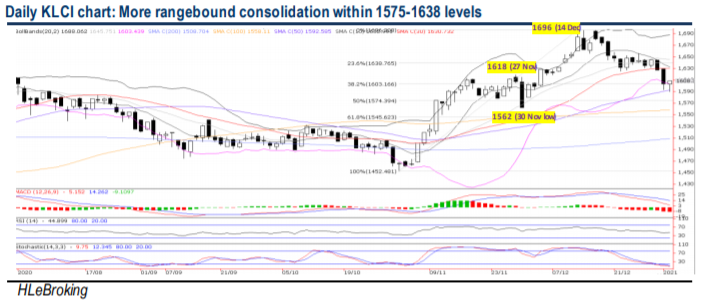

TECHNICAL OUTLOOK: KLCI

Following the recent slump of 6.3% or 107 pts from a high of 1696 to a low of 1589 yesterday, KLCI finally staged a rebound to end 5.8 pts higher at 1608 yesterday. The could be a follow-through rebound in the near term amid the hammer fomation with stiff resistances pegged at 1618-1638 (23.6% FR) levels. A strong breakout above these hurdles will spur greater upside towards 1667 (200W SMA) and 1696 zones. Towards the downside, a breakdown below 1589 will trigger more selloff towards 1562 (30 Nov low) and 1545 (61.8% FR) levels.

MARKET OUTLOOK

In the absence of immediate-term drivers, KLCI may continue to extend consolidation (weekly supports: 1562-1575; resistances 1618-1638), as investors digest more news flows about the resurgence of Covid-19 pandemic, vaccine distributions and challenges faced by nations in vaccinating their citizens coupled with the resumption of RSS. Nevertheless, optimism on economic recovery amid the multiple Covid-19 vaccine breakthroughs, a combination of continuing fiscal and monetary stimulus, the low-interest rates environment and China's firmer economic recovery will continue to underpin interests on the equity market. Meanwhile, surging oil prices, soybean prices and FCPO may provide some trading interests among the O&G (ARMADA, SERBADK, MISC, DIALOG and DAYANG) and plantation stocks (HSPLANT, IJMPLNT, FGV, TSH, CBIP and JTIASA).

Source: Hong Leong Investment Bank Research - 6 Jan 2021