Tex Cycle Technology - Bullish Downtrend Line Breakout

HLInvest

Publish date: Wed, 17 Mar 2021, 04:44 PM

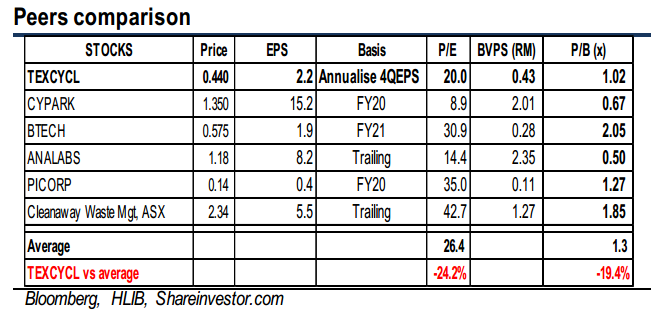

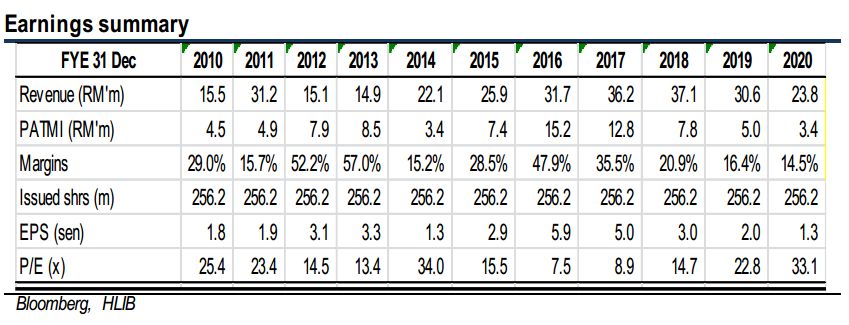

Despite tumbling 32% YoY in FY20 earnings, we see promising LT growth for TEXCYCL, backed by its bread-and-butter scheduled waste management and more RE projects come on stream. Also, the eventual crystallisation of its waste-to-energy plant businesses in Teluk Gong and UK should further help to propel future earnings. After falling 21% from 52-week high of RM0.555 to RM0.44, valuations have become more palatable at 20x P/E (vs industry 26.4x) and 1.0x P/B (vs industry 1.3x).

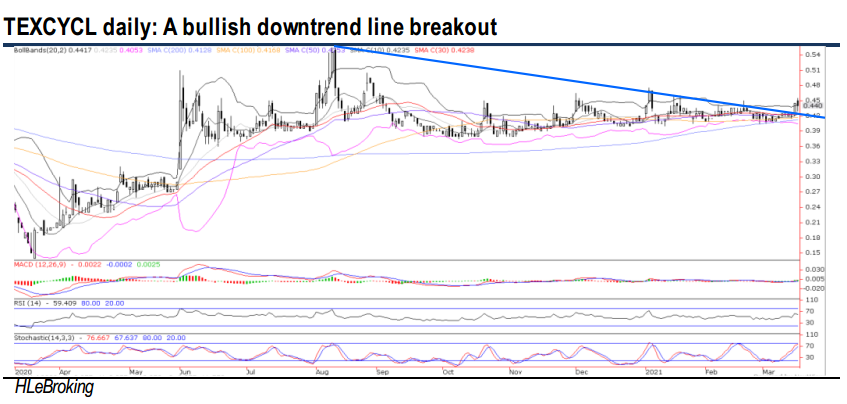

Bullish downtrend line breakout. After plunging 32% from 52-week high of RM0.555 (11 Aug) to a low of RM0.375 (8 Oct), TEXCYCL has been trapped in sideways consolidation mode before staging a bullish downtrend line breakout on 15 March. A successful breakout above RM0.465 neckline resistance is expected to spur prices towards RM0.50 barrier before hitting at our LT target of RM0.555 levels. Supports are pegged at RM0.41 (200D SMA) and RM0.39 (weekly lower BB). Cut loss at RM0.38.

Source: Hong Leong Investment Bank Research - 17 Mar 2021