Traders Brief - Market to Remain Seesaw

HLInvest

Publish date: Thu, 25 Mar 2021, 10:25 AM

MARKET REVIEW

Global. Led by the overnight slump in Wall St, Asian markets ended lower due to resurgence in Covid-19 cases and fresh lockdowns in Europe. Sentiment was further spooked by potential US rate hikes after Dallas Fed President Robert Kaplan expects the central bank to start raising rates as soon as next year. The Dow surged as much as 364 pts to 32788 following optimistic testimony by Powell and Yellen as well as falling US 10Y bond yields. However, the gains evaporat ed as the benchmark ended -3 pts at 32420 whilst the S&P 500 and Nasdaq 100 lost 0.6% and 2% respectively, with losses for technology related stocks accelerated towards the close.

Malaysia. Contrary to the sluggish regional markets, KLCI staged a 7.1-pt technical rebound to 1602.4 (from intraday low 1585) after sliding 32.7 pts in three consecutive sessions. On the broader market, turnover was 6.95bn shares (-0.2bn shares vs Tuesday) worth RM3.6bn while sentiment has improved mildly as the G/L ratio rose to 0.69 from 0.37 previously. The local institutional (-RM48m; 5D: -RM1m) investors were the major sellers whilst the retailers (+RM42m; 5D: +RM354m) and the foreign (+RM6m; 5D: -RM345m) investors were the major buyers.

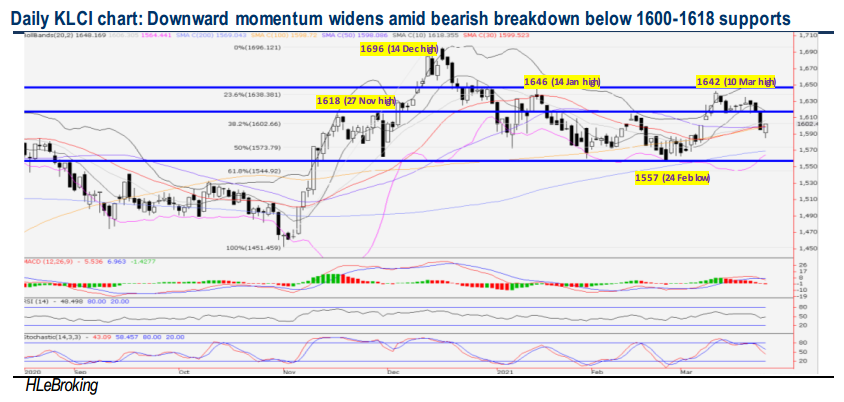

TECHNICAL OUTLOOK: KLCI

After sliding 57pts from March’s high of 1642 (10 March) to a low of 1585 yesterday, KLCI staged a mild technical rebound to finish at 1602. Unless quickly reclaiming above the 1618-1642 resistances, KLCI may potentially trade sideways to lower in the near term in the absence of fresh impetus, with key supports at 1585-1569-1557 zones.

MARKET OUTLOOK

On the back of persistent profit taking consolidation in Wall St and commodities markets after a year-long rally, we expect KLCI to remain choppy in the near term, as sentiment is dampened by growing Covid-19 curbs in Europe due to slow rollout of vaccines as well as mutating virus. Key supports are situated at 1585-1569-1557 whilst stiff resistances are pegged at 1618-1635-1646 levels. Sector-wise, we believe major rubber glove makers such as Top Glove (HLIB BUY-RM8.14 TP), Hartalega (HLIB BUY-RM15.80 TP), Kossan (HLIB BUY-RM5.22 TP), and Supermax (Not-rated) are close to ending their recent base building phases and poised for a potential technical rebound in the short to medium term, given the strong global demand outlook and resurgent Covid-19 infections in Europe and Brazil.

Source: Hong Leong Investment Bank Research - 25 Mar 2021