Oil & Gas - OPEC+ to Ease Production Cuts

HLInvest

Publish date: Wed, 07 Apr 2021, 10:20 AM

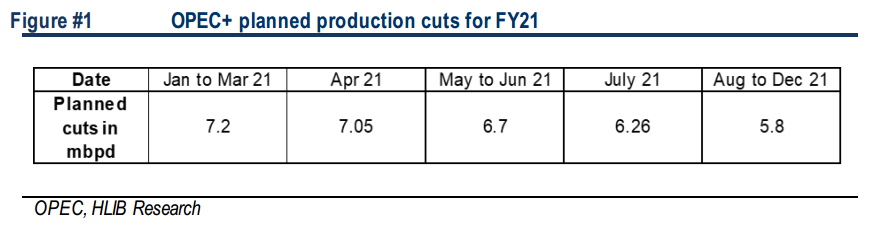

OPEC+ has announced that it will gradually increase its output by circa (i) 350,000 bpd in May, (ii) 350,000 bpd in June and (iii) 441,000 bpd in July. We view this news positively as we believe that OPEC+ is committed to keep Brent crude oil price within the range of USD60-65 per barrel in FY21. The increasing stability of crude oil prices should act as a catalyst for Petronas to elevate its capex spending in FY21 and FY22. We maintain our OVERWEIGHT call on the sector, leaving our Brent crude oil price per barrel forecast for CY21/22 unchanged at USD60/65. Our top pick for the sector is Bumi Armada (BUY; TP: RM0.75).

OPEC+ to ease production cuts from May to July. OPEC+ have agreed to gradually increase their output over the next 3 months. The move follows a sharp increase in oil prices, and a call from the US to keep energy affordable. The group will increase its output by circa (i) 350,000 bpd in May (ii) 350,000 bpd in June and 441,000 bpd in July. Saudi Arabia will gradually ease its additional voluntary cuts and eliminate them altogether by the end of July.

The sectorial impact from the aforementioned news are as follows:

Maintenance activities (HUC, O&M, TMM). We view that there would be a satisfactory recovery in maintenance spending this year due to the delays and deferments that has occurred in FY20. We expect maintenance capex to be c.20-25% higher YoY in FY21.

Drilling. We opine that the recovery in drilling has just begun as manifested by the 3 contracts (Naga 2, 5 and 7) that Velesto secured recently. We believe that the relatively short tenure of the aforesaid contracts was mainly attributable to Petronas’ uncertainty with regards to the movement of Brent crude oil prices. We view that Petronas would be willing to dish out longer-term drilling contracts if Brent crude oil price is able to hold up at the USD60-65/bbl range until the end of FY21.

OSV. We believe that the OSV segment will see a gradual recovery in FY21 but we do not think that it will be material as the recovery in drilling activities have only just begun. Nevertheless, we expect to see a more material improvement in OSV utilisation in FY22.

Refining. While the global economy seems to be recovering at a healthy pace, refined product demand has not recovered in tandem with oil prices. Coupled with excess capacity globally especially from China, crack spreads might remain sideways with a bit of downside bias in the next 3 to 6 months before recording a sharper recovery in FY22 as we are expecting gasoline, diesel and jet fuel demand to record a steeper demand recovery in FY22.

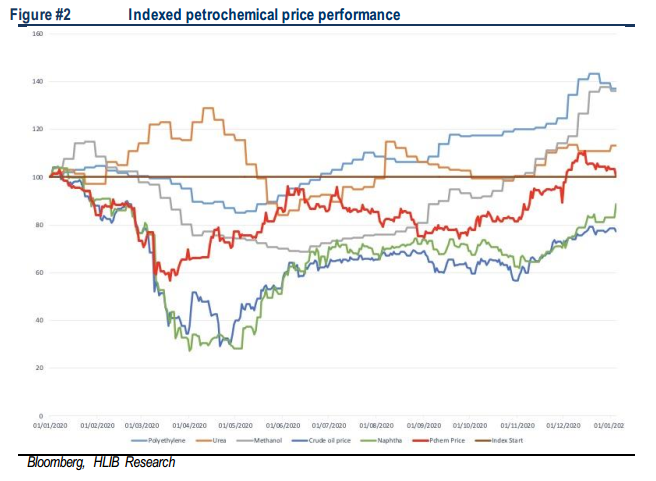

Petrochemicals. Stable oil prices will be good for petchem players and buoyant plastic demand has resulted in higher ASP for polyethylene. Lower carbon emission initiatives has also resulted in ammonia and urea prices recording strong gains over the last 2 weeks. We believe that the strong ASP for petchem products are expected to continue and PCHEM is expected to benefit from this.

Oil Price forecast and Petronas capex. We maintain our Brent crude oil price per barrel forecast for CY21/22f at USD60/65 as we believe that OPEC+ would try to keep Brent crude oil price between the range of USD60-65/bbl. We opine that sequential easing of production cuts would come in tandem with crude oil demand recovery , thereby limiting the upside of Brent crude oil price. Nevertheless, we believe that there would be more downside risks on Brent crude oil prices in 2H21 as we view that the easing of production cuts could supersede demand recovery in 2H21. We are also maintaining our RM40bn (+21% YoY) capex spending target for Petronas.

Maintain OVERWEIGHT. We maintain our positive stance on the sector as we believe that the fundamentals of the O&G sector are turning positive, with (i) higher and more stable oil prices, (ii) stronger commitment from OPEC+ to keep oil prices afloat, (iii) higher capex from Petronas in FY21 albeit not at pre-Covid levels, (iv) timeline of vaccine rollouts and (v) the strong economic recovery from China. We currently have 7 buy calls, 4 hold calls. Our top pick for the sector is Bumi Armada (BUY; TP: RM0.75) for its strong FPSO business and fast improving balance sheet.

Source: Hong Leong Investment Bank Research - 7 Apr 2021