Traders Brief - Jittery Mode to Persist

HLInvest

Publish date: Wed, 23 Feb 2022, 11:12 AM

MARKET REVIEW

Global. Asian market fell after Putin’s decree of recognising the independence of two Moscow-backed separatist regions (i.e. Donetsk and Luhansk) and calling for forces to enter the two regions, triggered a series of Western sanctions and broad condemnations. Wall St plunged (Dow: -482 pts to 33596/-9.1% from all-time high 36952; Nasdaq: -165 pts to 13381/-17.5% from all-time high 16212) as hopes for a diplomatic resolution to de escalate tensions on the Ukraine border faded and followed by the first wave of sanctions from the US and some European nations on Russia, after Russia deployed its military troops into parts of Ukraine.

Malaysia. Tracking the sluggish regional markets, KLCI fell 5.7 pts at 1576.96 to record its 3rd straight decline, dragged by selloff in banking, healthcare, telco and gaming stocks. Market breadth was bearish as losers thumped gainers by 778 to 284. In terms of funds flow, local institutions recorded their net outflows for the 13th straight session with net trades of -RM255m (Feb MTD: -RM1.98bn; Jan: -RM418m). This was matched by net buying via foreign institutions (Feb MTD: +RM1.85bn; Jan: +RM332m) and retailers (Feb MTD: +RM129m; Jan: +85m) amounting to RM129m and RM126m, respectively.

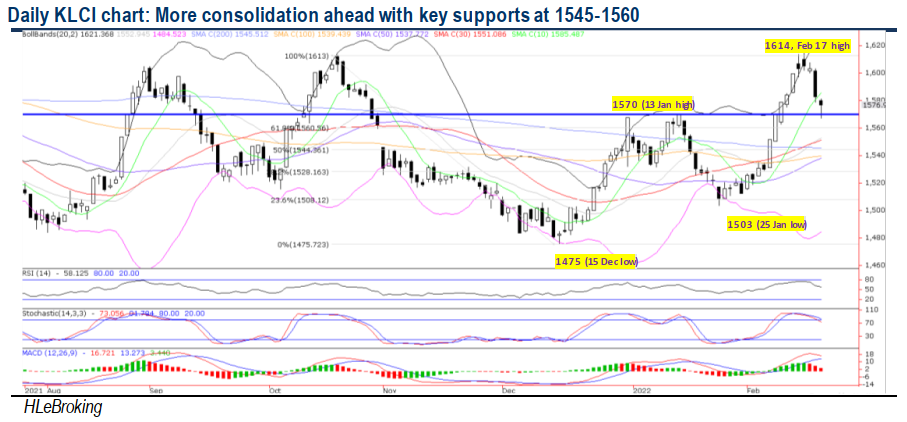

TECHNICAL OUTLOOK: KLCI

Following the dark cloud cover confirmation pattern on 21 Feb, KLCI fell as much as 15.5 pts to 1567.2 before paring the losses to 5.7pts at 1577. Although we reckon that the recent pullback from the 1614 high has not completed yet amid external headwinds, the hammer candlestick pattern yesterday could give us a glimmer of hope that further downside risk is likely to be cushioned at 1560-1567 levels, with 200D MA at 1546 to provide another sound support. On the topside, we expect the resistances at 1613-1623 to cap gains.

MARKET OUTLOOK

On the back of worsening geopolitical crisis in Ukraine, negative KLCI technical perspective, speculation of Fed’s next move amid elevated inflation, the Omicron wave in Malaysia and ongoing Feb reporting season, we expect further consolidation ahead with key downside support at 1546-1560-1570 levels (resistances: 1600-1613-1623).

VIRTUAL PORTFOLIO POSITION-FIG2

We took profit on TAWIN (38.5% gain) after hitting R2 upside target at RM0.18 yesterday.

Source: Hong Leong Investment Bank Research - 23 Feb 2022