The studies of HENGYUAN Refining Co Bhd Dividend

hrcmedia

Publish date: Mon, 19 Mar 2018, 03:27 AM

Recently Heng Yuan declared 0.02 cents dividend after the result was published.

The forum was flooded with lots of disapproval comments.

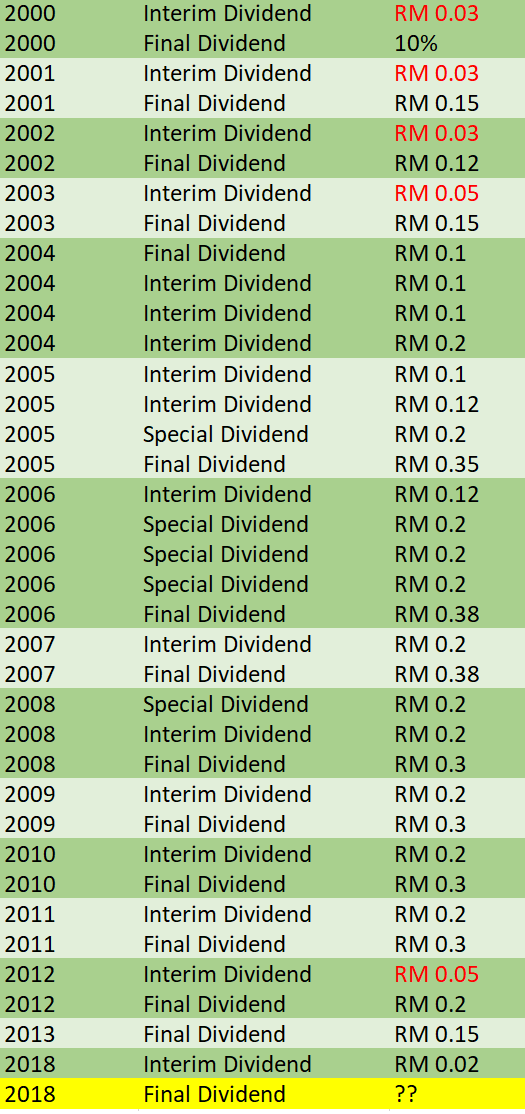

The following are some observations based on dividend declaration since year 2000.

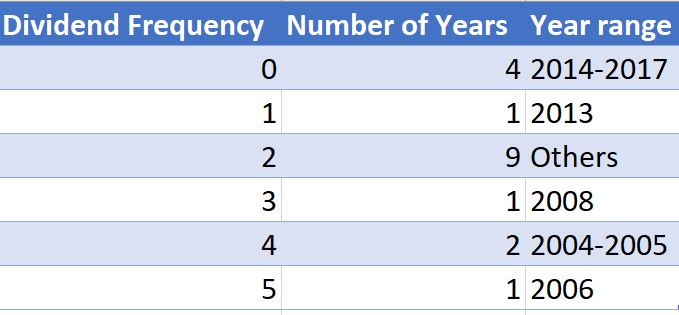

Following are some statistic and observations based on the Figure 2.0 and Figure 3.0

It is not unusual for the company to pay a small amount of interim dividend followed by a large sum in the final dividend. (See row highlighted in red in Figure 2.0).

There is no dividend between 2014 – 2017.

The company paid dividend twice a year for 9 years.

In 2006, the company paid a record of 5 dividends

Probability of getting a dividend over 17 years - 82%

Probability of getting a second dividend between 2000-2017 - 72%

Probability of getting a second dividend between 2000-2017 (Ignoring 2014-2017) - 92%

The chances of getting a second or even more dividend in 2018 is almost certain.

Finally, there is no single year that the company declared an interim dividend without following by a final dividend.

There is some question about the reason that the company chose to finance the latest project by borrowing from 3 major banks instead of using the retain earnings or cash. Cash can be reserved for investment, declare as dividend or retain for paying liabilities.

It is a common practise that part of the reserve (correction - not retained , thanks to reader that spotted this mistake ) earning/cash is used for dividend payment in the future or share buy back.

Based on the studies, it is quite likely the company will declare a further dividend in the range of 0.15-0.20

Please note : This is only a studies base on observations and it may not correctly reflect the company's view and position. Past Performance Is Not Indicative Of Future Results.

FIGURE 1.0 - Interim dividend was declared on 27-Feb-2018.

FIGURE 2.0 Dividend History Since Year 2000.

(The table in figure 2.0 is constructed in the order of year following by the dividend amount in ascending order)

FIGURE 3.0 Dividend summary.

STOCK: https://klse.i3investor.com/servlets/stk/4324.jsp

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

Discussions

There is some question about the reason that the company chose to finance the latest project by borrowing from 3 major banks instead of using the retain earnings

Using retain earnings to finance latest project?????

Retain earnings is not cash leh

2018-03-19 07:55

As per Q4 result:

Retained earnings 1,619,660M

Short Term Borrowing 79,103M

Long Term Borrowings 1,125,905M

Deposit with banks 210,000M

Bank Balance 302,907M

Do u know what is Retained Earnings?

2018-03-19 08:01

When you see articles like this, it means many idiots are still stucked with hengyuan or hoping that it will go up. Avoid hengyuan. TP RM 5

2018-03-19 08:02

Posted by Flintstones > Mar 19, 2018 08:02 AM | Report Abuse

When you see articles like this, it means many idiots are still stucked with hengyuan or hoping that it will go up. Avoid hengyuan. TP RM 5

From now onwards i only believe in Paul n Jack Kong for short term price movement..

2018-03-19 08:06

Have to study their free cash flow so as to see if they are able to pay div consistently or not...but again it's in a cyclical biz...so a bit uncertain...

2018-03-19 08:16

after failing miserably in eps prediction, now switch to cash flow and dividend prediction. unfortunately, recent 2 articles clearly illustrated the flaw assumption in their writing. when basic thing also get it wrong, you better run far far away.

2018-03-19 08:20

Posted by CharlesT > Mar 17, 2018 12:25 PM | Report Abuse X

Anyway a quick look at their past 10 years' EPS

2017 Rm3.04+

2016 Rm1.10+

2015 Rm1.10+

2014 (RM4.00+)

2013 (RM0.50+)

2012 (RM0.30+)

2011 (RM0.30+)

2010 RM0.30+

2009 Rm0.90+

2008 (RM1.10+)

3 best years (EPS above RM1 fm 2015 to 2017)

2 profitable years (EPS 0.30 n 0.90 in 2009 n 2010)

2 extremely bad years (-RM4 in 2014 n -RM1.10 in 2018)

3 bad years (-0.30 to -0.50 in 2011 to 2013)

What tells u from the above?

Watch out closely for crack spreads? Welcome to Casino??

2018-03-19 08:36

Can we use an average Gross profit margin of 2016 n 2017 to do a DFC model for the next 10 years?

2018-03-19 08:46

the smart cook already left and said goodbye

Posted by Flintstones > Mar 19, 2018 08:02 AM | Report Abuse

When you see articles like this, it means many idiots are still stucked with hengyuan or hoping that it will go up. Avoid hengyuan. TP RM 5

2018-03-19 09:50

This Charles naive loh.....!!

The latest EPS hengyuan shows strong consistent eps for 3 solid yrs mah ....!!

Absurd U call this gambling meh ??

If u think so easy ah..! show me lah....go genting and show me whether u can show consistent strong winning for consecutive 3 yrs leh ??

Hengyuan is pure earnings improvement, it is truly a bluechips in the making based on strong chinaman management, technological & military might mah....!!

This is hengyuan is a world champion mah...!!

Posted by CharlesT > Mar 19, 2018 08:36 AM | Report Abuse

Posted by CharlesT > Mar 17, 2018 12:25 PM | Report Abuse X

Anyway a quick look at their past 10 years' EPS

2017 Rm3.04+

2016 Rm1.10+

2015 Rm1.10+

2014 (RM4.00+)

2013 (RM0.50+)

2012 (RM0.30+)

2011 (RM0.30+)

2010 RM0.30+

2009 Rm0.90+

2008 (RM1.10+)

3 best years (EPS above RM1 fm 2015 to 2017)

2 profitable years (EPS 0.30 n 0.90 in 2009 n 2010)

2 extremely bad years (-RM4 in 2014 n -RM1.10 in 2018)

3 bad years (-0.30 to -0.50 in 2011 to 2013)

What tells u from the above?

Watch out closely for crack spreads? Welcome to Casino??

2018-03-19 10:27

CharlesT Have to study their free cash flow so as to see if they are able to pay div consistently or not...but again it's in a cyclical biz...so a bit uncertain...

---------- ---------- ----------

Ppl show history, you say must do fcf. Pple do fcf, you say cyclical, not reliable, cannot predict future. What you want? You so smart you write article lah. Everything also you want to complain

2018-03-19 12:01

Agreed...with previous owner but the record of dividend paid out by the chinese controlling shareholders speak otherwise..

You must be naive to expect the chinese from the mainland to pay fat dividend to small minorities. Which listed china owned companies here pay good dividend?

Great day to daydream!

2018-03-19 12:06

Flintstones When you see articles like this, it means many idiots are still stucked with hengyuan or hoping that it will go up. Avoid hengyuan. TP RM 5

---------- ---------- ----------

Meaning you are not an idiot, right? Since you are not invested in hengyuan, you come to hengyuan forum do what? Very free? Pls go do something positive and contribute to humanity pls

2018-03-19 12:13

A lot of china companies listed in malaysia carried plenty of cash but pay peanut dividend..

Using free cssh flow to estimate the capability of future dividend for such companies is an act of no diffrent than closing both eyes to cross the the road during peak traffic hour

2018-03-19 12:16

John lee i m not so smart so dare not simply write rubbish nanti kena tembak susah

2018-03-19 14:01

Anyway I believe I3 is a place for healthy discussion with different views...or else U everyday see Stockraider posting his TP of RM22 to RM42 basing on PE 10 to 20 times u also sien lah...

Betul kah?

2018-03-19 14:05

Without all these discussion David also dont know his mistakes in his DCF model to value the fair price of Heng Yuan....

Betul kah?

2018-03-19 14:07

HRCMedia now also realised Retained Earnings is not cash....everybody learnt something by having discussion here...not always listen n follow Sifu sky high TP buta buta..later go Holland buta buta also

2018-03-19 14:11

CharlesT Anyway I believe I3 is a place for healthy discussion with different views...or else U everyday see Stockraider posting his TP of RM22 to RM42 basing on PE 10 to 20 times u also sien lah...

Betul kah?

---------- ---------- ----------

Agreed. But pls comment in a non-hostile manner

2018-03-19 14:24

CharlesT Without all these discussion David also dont know his mistakes in his DCF model to value the fair price of Heng Yuan....

Betul kah?

---------- ---------- ----------

I read that article. And your comments. I think you either refuse to read the article properly or you purposely want to act stupid.

2018-03-19 14:26

Posted by John_Lee > Mar 19, 2018 02:26 PM | Report Abuse

CharlesT Without all these discussion David also dont know his mistakes in his DCF model to value the fair price of Heng Yuan....

Betul kah?

---------- ---------- ----------

I read that article. And your comments. I think you either refuse to read the article properly or you purposely want to act stupid.

Which part do u think I purposely want to act stupid?

I wish to learn from u loh

2018-03-19 14:32

Posted by PureBULL . > Mar 19, 2018 02:32 PM | Report Abuse

These Short Selling Macchines r waiting for the last Mohigan, stockraider to begin shouting loud that HY is the worst stock with 2.9X PE now n is the best stock in the world for Short.

Things will change immediately for GOOD>

Since shouting so much good, is not working.

why not shout bad, v bad is best !

When a stock is under attack, no matter what good u shout, it's still a laughing stock, FA, TA, QA, TATA all gone

Who do u think r attacking the stock? A few nobody like us who gave some different point of views? Who r those who sold millions of shares from Rm19+ to Rm8+ (ok ok Uncle Koon confessed he was one of them...)..Who else?

2018-03-19 14:35

Posted by John_Lee > Mar 19, 2018 02:24 PM | Report Abuse

CharlesT Anyway I believe I3 is a place for healthy discussion with different views...or else U everyday see Stockraider posting his TP of RM22 to RM42 basing on PE 10 to 20 times u also sien lah...

Betul kah?

---------- ---------- ----------

Agreed. But pls comment in a non-hostile manner

Please define non-hostile manner....

Do u mean anything negative on Heng Yuan is hostile to U?

2018-03-19 14:39

CharlesT Which part do u think I purposely want to act stupid?

---------- ---------- ----------

I posted comment at the DCF forum. You go look yourself

2018-03-19 14:41

Crack spread is lower in Q1 and anticipating a lower Q1 profit n prices may come down lower...

Is the above hostile to u?

Or

Tp RM22 or RM33 or RM44 most undervalued stock in the world...huat ah!!!!

Is above non hostile to u?

2018-03-19 14:41

CharlesT, you know what you type yourself. Just click your profile can see history of your comments. I no need to list down 1 by 1 those you talk to pple rudely. If you dont realise that you have been rude, then maybe I be the person to tell you to pls improve on your social skills in i3investor

2018-03-19 14:49

Could be rude but always with a sincere heart (noble intentions).

Thank you

2018-03-19 15:02

not really appropriate to judge current owner based on previous owner's behaviour

2018-03-19 22:44

not relevant to use past owner's performance to forecast current dividend under different circumstances.

2018-03-21 09:31

careful oh, pump and dump. what's the intention of author? haha. You got include risk section or not?

2018-03-21 19:54

Flintstones

Okay okay. We get it. This time is different. Hengyuan gonna reach RM 20 TP

2018-03-19 07:49