[KAYAPLUS]: AirAsia Group Bhd

mykayaplus

Publish date: Wed, 04 Dec 2019, 02:43 PM

Business Summary

AirAsia Group Bhd is an airline company listed on the Malaysian Stock Exchange. It is the biggest airline company in Malaysia in terms of fleet size and also destination. It’s sister company, AirAsia X Bhd, which focuses more on long haul flights, is also listed on the stock exchange.

AirAsia Bhd has come a long way since its inception. Founded in 1993 by DRB-HICOM, it went into trouble only to be offered a lifeline by Tan Sri Tony Fernandes. Mr. Fernandes famously bought the whole company with RM1 but saddled with RM 40 million of debts.

Since then, AirAsia Bhd has seen a remarkable recovery to be the company it is today. It is the world’s best low-cost carrier for 11 years in a row (latest as of the year 2019). It now also has affiliate companies Thai AirAsia, Indonesia AirAsia, Philippines AirAsia, and AirAsia India.

Update 30.08.2019

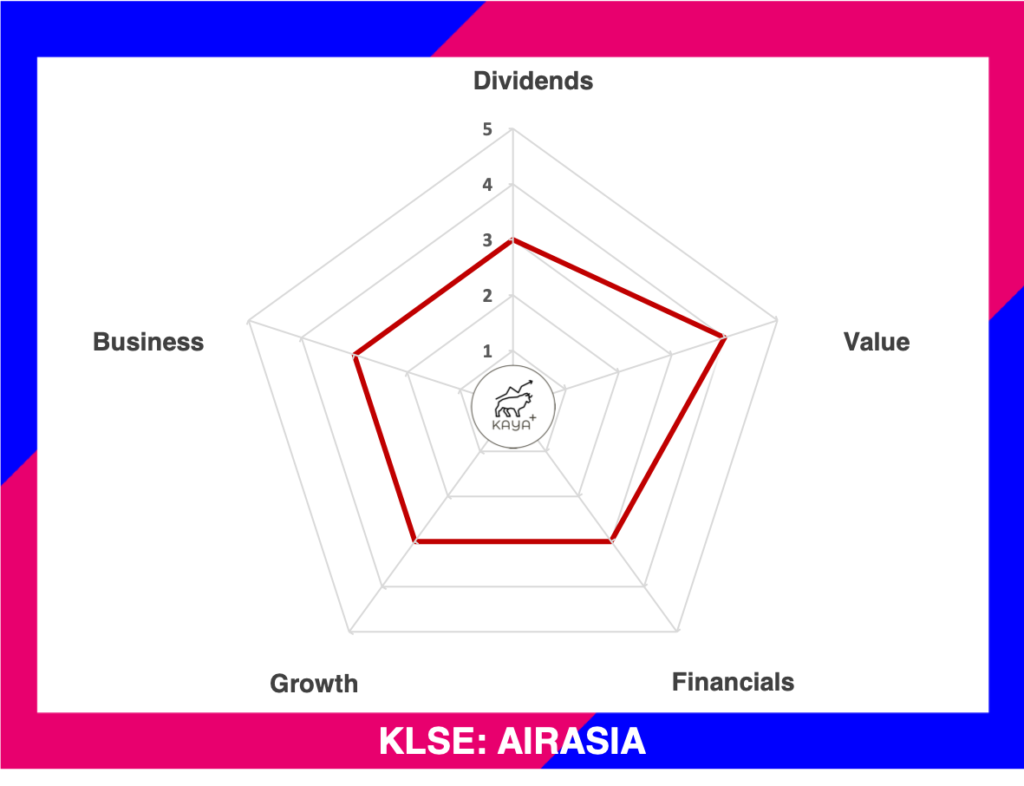

Dividends (3/5): ⭐ ⭐ ⭐

Value (4/5): ⭐ ⭐ ⭐ ⭐

Financials (3/5): ⭐ ⭐ ⭐

Growth (3/5): ⭐ ⭐

Business (3/5): ⭐ ⭐ ⭐

Reference: (i) MyKayaPlus Metrics Definition (ii) MyKayaPlus Metric Evaluation Scale

Financial Performance

AirAsia Bhd's main business is ferrying customers from one place to another via flights. It sells air tickets and then fulfilling the obligations to ferry customers from point A to point B.

AirAsia Bhd has seen remarkable growth in revenue. Revenue skyrocketed from RM 2.9 billion a year in 2008 to almost RM 12 billion a year in 2018. That is a remarkable 13.78% CAGR growth in revenue!

Operating profits wise, it is also on an uptrend. But the revenue growth pattern does not really translate accordingly to AirAsia Bhd’s profit margin. One of the main operating costs of running an airline company is jet fuel costs. Air fuel cost is cyclical hence it tends to impact AirAsia Bhd’s operating margins significantly.

A choppy profit margin will, in the end, impact the investment returns of a company. AirAsia Bhd has seen a Return on Equity fluctuating from around 30% to less than 10% over the span of 10 years. Return on Assets fluctuates between 10% and 0%.

Balance Sheet

| Year | Assets (RM’000) | Liabilities (RM’000) | Equities (RM’000) | Current Ratio |

| 2018 | 18,549,771 | 12,364,506 | 6,185,265 | 1.29 |

| 2017 | 21,674,078 | 14,963,998 | 6,710,080 | 0.81 |

| 2016 | 21,985,387 | 15,357,608 | 6,627,779 | 0.97 |

| 2015 | 21,316,257 | 16,865,403 | 4,450,854 | 0.81 |

| 2014 | 20,664,118 | 16,109,027 | 4,555,091 | 0.62 |

In the year 2018, AirAsia Bhd has Assets of RM18.5 billion, liabilities of RM12.4 billion and Equities of RM6.2 billion. The current ratio is stable at 1.29, a great leap from its previous years’ current ratio which hovers below the safety level of 1.0. One keynote was that AirAsia Bhd sold off its plane fleets to a leasing company, causing its total assets to reduce by around RM 3 billion. With the cash on hand, AirAsia Bhd repaid the majority of its debts and also distributed a special dividend. Hence we noticed a dip in Total Assets, Liabilities, and Equities if compared between 2018 and 2017.

Free Cash Flow & Dividends Paid Out

Source: AIRASIA BHD ANNUAL REPORT

AirAsia Bhd’s Free Cash Flow has been choppy for the past 10 years. Only for the past 5 years, free cash flow edged past the negative mark. But there is no trend that free cash flow will persist and trend further upwards as of now.

AirAsia Bhd has been making news headlines from time to time on their special dividend payment. The recent RM0.90 per share special dividend was the largest sum ever recorded.

The cash derived for the special dividend payment is obtained when AirAsia Bhd sells off its airplanes to another company. Then it leases back these planes to run its operations as normal. There are no operational changes, just ownership of the planes are transferred to a leasing company. The effects will be primarily on AirAsia Bhd’s profit and loss statement.

Do note that a special dividend is a “special” dividend. One should not expect “special” dividends to happen every year. Then it would not be considered special anymore.

Price

MyKayaPlus Verdict

A share price always tags along with a company’s prospects and profits. AirAsia Bhd is considered more of a growth company rather than a dividend company. It has shown explosive growth but investors who are looking for dividends would not want to bet on AirAsia’s erratic share price and one-off special dividends to stay vested for passive income.

Nonetheless, we see plenty of initiatives from the Management to further grow and compliment the AirAsia brand. AirAsia Big Loyalty Programme, BigPay, and Teleport (their air cargo service provider), and also the highly anticipated Santan franchise are seen as key areas for AirAsia to morph from an airline business into F&B and E-Commerce.

Of course, all these initiatives are still in the very early budding phase. It would take time to see how these new business segments grow. But as Warren Buffett says, “Time is the friend of a wonderful company” perhaps we should keep an eye on AirAsia Bhd and let time and the management team decide whether it can grow further in the future?

Like our Facebook page

DISCLAIMER

The information available in this article/report/analysis is for sharing and education purposes only. This is neither a recommendation to purchase or sell any of the shares, securities or other instruments mentioned; nor can it be treated as professional advice to buy, sell or take a position in any shares, securities or other instruments. If you need specific investment advice, please consult the relevant professional investment advice and/or for study or research only.

No warranty is made with respect to the accuracy, adequacy, reliability, suitability, applicability, or completeness of the information contained. The author disclaims any reward or responsibility for any gains or losses arising from direct and indirect use & application of any contents of the article/report/written material

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on https://www.mykayaplus.com/

Created by mykayaplus | Apr 05, 2020

Created by mykayaplus | Feb 07, 2020

Created by mykayaplus | Jan 19, 2020

Created by mykayaplus | Jan 14, 2020

Created by mykayaplus | Dec 23, 2019

Created by mykayaplus | Dec 23, 2019