《牛奶冰》如何设定投资的套利或卖出点 (2)

icemilkinvestment

Publish date: Fri, 31 Mar 2017, 09:32 PM

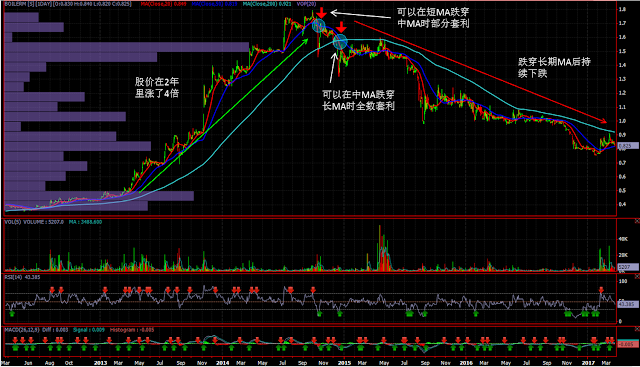

这个技术指标就是移动平均线(Moving Average)。

Evergreen

Flbhd

Hevea

Topglove

股谚云:“会买的是徒弟,会卖的是师傅”

More articles on Ice Milk Investment

Discussions

u can see these MA intersecting only when u look back... u can't see when it's intersecting in the future... go find some graph that can predict the future here and proof m wrong... thx

2017-04-01 11:10

Hi SC,

Yes you are right, MA sell signal is confirmed when there was a intersection between each other, we can't predict for future or timing when it will going to intersect each other.

That's why I mentioned MA can't help us to sell at the highest point, it just give us a signal that the trend might be changed. We could take action after few candles of MA intersection point.

Thanks for your comment :)

2017-04-01 12:07

Thank you. Your article is so easy to understand and is extremely useful for newbies. Please continue to write more for the benefits of all.

2017-04-01 13:16

When intersection happened, it may be too late to sell! I noticed the price was always at the lowest side.

2017-04-01 15:49

Hi nokenzo,

Yes, this is one of the disadvantage of MA.

Actually what I want to share is the concept and function of MA to determine exit point.

The period I choose here 20,50,200 are very common to use, trader can fine tune the period to match their trading strategy.

If want to be more sensitive, trader can choose 10MA cross 50MA as exit point, Or even can exit when the candle crossed the MA.

Sometimes MA might be too late to trigger sell, but in other view it also prevent us to sell too early in bullish uptrend.

Thanks for your comment :)

2017-04-01 16:35

hi icemilkinvestment, can go check out ARMADA using TA? is that mean its going to break out? as MA50 crossing MA200... thanks

2017-04-04 23:42

Hi SC, yes Armada MA50 had crossed MA200, today also succeed breakout nearest resistance, short term still forming higher high and momentum still there.

2017-04-05 21:57

VenFx

TQ!!!

Easy self explanation.

for,,,

20Ma

50MA

2017-03-31 21:43