TNLOGIS - AGRESSIVE SHAREHOLDING INCREASE BY MD?

jomnterry

Publish date: Mon, 19 Oct 2020, 10:08 AM

#jntstudynotes

TNLOGIS

(8367)

AGRESSIVE SHAREHOLDING INCREASE BY MD

TURNAROUND WITHIN HORIZON?

LET'S SEE.

TOTAL LOGISTIC SOLUTION PLAYER ACROSS ASEAN

TNLOGIS provides fully integrated logistics and warehousing services across Malaysia, Thailand, Singapore, Myanmar, and Laos. Clients are from F&B, FMCG, IT, O&G and healthcare industries.

FY2020 REVENUE DRIVEN BY LOGISTICS & WAREHOUSEING SERVICES

On Sep 26, TNLOGIS’ Managing Director, Mr. Ong Yoong Nyock said the Covid-19 pandemic has clearly showed that TNLOGIS’ services are essential for many industries, including food and beverage, fast moving consumer goods and electrical and electronics, which has helped it achieve high average utilisation rates of 80% for its 83 warehouses across ASEAN.

Source: TheEdge, Sep 26

In FY2020, the main driver of TNLOGIS’ turnaround is the Logistics and Warehousing Services division, which showed revenue expansion, a larger client base, and higher volumes of goods, especially for essential products such as F&B and other consumer goods, as well as medical equipment supplies. These led to higher utilisation of warehouses and increased economies of scale.

Source: TNLOGIS Annual Report 2020

GROWTH MODE ON: CAPACITY EXPANSION & EMBRACING INDUSTRY 4.0

TNLOGIS aims to continue enlarging logistics and warehousing footprint by establishing new routes and building new warehouses. TNLOGIS is investing RM200 million in CAPEX, which will go towards the construction of three new warehouses, the expansion of its truck fleet and for the logistics business. The three warehouses are expected to be completed in its financial year ending March 31, 2022 (FY22).

Source: TheEdge, Sep 26

TNLOGIS will also strengthen operations by focusing on enhancing operational efficiency and cost control effectiveness by adopting Industry 4.0 logistics and warehousing technologies such as robotics and big data.

LACKLUSTRE FINANCIALS, SELLING BELOW BOOK VALUE

TNLOGIS has a debt-to-equity-ratio of 1.47 times. Current ratio stands at 0.93 times. At a share price of 51.5 sen, it is being traded at the price-to-book ratio of 0.34 times.

Business Risks

TNLOGIS’ expansion plan may fail. TNLOGIC may fail to capture existing demand, be dragged down by its operating and finance costs that, thereby incurring financial losses in the coming quarters.

MANAGING DIRECTOR INVESTING RM29.2 MILLION AT 43.5 SEN PER SHARE

On Oct 12, TNLOGIS’ Managing Director and major shareholder, Mr Ong bought 67.05 million of new TIONGNAM shares at RM0.4354 per share, equivalent to an investment amount of RM29.2mil. The amount will be mainly used for business expansion – Purchasing properties to increase storage capacity to meet the growing demand from the customers. TNLOGIS believes achieving greater economies of scale is possible.

After purchasing the new shares, Mr Ong’s shareholding will increase from 20.3% to 30.7%. This means the Mr Ong has increased about 50% (20% to 30%) of his shareholding in TNLOGIS, at 43.5 sen per share. That’s a lot of shareholding increase in one go.

This is interesting. Affin Hwang capital gave TNLOGIS a target price of RM0.32 sen on Aug 25.

What makes Mr Ong bought his new TNLOGIS shares at 43.5 sen and increase his shareholding from 20% to 30%?

Mr Ong has joined TNLOGIS since 31 January 1990. Having more than 40 years of experience in the logistics industry, he probably sees potential in TNLOGIS that the market doesn’t.

FUNDAMENTAL GUESS – WE COULD BE WRONG

Going back to the fundamentals, the financial goal of any company is to generate earnings. Public companies that are able to generate growing earnings will be favoured by investors, causing an increase in share price.

TNLOGIS can increase their earnings by achieving two things: Earning more, and ‘spending’ less.

-

#1: Earning More - Via business expansion

TNLOGIS is striving to earn more by expanding its logistics and warehousing footprint by establishing new routes and building new warehouses. The expansion is expected to contribute to TNLOGIC’s revenues and earnings moving forward. Let’s see whether this would happen.

-

#2 Spending Less – Reducing Depreciation and Finance Costs

Based on Mr Ong’s aggressive increase in shareholding, our guess is that TNLOGIC could potentially achieve significant savings or reduction in expenses.

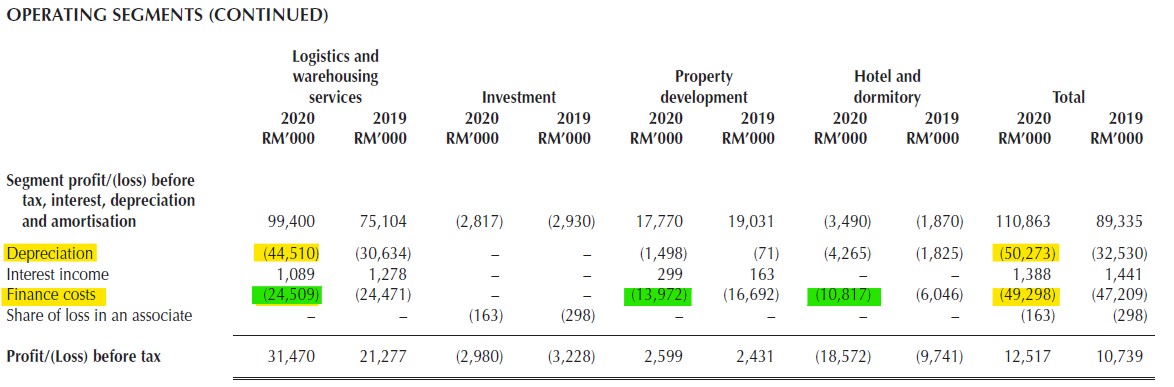

Based on TNLOGIS’ latest annual report released on Aug 28, the company incurred a total depreciation of RM50 million and finance costs of RM49 million in FY2020. This was before Mr Ong increased his TNLOGIS shareholding from 20% to 30%.

We are guessing that perhaps very recently, TNLOGIS has just managed to save a huge sum of depreciation costs and finance costs:

-

Depreciation of properties hotel and dormitor can be reduced, if they are sold successfully.

Note: TNLOGICS has also been involved in the property development as well as hotel and dormitory businesses. However, they are loss-making.

- Finance costs can be reduced, if TNLOGIS is able restructure its borrowings and benefit from the reduction of borrowing interest rates.

If above guesses are true, it would make sense why Mr Ong increased his TNLOGIS shareholding from 20% to 30% on Oct 12, about 6 weeks after its latest annual report was released.

FOOD FOR THOUGHT

TNLOGIS made losses in the previous 2 profits. Is the worst over? Let’s see.

CONCLUSION

-

TNLOGIS believes the industry prospects are bright, and is expanding their core business aggressively, despite being net-debt.

-

However, it is still too early to determine whether a turnaround would take place in near future, as TNLOGIS has made loss for 2 continuous quarters.

- The managing director is showing confidence in increasing his shareholding from 20% from 30% in October via buying new shares at 43.5 sen.

DISCLAIMER

Our views are for sharing purpose only. They could be inaccurate. Valuation perspective is beyond scope. There is no BUY/SELL recommendation.

#jntstudynotes

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Jom & Terry

Created by jomnterry | Nov 11, 2021

Created by jomnterry | Apr 13, 2021

Created by jomnterry | Oct 21, 2020