Is Icap.biz still worth investing? kcchongnz

kcchongnz

Publish date: Sun, 28 Jan 2024, 06:30 AM

Is Icap.biz still worth investing? kcchongnz

Investing is simple. Whatever stock it is, if it is selling cheap in relation to its value (quality considered), it is a good investment. K C Chong

There have been some high-quality discussions on icap.biz in i3investor forum recently where one can obtain good information about the stock. The argument about icap is centred around the persistent big discount of its share price to its net asset value (NAV).

First, let’s understand the difference between close end funds (CEF) which icap.biz is, open-end funds (OEF) which many people are familiar with, i.e., mutual funds or unit trust funds.

Similarity and differences of CEF with OEF

CEF share some traits with OEF and ETFs, but there are a number of differences that set them apart.

CEF versus OEF

- Both have an underlying portfolio of investments with a net asset value.

- Both are run by a professional management team.

- Both have expense ratios and, typically, fee schedules.

- Both may offer distributions of income and capital gains to investors.

However, OEFs issue and redeem shares daily, at the end of business, at the fund's net asset value (NAV). There is no limit to the number of shares that they can issue. When investors purchase shares in a mutual fund, more shares are created to accommodate them. When investors sell their shares back to the company, the shares are taken out of circulation. When a large number of shares are sold (called a redemption), the fund may have to sell some of its investments in order to pay the investor.

CEFs do not issue or redeem shares daily. CEFs issue only a set number of shares during its initial public offer (IPO), which then are traded on an exchange, just like any other stock listed in the exchange. Since the shares continue to trade, their market price is affected by supply and demand. That means the shares may trade at a price above or below their NAV. Often CEFs are trading below their NAV for various reasons.

What causes a CEF to trade at a discount or premium?

A CEF’s market price is largely determined by demand and supply. Similar to a stock, demand for a CEF is affected by market dynamics, investor sentiment and quantitative and qualitative factors about the fund. The fund with a newly developed investment strategy investors are eager to access, managed by a highly regarded manager, or it is paying higher distributions than other similar funds could cause a fund’s shares to trade at a premium.

Conversely, a fund may be trading at a discount due to poor fund performance, low distribution, high management fees, unrealized gains which may be subject to high tax, or the market may forecast that a fund’s future earnings or distribution potential is limited or declining. Market fear can prompt investors to sell, which will temporarily flood the market with supply.

There are more than 450 CEFs in the US as shown in the link below, whereas in Bursa, we have only one, i.e. icap.biz.

https://www.cefa.com/FundSelector/AdvancedSearch.fs#Top

Most CEFs are traded at a discount to their NAVs. Depending how wide the diversion of prices and NAVs, CEF may present good investment opportunities for investors.

At end of February 2023, 17% of all CEFs traded at a premium to their NAV, with 21% of equity CEFs and 14% of fixed income CEFs trading in premium territory. The highest discount for CEFs was 44.3%, with only three others, all in the developed market, experienced a discount of over 30%.

Is icap.biz a good investment?

Back on 20 April 2023, with a NAV of RM3.46, and at a price of RM1.99, icap.biz is trading at a whopping discount of 42.5%. If icap were to be listed in the NYEX, it would be the CEF with the second (out of 450) highest discount! So, investing in icap.biz on 20 April 2023 is a no-brainer, isn’t it?

How about now? Icap’s share price has gone up by 42.7% to RM2.84 last Friday on 26 January 2024 in about 9 months. With its NAV up by only about 4% at RM3.60, the discount has narrowed to 26.8%.

Is Icap still worth investing at this price and discount?

Performance of icap

The share price movement of a CEF does not necessary to be in sync with the growth of its NAV. The growth in NAV depends on the ability of the fund manager in picking stocks, whereas the share price movement, besides the above, is also affected by the macro-economy and market sentiments.

Growth in NAV and Share price of icap

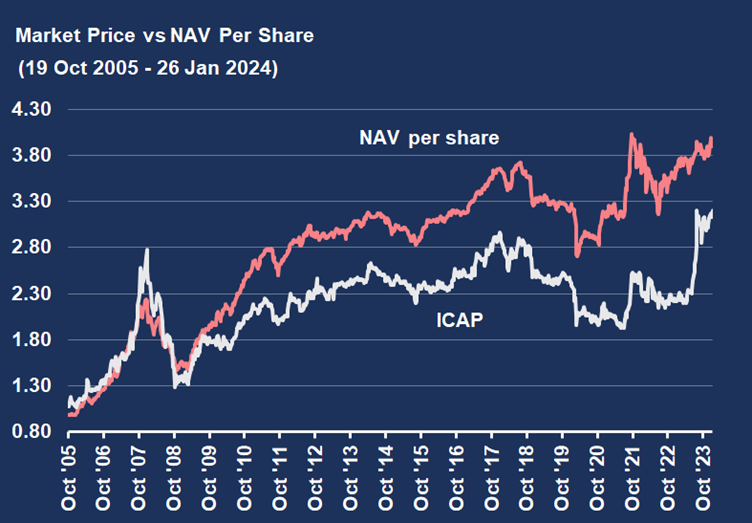

Figure 1 below shows the growth in icap NAV against its share price movement from its inception up to 26 January 2024.

Figure 1

By approximating from the charts above, the NAV of icap (in red) rose sharply since public listing at RM1.00 to RM2.30 in January 2008. That was a gain of 130% in 26 months. The share price of icap (in white) rose even higher by 180% to RM2.80 apiece. During the same period, the broad FBMKLCI rose by only 53%. The total return of Icap was more than 3 times that of the broad market. That showed the prowess of the fund manager, and it earned him the title of “The Oracle of Bursa”. At one time in January 2008, the price of icap was at a premium of 2.5 times its book value.

When the Asian Financial Crisis happened in 2008, the NAV, as well as the share price of icap retreated sharply, both to a low of RM1.40 at end of year 2008, and the premium disappeared altogether. Since then, NAV of icap was still growing at compound annual rate of about 5% until to-date.

As at to-date, with NAV of RM3.60, plus the total 29 sen dividends distributed, NAV grew by about 300% for the 18 years since public listing, or at a CAGR of about 8.0%. Share price wise, at today’s price of RM2.84, it grew about 210%, or a CAGR of about 6.5%, still not too bad, but that is nothing great, compared to the total return of the broad FBMKLCI (including estimated dividend yield) at a CAGR of about 6% during the same period.

Many initial investors of icap are quite happy with the performance of the fund manager. However, it is not true for those who invested in it through the secondary market and held the shares until today.

Figure 1 above shows that if one invested in icap 16 years ago at the beginning of 2008, or 6 years ago in 2018, he gained nothing except 29 sen and 20 sen respectively in dividends. The return in investing in icap in other times were not good too and likely under performing the broad market.

Poor performance of icap share price

In the first 26 months since listing, the fund obtained a total return more than 3 times that of the broad market. The fund manager of icap is definitely not a bad investor. The Achilles heel of the fund manager was psychological, his prolonged fear of adverse macro events, and keeping large amount of fund un-invested. From year 2013 to 2021, the fund manager kept most of the assets of icap in cash, instead of investing in shares as a fund manager supposed to do. In 2016, more than 70% of the assets of icap were kept as cash.

While icap kept much of its assets in cash, the broad FBMKLCI shot up from 864 points to 1887 points in 5 years from 2009 to 2014, and then some corrections due to the oil crisis. Then from 2016 to 2019, I remember it was a good time picking stocks in Bursa.

I personally had made good return during these periods. I believe, if icap was fully invested, which as a managed fund should do, its NAV would have grown a lot more.

Is icap still worth investing now?

I reiterate that 9 months ago, at a discount of NAV of 42%, investing in icap is a no-brainier. What about now at half the discount of 21%?

I still think so although the thesis is not as compelling now compared to 9 months ago.

The median discount of the 450 CEFs in the US was about 10%.

I also believe the fund manager is good one too and he should be able to grow the NAV of icap faster than the broad market. It helps if he has more humility. Just my personal opinion.

Moreover, there seems to be some catalysts in narrowing the discount of icap.

For continuous reading, please go to my Facebook page below, click “like” and follow,

https://www.facebook.com/kcchongnz

kcchongnz

More articles on kcchongnz blog

Created by kcchongnz | Jan 22, 2024

Which to buy, Insas or Insas WC?

Created by kcchongnz | Jan 15, 2024

Created by kcchongnz | Jan 01, 2024

Created by kcchongnz | Dec 25, 2023

Created by kcchongnz | Oct 02, 2022