2024 New Year Reflection Investing in the Stock Market: Timing the Market

kcchongnz

Publish date: Mon, 01 Jan 2024, 08:07 AM

This post was first published in my FB page below.

https://www.facebook.com/kcchongnz/

The stock markets around the world ended its last day of the year on 30 December 2023. How well have you done in investing in the market this year? Were you meaningfully invested in the markets in the first place, or you were scared off by the fear of recession in the year?

A few years ago, I know of some friends in my WhatsApp Group who were fervent investors, or rather just stock market participants in Bursa Malaysia, as investing like what Ben Graham wrote in The Intelligent Investor:

“An investment operation is one which, upon thorough analysis, promises safety of principal and a satisfactory [or ‘adequate’] return. Operations not meeting these requirements are speculative.”

Most of them were getting in and out from the market, from their WhatsApp messages, they were trying to time the market looking at charts every day, trying to maximise their returns. Since about 4 years ago, I hardly seen any of those messages anymore.

Have they left the stock market completely? Probably most of them have and that would be the right move to conserve wealth rather than taking risks to try to make more money as we are all retirees now. Most of them are quite well to do from years of working with a good career, and with their savings which are adequate to last their retirement.

But how good are you in predicting the stock market? Let us carry out a review to see if it is advantageous in timing the stock market?

Here, we will base on the predictions of pundits, the economists, professional analysts and investment bankers, and many other influencers. These experts and market predictions were more readily available in the U.S. market, and we will use the performance of the U.S. market as example.

Figure 1 below shows the stock market performance of S&P 500 which we use for our illustrations.

The last five years was an interesting period for the U.S. as it involved elevated stock price volatility because of the unprecedented Covid-19 pandemic, lock downs, uncontrolled printing of money of the U.S. government and many others, irrational exuberance in the high growth technology sector, the Russian-Ukraine war, followed by high inflation and fast rise in interest rates from almost zero to more than 5%, etc.

The Covid-19 pandemic

The World Health Organization (WHO) declared the deadly contagious virus which started from Wuhan, China in 2019 as Covid-19 pandemic. When the pandemic got more widespread around the world in March 2020, the stock markets around the world plunged. The leading world index of the S&P500 lost more than 1,000 points, or 32% within a week in March 2020 to 2,305 points on 20 March 2020 as shown in point A in Figure 1 above.

The spread of Covid-19 and the subsequent economic fallout had a serious effect on the livelihood of everybody all around the world and hence the stock markets. There were lockdowns, and people are dying, in hundreds of thousands. It was hard not to know someone or close to someone you know, died from the virus.

On hindsight, a stock investor “should have known” this seriousness and would have sold all his shares just before the pandemic, instead of incurring heavy losses at the start of the pandemic. However, it is only after the fact.

But that was what most of the pundits; the economists, professional analysts and investment bankers advised, to sell off at the advent of the pandemic, right at the bottom at the end of March 2020, as they forecast there would likely be a world-wide economic depression, equal to that of the 1920s. The pandemic was really very serious.

But thanks to the Fed’s action, the economic depression was not to be with printing of money in a furious manner.

The largest and unprecedented stimulus packages the US and other governments poured into the economy led to a V-shape recovery in the stock market to its pre-pandemic level within 5 months as shown in Figure 1 below.

A big surprise to everyone, professional analysts and investment bankers included, instead of killing the economy, the lockdowns pushed record-high demand for digital and in-home products & services. This marked one of the best periods for technology companies as the S&P500 continued to go up to reach a peak of 4,766 points, point B in Figure 1. That was a gain of 107% from trough to peak.

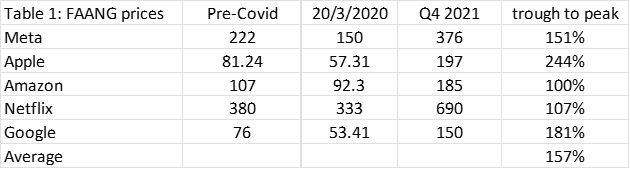

Table 1 below shows the peak prices of the stocks of the five most popular and best-performing American technology companies, the FAANG, at pre-pandemic, the low during the peak of Covid-19 pandemic, and the peak in 2021.

Again, on hindsight, an investor “should have” invested with all the money he had at the third week of March 2020, or even use heavy margin finance when the market has dropped to its lowest level. He would have made huge profit when the overall market has gone up 47%, back to its pre-pandemic level, and even much more by 107% at the end of year 2021 at point B in Figure 1.

The opening up of the economy

In early 2022, the good news continued pouring in. The economy is reopening and everything is back to normal. There was no more lockdown. People were expected to spend and travel again.

Most pundits were optimistic about the stock market in the near future. There was great interest in the high growth stocks which benefitted from the pandemic. The stock prices of many high growth stocks which have not made any profit yet were chased to sky-high prices.

However, there was a problem. The inflationary pressure started to heat up and the Fed decided to do something about it. The fast and furious quantitative tightening by the Fed caused the interest rate to rise from almost zero to above 5% in a short period of about a year.

The stock market plunged in 2022 precipitately. It was one of the worst-performing periods over the past decade.

How bad was the correction?

The S&P500 fell about 25% from the beginning of the year 2022 as shown from Point B to middle of October 2022 (Point C) in Figure 1.

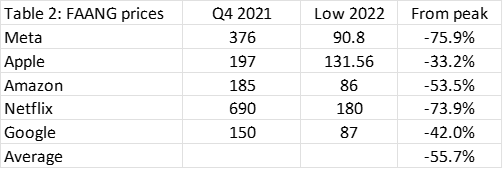

The share prices of FANNG (Same for the magnificent 7) fell by a whopping average of 56% as shown in Table 2 below. The share price of Meta and Netflix fell much more at 76% and 74% respectively.

Many of the high-flying technology stocks recommended by the popular Cathy Wood, Motley Fools such as Teladoc, Lemonade, Twilio, UiPath, Roku, Upstart, Unity Software, StoneCo, Fubo, Fastly, etc., fell by more than 80%! Even Tesla fell by more than 75%.

Again, the market behaved very different from what was predicted and expected by the pundits.

What if one got disillusioned and get out from the stock market completely at the end of year 2022?

2023: The Highly Predicted Recession Year

With inflation remaining persistently high toward the end of year 2022, and still going up, and reinforced by an inverted yield curve, many economists and analysts saw a recession and market crash coming in 2023. That was also the overall worrying sentiment in the year. Many businesses and consumers are feeling the pressure.

Instead, powered by resilient consumers and a strong labour force, the U.S. economy defied expectations of a recession by posting consistent growth in 2023. The most recent results show 5.2% GDP growth in the third quarter, coming after 2.2% in the first quarter and 2.1% in the second.

Most economists didn’t see that coming, and they generally forecast a 70% chance of recession, according to a Bloomberg monthly survey of economists from December 2023. The median estimates forecast anaemic 0.3% GDP growth in 2023.

But that expected recession in 2023 didn’t happen. From the latest data, inflation has subsided. The market is looking at interest cuts in the year 2024.

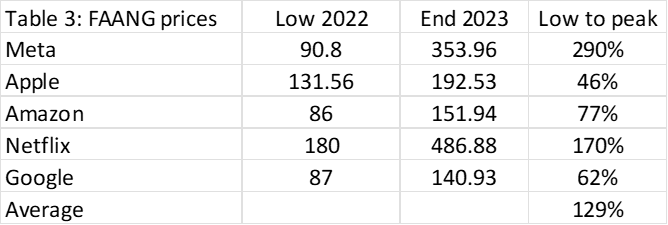

With the economy steering clear of recession, the stock market soared, too. In just about one year to end of year 2023, the S&P500 gained 33.1% from its low in 2022 as shown in Figure 1 above. The share prices of the FANNG increased by a whopping 130% as shown in Table 3 below!

But the great results were not followed by the high growth stocks which went up sky-high in prices during the 2012 market run. Many of their share prices remain a small fraction of their peak prices.

Valuation matters.

Investors who followed the predictions of economists and professional analysts would have missed another big run of the market. But again, that is also a hindsight bias.

A Better Way: Do Nothing

“The stock market is a voting machine in the short term and a weighing machine in the long term.”

It is very hard for us to predict the short-term share price movement, even economists failed most of the time as you can see. It may be easier to predict the long-term future. All we have to do is to focus on what are the long-term trends that have worked and will continue to work in the next 3-5 decades?

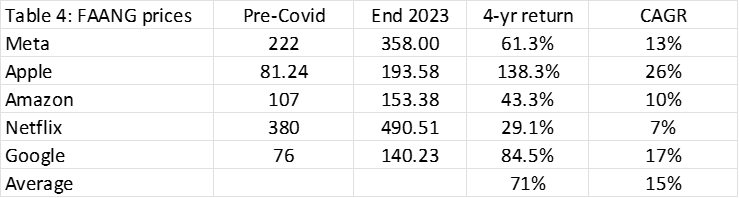

Figure 1 above shows that if you invest in the broad S&P index and do nothing since the advent of Covid-19 four years ago, your cumulative return would be about 42%, or a reasonably good CAGR of about 10%, after riding through two deep stock market corrections in March 2020 and the year 2022.

But if you are savvy enough to have invested in the FANNG in the last 4 years and do nothing, your return is much more at 71%, or a CAGR of 15% as shown in Table 4 below.

So, a good way to invest is invest smartly, and then do nothing.

“Whatever will be, will be”.

Just look at the 40 years trend of the broad market as shown in Figure 1 below you will understand the power of investing (in good companies) for the long term.

Over the 40 years period, the broad U.S. market has gained 2718% as on 31 December 2023, or at a compounded annual growth rate (CAGR) of 8.7%. The total return, with dividends reinvested, would be slightly more than a CAGR of 10%.

$1,000 invested in the market becomes $45,300, about 8.5 times more if one were to put into bank earning at interest rate of 4%. Can you appreciate this vast difference in wealth-building process, the power of compounding?

And of course, the business performance and valuation matter too. However, most market participants cannot do that due to various reasons, either lack of knowledge, or time, or simply have no interest in stock investing. Hence, instead of earning good returns from the stock market, 90% of retail investors lost money in the stock market.

Happy New Year 2024.

KC Chong

More articles on kcchongnz blog

Created by kcchongnz | Jan 22, 2024

Which to buy, Insas or Insas WC?

Created by kcchongnz | Jan 15, 2024

Created by kcchongnz | Dec 25, 2023

Created by kcchongnz | Oct 02, 2022

Discussions

By the way do nothing is not an option. You have to monitor internal and external factor, the macro and micro economic factor that will impact the forward earning of the company.

2024-01-01 10:53

Sslee

By the way do nothing is not an option. You have to monitor internal and external factor, the macro and micro economic factor that will impact the forward earning of the company.

Sslee, Happy new year to you too. Congrats that you are one big contributor in i3 now.

Investing is an interesting thingy. Everyone has his own opinion. It is hard to say who is right or wrong, until we got the fact, later.

My article here describe how most of the experts have predicted the market. They were mostly bearish at the advent of Covid-19, but the year 2020 and 2021 turned out to be a couple of best years in stock investment. Most experts turned bullish later for 2022 when the market was so bullish that high growth stocks in 2021, and 2022 turned out to be one of the worst years for high growth technology stocks. When Fed started the quantitative tightening in 2022, most experts predicted a recession in 2023 and stocks would be hurt. But then what was the results in 2023?

If most experts were wrong for the last 3-4 years in macro thingy, what is the chance that we can be better than them?

In my article, I have also shown that buying good stocks, for example the FANNG stocks 4 years ago and do nothing, the return were good too even encountering the Covid-10 debacle as well as the high inflation and interest rate environment in 2022, compared to if one were to follow the advice of the experts to get in and out of the market.

These are just statistics.

2024-01-01 15:10

Kcchongnz,you summed it up well.However in bursa we do not have FANNG.Bursa lacks the innovation factor behind FANNG.However we do have our own smallish kampong champions.

2024-01-01 15:38

I have nothing against buying good stocks and do nothing BUT in Bursa how many stocks can be considered as good stocks?

I am more aggreeable with CharlesT obversation.

Posted by CharlesT > Dec 31, 2023 12:34 PM | Report Abuse

Only for those newbies who after reading few books of WB/Cold Eye etc then wanna aim to be a so called long term value investor....sounds very geng....lol

It shouldn't come fm such a seasoned old snake in the mkt

2024-01-01 17:08

Posted by klee > 17 hours ago | Report Abuse

Klee

"Kcchongnz,you summed it up well.However in bursa we do not have FANNG.Bursa lacks the innovation factor behind FANNG.However we do have our own smallish kampong champions."

You are right. My "Do nothing" comment is for the broad US market in general using the S&P 500 for illustration, and the FANNG stocks as examples.

For Bursa, we do have some good stocks which can also good to invest for long term, like some of the component stocks in KLCI. But those good stocks in Bursa don't come cheap, and hence not qualified for "Do nothing" kind of stocks.

Nevertheless, we can still find many good stocks to invest in Bursa when they are selling cheap, but we should take profit when they become overvalued.

So investing in Bursa is best to use the value investing strategy.

2024-01-02 09:38

Integrity. Intelligent. Industrious. 3iii (iiinvestsmart)$â¬Â£Â¥

>>>

Posted by Sslee > 2 days ago | Report Abuse

By the way do nothing is not an option. You have to monitor internal and external factor, the macro and micro economic factor that will impact the forward earning of the company.

>>>

I spent many hours listening to Bloomberg and CNBC over many years. Did this influence or help in my long term investing? Not really. The macroeconomic and the microeconomic issues and the talking heads mattered little, if at all, in my investing. Over the long term, keeping investing simple and sticking to a good philosophy and method are all that mattered.

Keep it simple:

Know the company you invest in.

The business must have economic moat, preferably with a long runway.

The management must be trustworthy.

Buy at a fair price or bargain price.

Hold and hold for the very, very, very long term.

2024-01-03 20:14

Thank you for the infos. Am a retiree but has been in the market off and on. Never really make good money neither do lost much except in 1990s. Still learning

2024-01-16 08:01

Happy Chinese New Year

Choyson will come & bless us in this coming new year

Insas will be top pick of the year loh!

The great n really explain precisely what value investors to look for & capitalise on.

Base on insas negative enterprise value of Rm 1,844M or Rm 2.79 per share, an investor can takeover Insas for free & pocket Rm 2.79 per share loh!

Rationally this really ridiculous but it is a fact & real loh!

On top of that KC only monetize Inari & insas other liquid assets but exclude insas other listed subsidiary namely M&A, Insas sizeable real estate properties, profitable unlisted business ,Associate listed Ho Hup and Insas all other assets loh!

The above deep quality undervaluation shows that insas is really conservatively well manage thus debunked the notion of poor mkt perception loh!

Big shark should take this good opportunity to buy up insas by taking a sizeable stake of Insas & be a profitable business partner of Tan Sri Thong loh!

Actually Thong can be a good business partner & shows very good governership for example Inari has very good perceive governance compare to Insas loh!

I m sure Thong can easily adapt to this higher standard base on the current management formula as per Inari model!

The ideal position for the new opportunistic big investor is 20% stake of insas loh!

Assuming taking up 20% stake at average price of Rm 1.50 will only cost him Rm198m compare to Insas overall shareholders revise capitalization of more than Rm 3.3B or equivalent to Rm 660m @20% stake loh!

For small investors u should start buying insas now & side with the future opportunistic large investors loh!

As for Sifu Sslee, Raider suggest that he should forget about giving an exemption to Thong, if a GO trigger bcos of him buying or exercising his warrant as the cost of GO is only Rm 1M which is peanuts to him compare to Insas negative enterprise value of Rm 1.84B loh!

I think eventually Insas will eventually move above Rm 3.00 to Rm 4.00 loh!

2024-01-16 08:55

Sslee

Happy new year 2024 KCChong.

Market will always behave irrational and depend on all those international big funds whether they are moving their money from China/HK market to USA.

Otherwise how you explain the share price movement of Tesla compare to BYD.

Fundamentally is Tesla better than BYD???

2024-01-01 10:40