2023 Christmas reflection on pitfalls of investing in the Malaysian stock market kcchongnz

kcchongnz

Publish date: Mon, 25 Dec 2023, 11:05 AM

"Rule No.1: Never lose money. Rule No.2: Never forget rule No.1." - Warren Buffett

I3investor.com was the first investment blog I started my blogging. It was a great place for me to share my investment articles and at the same time, I got the good opportunity to know many friends, not only e-friends but have met quite a number of them and we have become close friends now. We do get together once a while. For this, I really have to thank the administrators of i3investor, who still able to keep this blog going.

I have left i3investor for a while now due to certain reason. Now, I try to come back and I hope I am welcomed.

I wrote my first post on how to avoid losing money in the stock market in i3investor, “A Christmas reflection of the pitfalls in investing in Bursa in 2013” in the link below,

https://klse.i3investor.com/blogs/kcchongnz/45373.jsp

Exactly 10 years have passed. How time flies!

Since then, in every year when Christmas is coming, I had a review on this topic again. Hopefully this can help those less informed to avoid losing big dabbling in the stock market.

When I first started dwelling in i3investor, there were many participants asking me whether certain stocks were good buy or not. There were good stocks, and there were bad ones, and different lists were compiled.

The above-mentioned article is about bad stocks, or lemons stocks. For the success of investing outcome, it is equally important to avoid potential bad stocks as getting multi-baggers. It is just like golfing. To get good overall score for a round of golf, it is equally important, if not more important, to avoid double bogey than taking chances to score birdie.

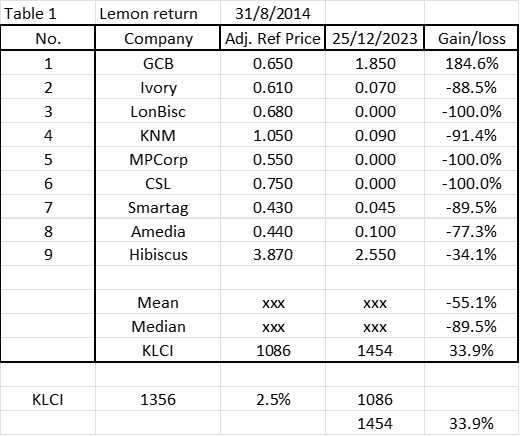

Let us re-look at some of the hot Bursa stocks which some people in i3 forums asked me way back in 2014 as shown in the link above. The list of stocks is shown in Table 1 in the Appendix.

Return of portfolio and individual stocks

As at to-date on the Christmas Eve 2023, out of the 9 stocks listed in Table 1 in the Appendix, only one stock, Guan Chong Berhad (GCB), did reasonably well with a return of 185%, much better than the return of the broad market, while the other eight, or 90% of them, lost heavily, ranging from 34% for Hibiscus to 91% for KNM over nine years period, while the total return of broad KLSE Index has gone up by about 34%.

Three stocks, or 33% of them, CSL, MPCorp, and London Biscuits suffered total loss and were delisted from Bursa. Another 2 stocks, KNM and Ivory are marching towards the same doomed destiny.

What are the characteristics of these stocks which have gone bankrupt, and some fallen so much in prices from their peaks?

Here is a summary of the characteristics of those stocks when I did my analysis nine years ago.

1. Hypes, rumours, fads, and hopes.

This includes Hibiscus, Smartrack, Asia Media, MPCorp touted by the interested parties as pumped and dumped candidates.

A few months ago I wrote about this company, Green Packet, also a hyped-up stock in the link below,

https://www.facebook.com/page/1238461152861295/search/?q=green%20packet

Hibiscus appears to have reversed its fortune with some good and cheap acquisitions of oil field some years ago and it has become highly profitable now. In fact, it has become a stock in my Bursa stock portfolio a couple of years ago,

2. High growth, even extremely high but value destroying growth

KNM’s growth for the ten years prior to 2013 with compound annual growth rate, CAGR of more than 30% outpaced many technology companies in the US. It was foraying and making its footprints all over the world with big acquisitions with borrowings ballooned to over billion of Ringgit.

London Biscuit was another one which had grown itself to bankruptcy now.

3. Low return on capital

Alas, the growth of these companies above were such a poor-quality growth with the return on capital way below their costs. That destroyed shareholder value.

London Biscuit, KNM, Ivory came out as Champions with return on capital consistently less than 4%. Others had no return to talk about as they incurred losses.

4. Poor cash flows

GCB, London Biscuits and KNM had had accounting profit but poor cash flows from operations and negative free cash flow almost every year. This was the result of continuous build up of inventories and receivables for years much faster than the growth in revenue.

These companies also continuously spending huge amount of money in capital expenses which did not yield any positive results, a value destroying act.

Was I wrong about GCB poor cash flows?

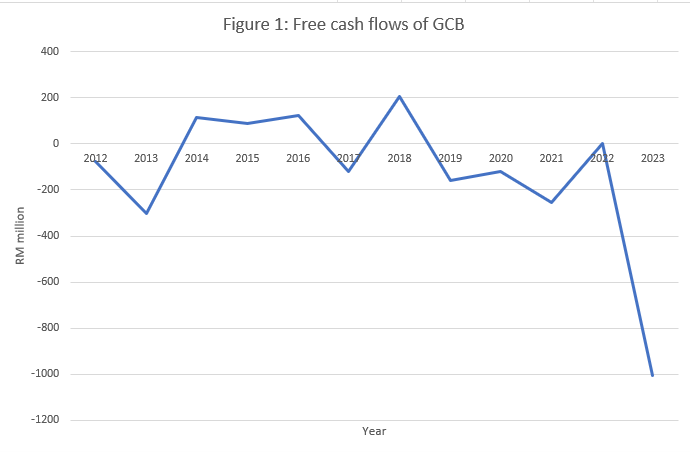

I just had a review of the cash flows of GCB. No, I do not think I was wrong about the poor cash flows of GCB.

In the last 10 years, the business of GCB has sucked RM1.43 billion of cash. In the last 5 years, it sucked even more cash of RM1.54 billion. Last twelve months alone, it has already sucked more than RM1 billion of cash, while earning only RM105 million of accounting net profit.

Figure 1 below shows the free cash flows of GCB in the last 11 years. Note FCF is negative in most years.

A lot of investors, some investment coaches, and many professional analysts and investment bankers have been singing praises for the high growth in revenue and profit of GCB, but I will not touch it with a ten-foot pole in view of its precarious cash flows problem.

Well, I was wrong about the future share price performance GCB previously.

But wait, was I wrong about its share price? No, I have never discussed about its share price, or the most, I would not buy GCB at that price then.

I do wish you can point out to me what was wrong with my analysis of its cash flows, if any.

The poor cash flows of GCB have resulted its bank borrowings escalated from RM878 million in 2014 to RM2.11 billion as on 30 September 2023. Total debt is 122% of its equity, and the quick ratio fell well below one at 0.6.

I do not think it is a good sign, do you?

I have also written another article on analysis of cash flows which can provide a guide for avoiding companies with poor cash flows in the link below.

https://www.facebook.com/search/top/?q=Lessons%20from%20the%20saga%20of%20Serba%20Dinamik%20continued%3A%20Grow%20Baby%20Grow!

Another piece on how to look for good cash flows and avoid bad cash flows companies here,

https://www.facebook.com/search/top?q=alcom%20cash%20flows

5. Poor quality balance sheet

The balance sheet has to be deteriorating with persistent negative free cash flows. This happened to Ivory, London Biscuits, KNM, and even the highflier GCB.

You can see their debts keep on increasing unabated to the extent of the high risk of bankruptcy with high debt-to-equity ratio, below unity current and quick ratio, and negative cash flow coverage.

The quality of the assets is poor, mostly in receivables, inventories, property, plant and equipment, tax assets, and intangible assets which when liquidated, are worth little or even nothing at all.

6. The red chip

The Chinese listed companies are notorious for their questionable financial account. Chines Stationery Limited, CSL’s annual report shows they are making tons of money with plenty of cash flows and cash in bank, a few times higher than its market capitalization, and yet they kept on asking shareholders to subscribe to rights issues.

Other red chips listed in Bursa, Xingguan, Maxwell, China Automobile Parts, China Ouhua, Multi Sports, Xinghe etc., all suffered and will suffer the same fate. No exceptions!

Recently I also wrote about this China-proxy company, Lambo, another classic case in the link below,

https://www.facebook.com/page/1238461152861295/search/?q=lambo

7. A lot of corporate exercises

KNM has made numerous corporate exercises; bonus issues, right issues, “free” warrants, share split, share consolidation after split, share value reduction etc.

London Biscuits, Asia Media, Lambo, etc. They all had numerous rights issues, private placements, and “free” warrants too until its share capital increased by many folds.

I have also written about the “fantastic” corporate exercises of EAH and Vivocom.

https://www.facebook.com/search/top/?q=Are%20freebies%20goodies%3F%20

Their share prices have diminished to a small fraction of their previous prices now.

8. Favourites of analysts’ coverage

KNM was the darling of the professional analysts and investment bankers in the early 2000s. Many local and foreign funds held substantial shares in it. Asia Media, London Biscuits, GCB were all favourites of the analysts in those times.

The king here would be IPower, Vivocom and Vinvest. It is the same company albeit with a different name heavily promoted by investment banks, especially by CIMB Investment Bank one time.

9. Seemingly Cheap Cheap

London Biscuits, KNM, GCB, and Ivory Properties have always been traded with low single-digit PE ratio. The PE ratio of CSL was even more ridiculous at 2 or 3.

This low P/E or P/B ratios only can deceive naïve investors, or those who don’t even bother to examine the financial statements (Most do not have the ability to do so anyway), thinking that they are cheap.

10. High volatility

Many of those hot stocks are volatile in their share prices as insiders, syndicates treat those individual investors as easy meat, frying the share price up and down, resulting many individual investors losing their hard-earned money.

KNM, London Biscuits, GCB, Hibiscus, Asia Media etc. in those days were stocks with big jump in share prices within days.

Do you think the individual investors can beat these insiders, manipulators, and syndicates in this zero-sum game of speculating and gambling?

Conclusion

It is always not easy to predict if a company would do well in the future and that its share price would rise. However, it is much easy to see if a company is likely not to do well. The evidence is all over the walls. I seldom get wrong in this respect, especially in the long-term.

For individual investors, it is best to take care of the downside first and let the upside takes care of itself. Guard yourself against risks. This should be the golden rule in investing.

So, remember, if you can avoid heavy losses in investing, half your battle has already won. But you must know what to look for, of course.

Merry Christmas and happy new year.

KC Chong

Appendix

More articles on kcchongnz blog

Created by kcchongnz | Jan 22, 2024

Which to buy, Insas or Insas WC?

Created by kcchongnz | Jan 15, 2024

Created by kcchongnz | Jan 01, 2024

Created by kcchongnz | Oct 02, 2022

.png)