Kenanga Research & Investment

Daily Technical Highlights - SKPRES | PENTA | SERSOL

kiasutrader

Publish date: Tue, 14 Jul 2015, 10:35 AM

The FBMKLCI inched up on Monday

The FBMKLCI ended Monday marginally higher (+0.53 points) to close at 1,716.11, tracking gains in key regional markets.

Furthermore, the European leaders have reached a deal with Greece on a debt bailout that will keep it in the Eurozone and the

better-than-expected Chinese trade data boosted the market sentiment. However, the Ringgit continues to weaken against the USD

to close above RM3.80/USD level (Refer to figure 2). Market breadth was relatively balanced, with 357 gainers, 360 losers and 322

counters traded unchanged. Chart-wise, a “Spinning Top” candlestick has formed, suggesting the indecision of the investors on the

market direction. Readings from key indicators are relatively neutral, implying the uninspired mood. We reckon that the trading

volume will remain subdued for this week approaching the Hari Raya Puasa holiday. Thus, we are maintaining our view that the key

index could continue to trade within the range of 1,690-1,730 level. Nevertheless, we are looking forward to the upcoming quarterly

results season for better clarity on market direction. Should the key index manage to convincingly break above the 1,725 (R1) level

with strong volume, it stands a chance to rally towards 1,750 (R2) next. Meanwhile, we observed that several precision moulding

counters are garnering investors interest recently potentially benefiting sentimentally from the stronger greenback, thus we are

featuring two precision moulding counters, namely SKPRES (TB, TP: RM1.47) and PENTA (NR).

Daily Technical Highlights

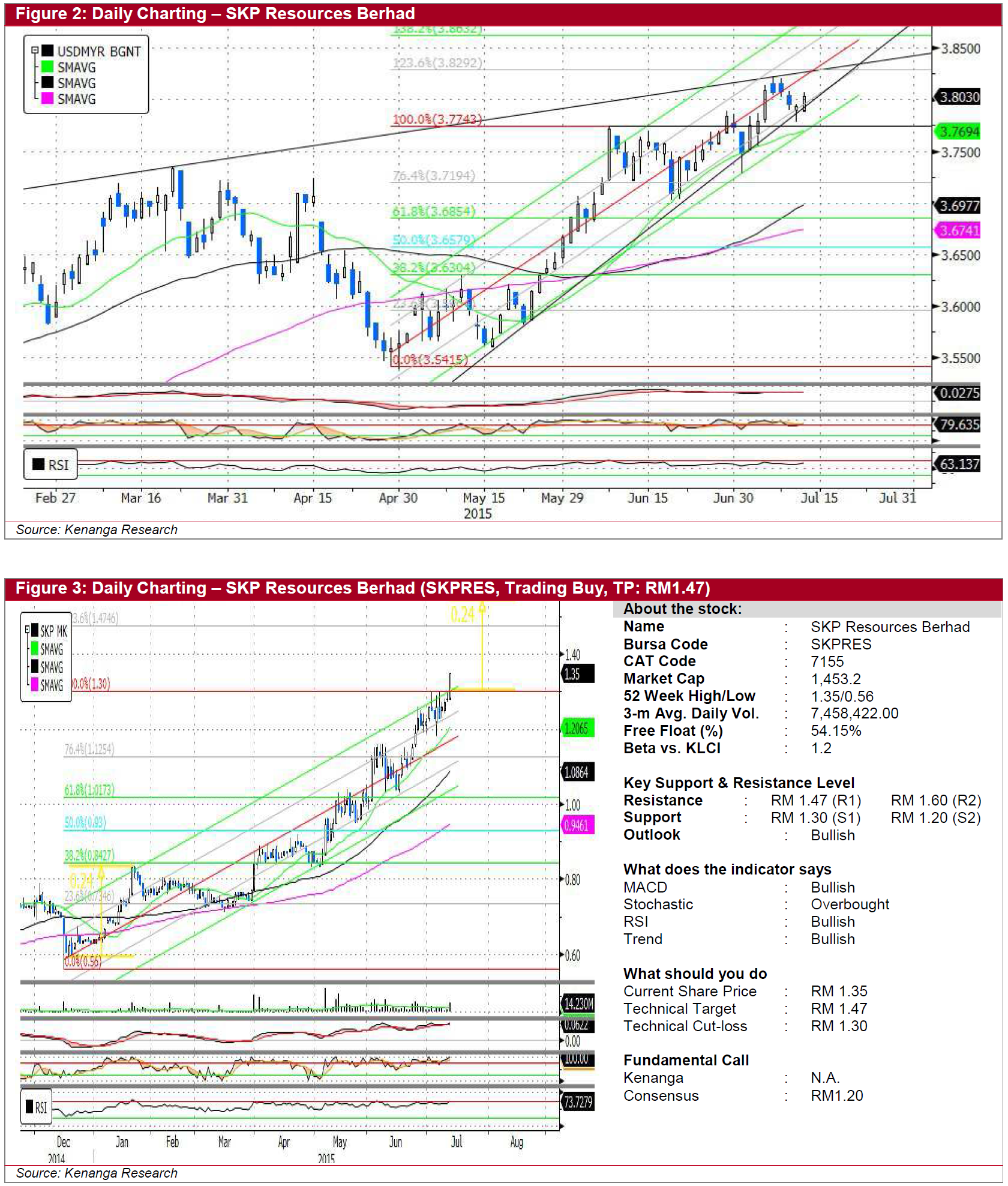

· SKPRES (TB, TP: RM1.47) recently secured a new contract in May from its key customer, Dyson, to manufacture the new

cordless vacuum cleaners. The contract announcement saw the share price garnering investors’ interest, as the share price

rallied to its all-time high of RM1.35 yesterday. Coincidentally, the share price has broken out from its +2SD regression level on

high trading volume. Despite the overbought situation in both the Stochastic and RSI indicators, we deem this as acceptable

levels as we observed that these indicators usually hover around such levels historically. Should follow through buying interest

continued to gain traction, we reckon that the share price could potentially rally towards its next Fibonacci resistance level of

RM1.47 (R1) in the near-term.

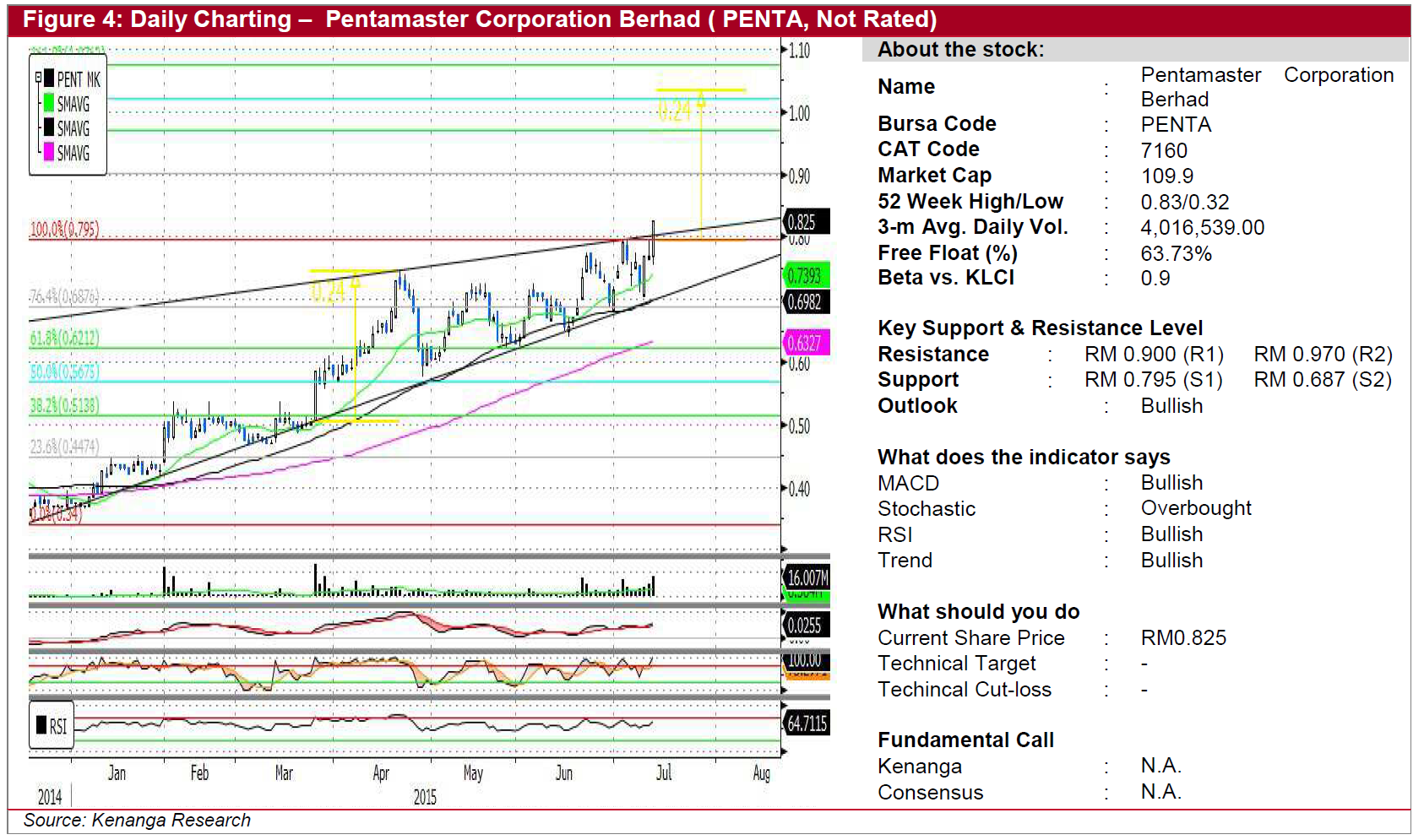

· PENTA (Not Rated) surged 5.5 sen or 7.14% yesterday, breaking out from its long-term resistance-turned-support to close at

an all-time-high of RM0.825. Coupled with high trading volume, strong buying momentum is showcased with all key indicators

heading north. We believe the share price could rally towards our measurement objective target price of RM1.055. However,

possible consolidation could occur in the near term as we are aware that the Stochastic indicator has entered overbought

territory while RSI is approaching the said threshold. Hence, we advocate investors to wait for the stock to consolidate back

towards its resistance-turned-support level of RM0.795 (S1) to neutralise its overbought situation before entering the stock.

· SERSOL (Stopped Out). Recall that we had previously placed a Trading Buy call on SERSOL (TP: RM0.34, report dated 5-

Jun-15) after the share price gapped up to stage a potential rebound play. However, SERSOL has failed to perform according

to our expectation as the share price continued on its consolidation mode after reaching a high of RM0.415. In tandem with the

lacklustre trading volume over the past month, key indicators are also relatively flattish to suggest the lack of buying momentum

and a prolonged consolidation phase is in the cards. As the share price has triggered our stop-loss level of RM0.28, we are

stopping-out our position on this counter.

Source: Kenanga Research - 14 Jul 2015

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Actionable Technical Highlights - MALAYSIAN RESOURCES CORPORATION BHD (MRCB)

Created by kiasutrader | Nov 28, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments