Daily Technical Highlights - (CCM, PUC)

kiasutrader

Publish date: Fri, 26 May 2017, 09:03 AM

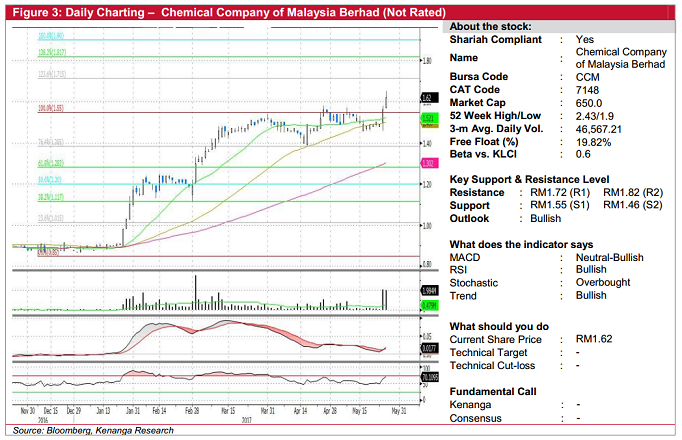

CCM (Not Rated). CCM’s share price ended a choppy day up 6 sen (3.8%) at RM1.62 on high volume of 2.0m shares. The company had earlier on Tuesday announced its 1Q17 results, which showed that revenue jumped 40.1% YoY while NP came in at RM8.2m compared to a net loss in 1Q16. Overall, CCM has been on a bullish trend since January. Although the share price entered into a two-month period of sideways trade, the share price finally broke out yesterday and now trades at a five-year high. With momentum indicators such as the MACD and RSI sporting bullish conditions, expect bias to be on the upside towards immediate resistance levels RM1.72 (R1) and RM1.82 (R2). Any weakness towards RM1.55 (S1) can be viewed as a buying opportunity while a break below RM1.46 (S2) would be highly negative.

PUC (Not Rated). PUC’s share price gained for a third-straight day with a 0.5 sen (3.3%) climb yesterday to RM0.155. The share price has been on a positive trend since the start of the year, having broken out at RM0.07 and subsequently rallying to as high as RM0.175 barely three months later (March). Although the share price had since consolidated back to RM0.13 recently, this week’s gains signal yet another breakout, which brings us to believe that PUC is poised for an uptrend resumption. From here, expect a retest of March’s high of RM0.175 (R1), before a possible move to RM0.19 (R2) next. Downside support levels are RM0.13 (S1), failing which further support is located at RM0.12 (S2).

Source: Kenanga Research - 26 May 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 27, 2024

Created by kiasutrader | Nov 27, 2024