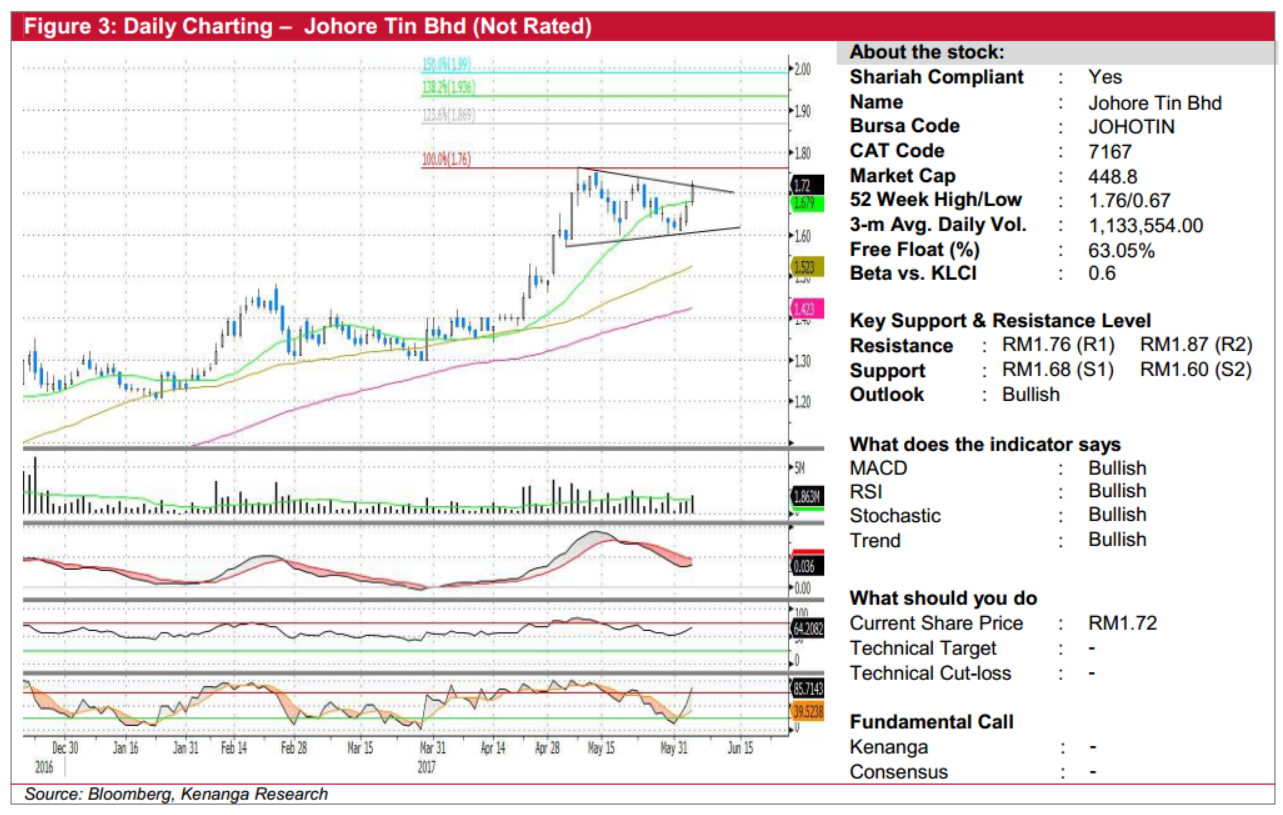

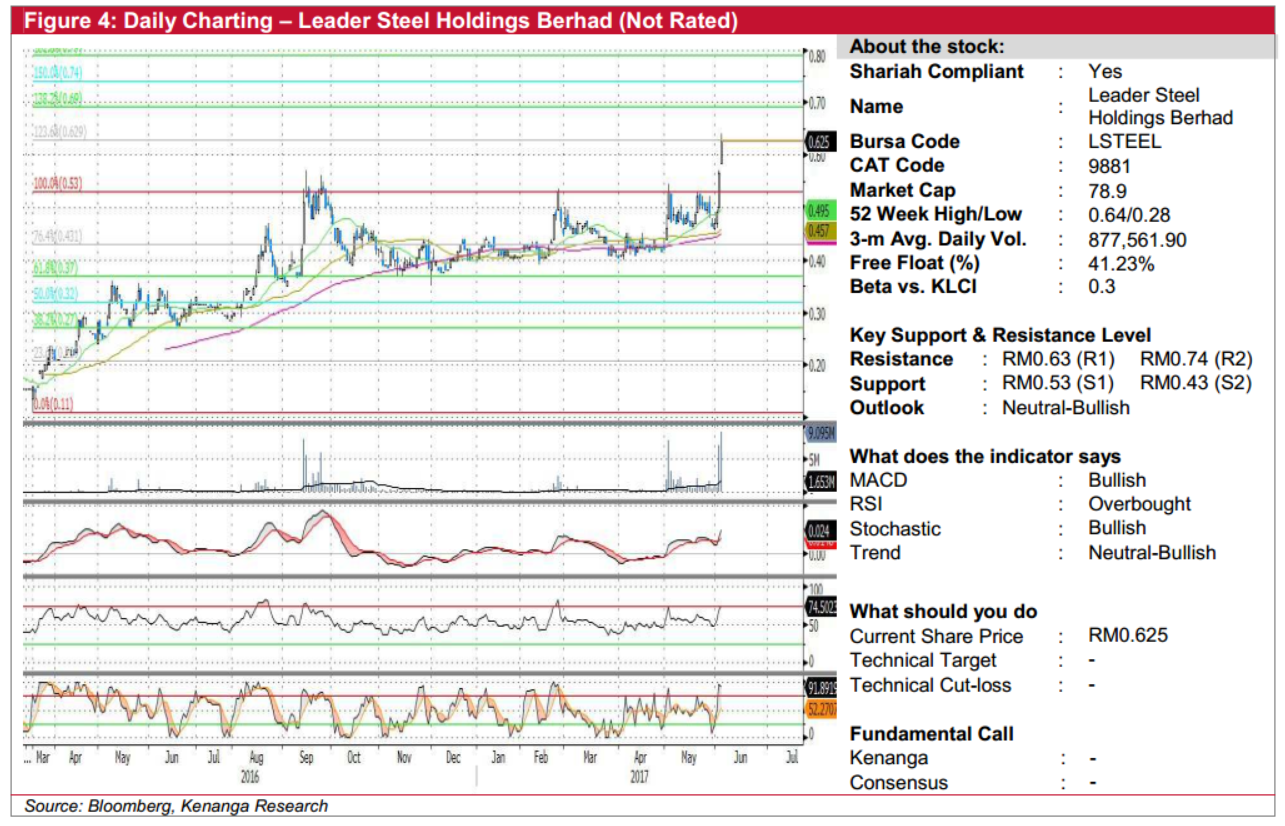

Daily Technical Highlights - (JOHOTIN, LSTEEL)

kiasutrader

Publish date: Tue, 06 Jun 2017, 10:19 AM

JOHOTIN (Not Rated). JOHOTIN’s share price climbed for a third-straight day yesterday, ending the day up by 5.0 sen (3.0%) at RM1.72. The company had earlier last week announced its 1Q17 NP which more than doubled to RM10.3m (1Q16: RM4.5m). Chart-wise, JOHOTIN’s short-to-longer term trend is positive. With yesterday’s bullish move, the share price has broken out of a narrowing range which signals a continuation of its uptrend after a brief 3-week pause. At the same time, both the RSI and Stochastic indicators have hooked upwards into bullish territory. Hence, investors may expect further gains from here. Immediate resistance levels to look out for are RM1.76 (R1) and RM1.87 (R2) while downside support levels include RM1.68 (S1) and RM1.60 (S2).

LSTEEL (Not Rated). LSTEEL had been forming an ‘Ascending Triangle’-like chart pattern over the past year, while it staged a technical breakout from its multi-year resistance-turned-support level of RM0.535 (S1) last Friday on strong trading volume. Yesterday, the stock formed a second white candlestick while performing a technical gap-up, closing 6.0 sen (10.62%) to close at RM0.625. In tandem with that, the bullish convergence of MACD and strong upticks displayed by RSI/Stochastic further lay a hand on the bullish-bias outlook ahead, albeit being in initial stages of being overbought. From here, LSTEEL could look to climb further up towards RM0.63 (R1) and possibly RM0.74 (R2). Support levels are tied at RM0.53 (S1)/RM0.43 (S2).

Source: Kenanga Research - 6 Jun 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 27, 2024

Created by kiasutrader | Nov 27, 2024