Daily Technical Highlights - (SUNWAY, TECFAST)

kiasutrader

Publish date: Thu, 15 Jun 2017, 01:39 PM

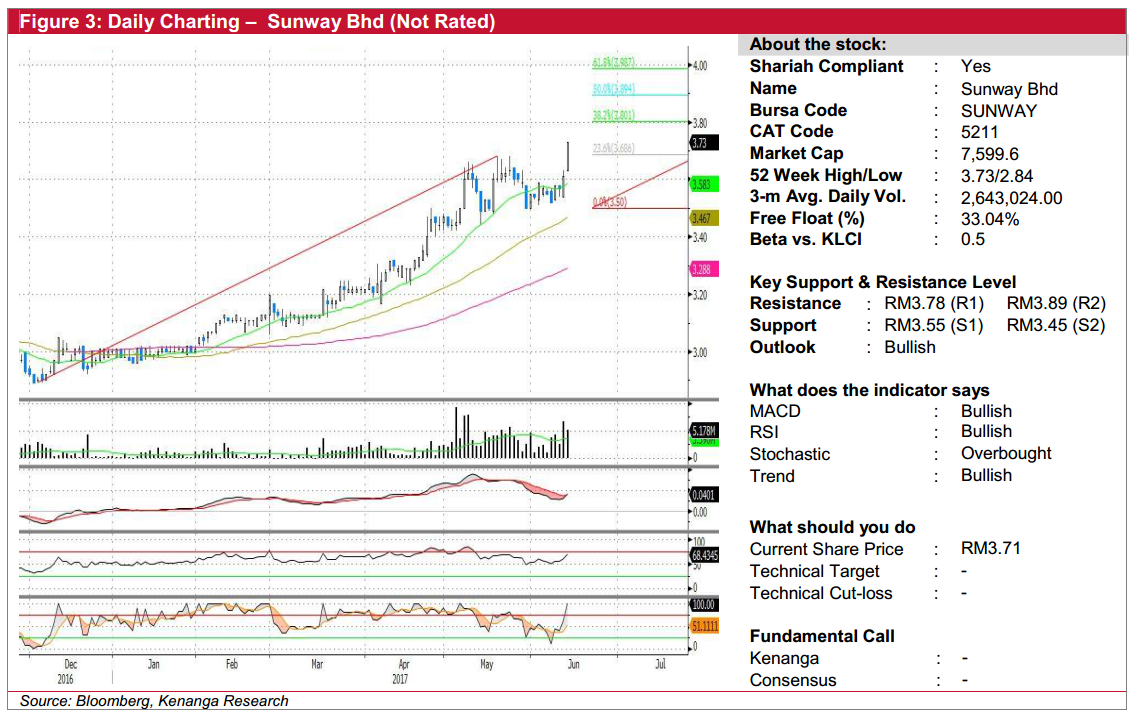

SUNWAY (Not Rated). SUNWAY saw its share price rallying 12.0 sen (3.3%) yesterday to a closing high of RM3.73 after the company announced a 4-for-3 bonus issue. On the daily chart, SUNWAY has been on a healthy uptrend since December. Although SUNWAY subsequently entered into a sideways consolidation phase, the share price is now poised to resume its prior run as a result of yesterday’s bullish move. Notably, the MACD has now crossed back above the Signal line while the RSI has hooked upwards into a bullish state. From here, the next resistance to look out for is RM3.78 (R1), beyond which RM3.89 (R2) is located further up. Downside support levels are RM3.55 (S1) and RM3.45 (S2).

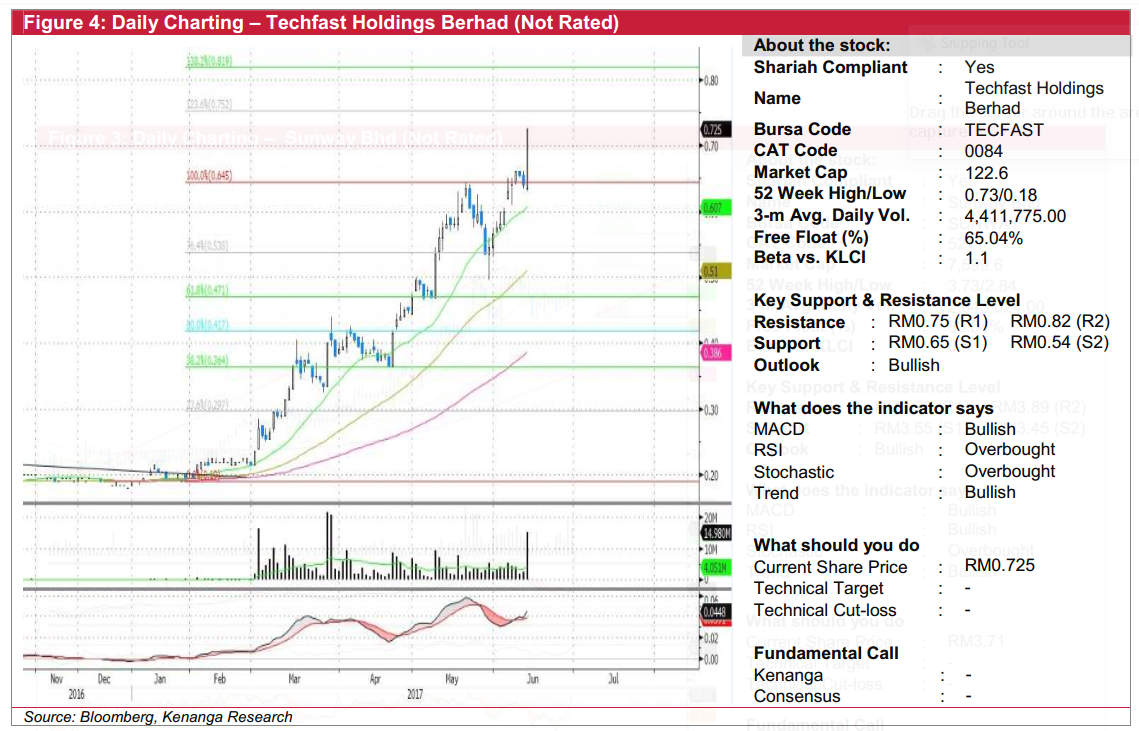

TECFAST (Not Rated). Yesterday, TECFAST saw an 8.5 sen jump (13.3%) to close at RM0.725. This comes after a few days of sideways consolidation, and marks as a decisive breakout above the RM0.645 resistance level which it tested twice in the past month. Trading volume spiked to 15m shares, almost quadruple the daily average of 4m shares while the MACD line is demonstrating healthy signs of bullish convergence. From here, we expect the share price to be positively biased towards resistances at RM0.75 (R1) and RM0.82 (R2). We also expect buying supports to emerge at RM0.65 (S1) and RM0.54 (S2)

Source: Kenanga Research - 15 Jun 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-27

SUNWAY2024-11-27

SUNWAY2024-11-27

SUNWAY2024-11-27

SUNWAY2024-11-27

SUNWAY2024-11-27

SUNWAY2024-11-27

SUNWAY2024-11-26

SUNWAY2024-11-26

SUNWAY2024-11-26

SUNWAY2024-11-26

SUNWAY2024-11-25

SUNWAY2024-11-25

SUNWAY2024-11-25

SUNWAY2024-11-22

SUNWAY2024-11-22

SUNWAY2024-11-22

SUNWAY2024-11-22

SUNWAY2024-11-21

SUNWAY2024-11-21

SUNWAY2024-11-21

SUNWAY2024-11-21

SUNWAY2024-11-20

SUNWAY2024-11-20

SUNWAY2024-11-20

SUNWAY2024-11-20

SUNWAY2024-11-19

SUNWAY2024-11-19

SUNWAY2024-11-19

SUNWAY2024-11-19

SUNWAY2024-11-18

SUNWAYMore articles on Kenanga Research & Investment

Created by kiasutrader | Nov 27, 2024

Created by kiasutrader | Nov 27, 2024