Daily Technical Highlights - (SAM, ANCOM)

kiasutrader

Publish date: Tue, 20 Jun 2017, 09:53 AM

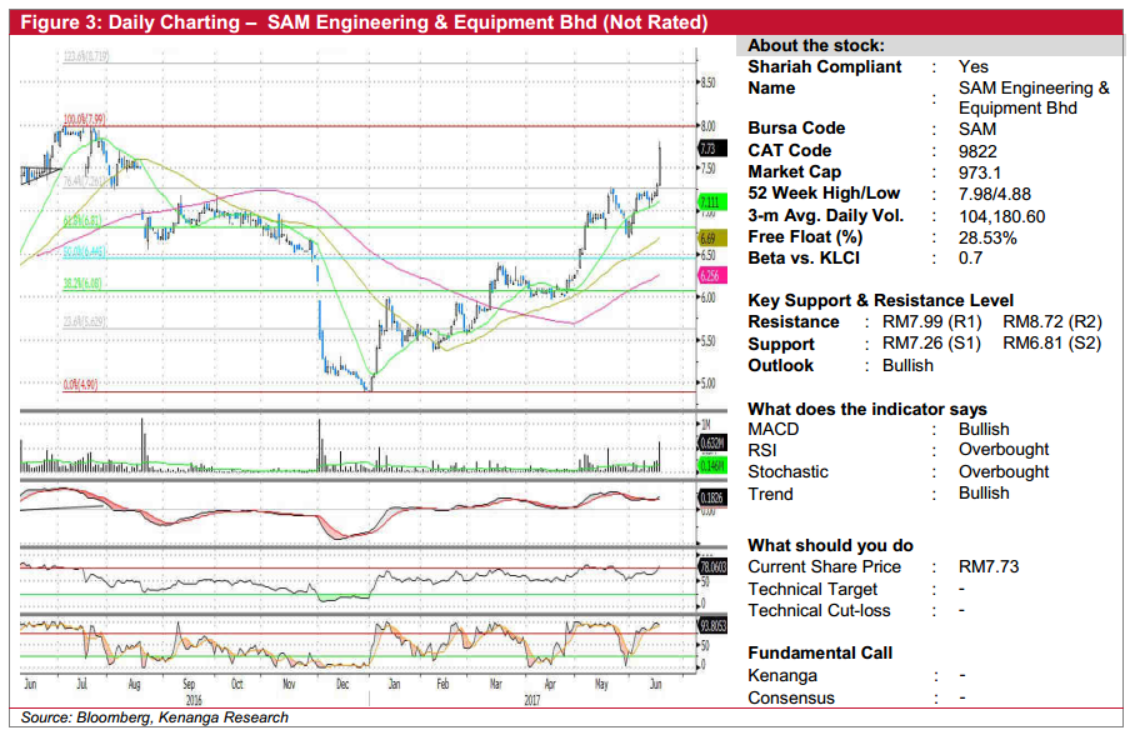

SAM (Not Rated). Despite the weaker performance on the broader market, SAM saw its share price rallying 43.0 sen (5.9%) to RM7.73. Chart-wise, SAM’s overall trend is bullish over the short-to-longer term trend. At the same time, the key momentum indicators such as the MACD and RSI are in a bullish state. From here, we expect bias to be on the upside, with a swift retest of its one-year high of RM7.99 (R1). Should this key resistance be taken out in a decisive manner, further gains would then be expected towards RM8.72 (R2) next. Any near-term downside is likely to be limited to RM7.26 (S1), failing which, the next support is present at RM6.81.

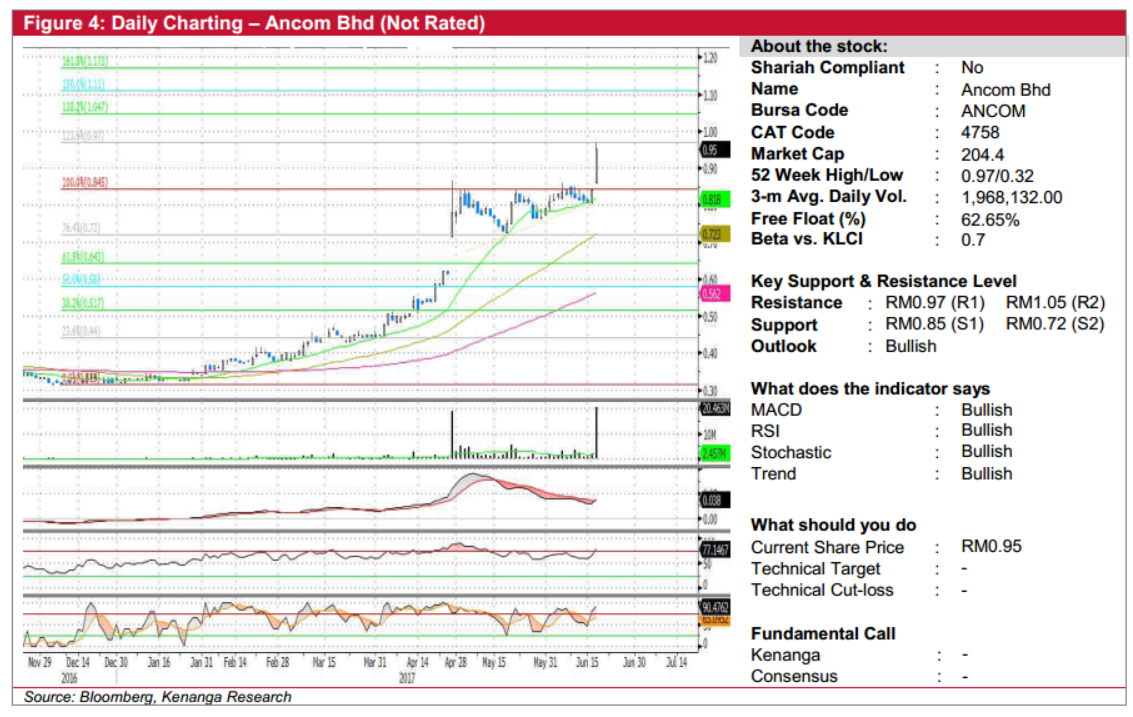

ANCOM (Not Rated). ANCOM rallied 11.0 sen (13.1%) yesterday to close at a new high of RM0.95 amid news flows from The Edge Malaysia suggesting that a group-wide restructuring exercise may be at play. Trading volume was exceptionally high with 20.7m shares changing hands, nearly 8x its daily average volume of 2.5m shares. We believe yesterday’s move marks a decisive breakout from the RM0.85-0.87 resistance level which was tested several times since late-May. Indicator wise, yesterday’s surge brought an uptick in the MACD to converge with its Signal line, ending its short downtrend since mid-May. From here, we expect the share to meet with an immediate resistance at RM0.97 (R1), which it tested in yesterday’s intra-day trading. Once taken out decisively, the next resistance to eye is RM1.05 (R2). An immediate resistance-turned-support can be identified at the aforementioned RM0.85-0.87 level (S1), with another support at RM0.72 (S2) further below.

Source: Kenanga Research - 20 Jun 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-26

ANCOMNY2024-11-26

SAM2024-11-26

SAM2024-11-25

ANCOMNY2024-11-22

ANCOMNY2024-11-21

ANCOMNY2024-11-20

ANCOMNY2024-11-20

SAM2024-11-19

ANCOMNY2024-11-19

ANCOMNY2024-11-19

ANCOMNY2024-11-19

ANCOMNY2024-11-19

ANCOMNY2024-11-19

SAM2024-11-18

ANCOMNY2024-11-18

ANCOMNY2024-11-18

ANCOMNY2024-11-18

ANCOMNY2024-11-18

ANCOMNYMore articles on Kenanga Research & Investment

Created by kiasutrader | Nov 27, 2024

Created by kiasutrader | Nov 27, 2024