Daily technical highlights - (KOSSAN, HAIO)

kiasutrader

Publish date: Tue, 11 Jul 2017, 02:27 PM

KOSSAN (Not Rated). KOSSAN rose to its highest level since last November, after the share climbed 15.0 sen (2.3%) to RM6.75. Chart-wise, yesterday’s bullish move signals a crucial breakout above RM6.60 resistance level. As a result, KOSSAN’s short-term technical outlook has improved significantly. The 50-day SMA has also just completed a “Golden Crossover” with the 100-day SMA which indicates that the medium-to-long term technical outlook is also set to improve after being sideways for more than a year. From here, we expect the share price to retest the RM7.00 (R1) resistance next before a potential move to RM7.56 (R2) further up. Downside supports are RM6.60 (S1), and RM6.30 (S2) below.

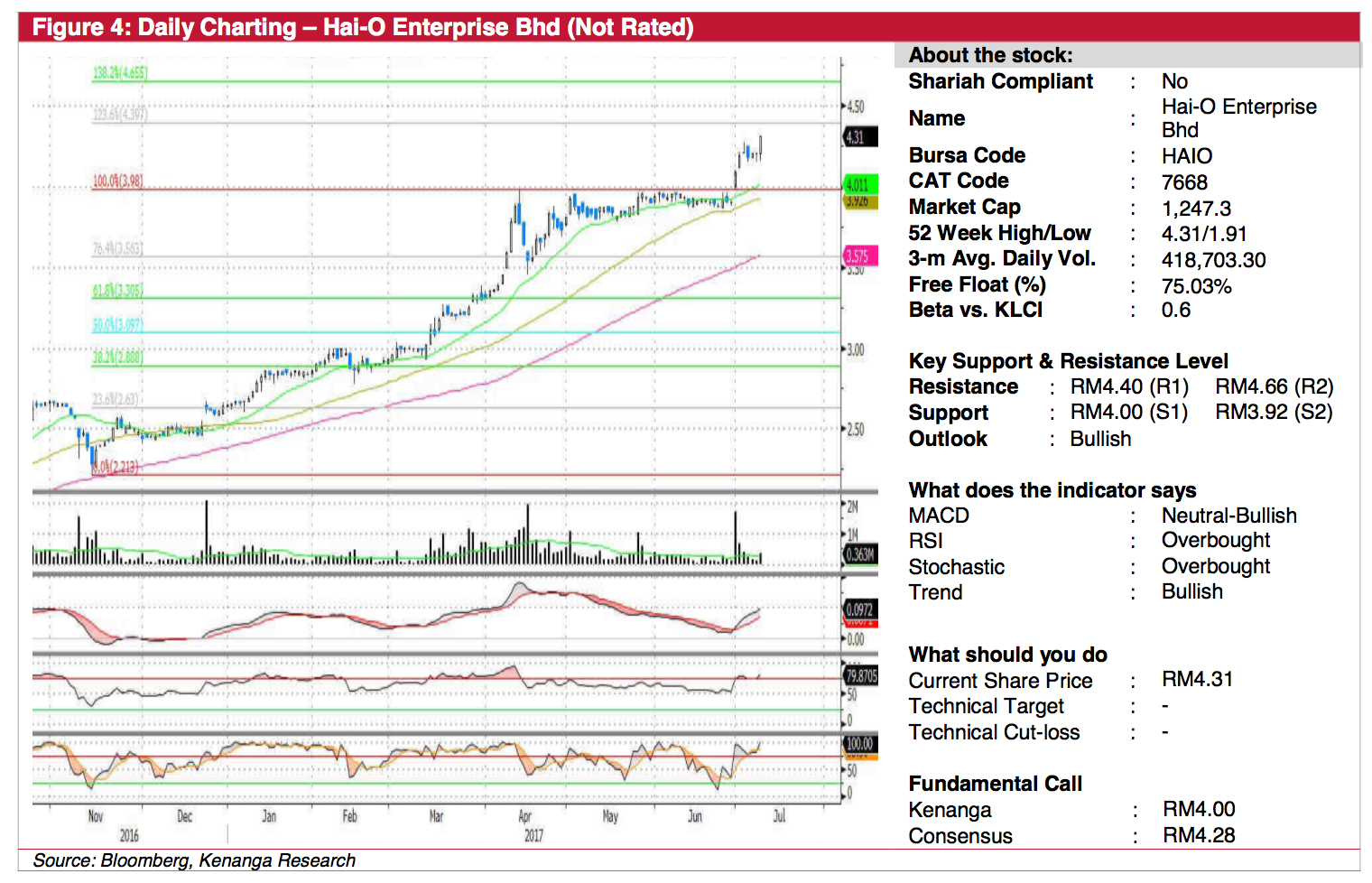

HAIO (Not Rated). HAIO’s share price rose to a fresh record, ending the day with an 11.0 sen (2.6%) gain to RM4.31. Chart-wise, the share price had been on a steady uptrend since November last year, having nearly doubled from a low of RM2.21. More recently over the past three months, the share price entered into a period of sideways consolidation. However, with the recent jump in trading interest, the share price has now punched-through the crucial RM3.98/RM4.00 resistance. Looking ahead, HAIO has a clear path towards RM4.40 (R1) and possibly RM4.66 (R2) next. Any weakness back to the RM3.98/4.00 (S1) may be viewed as a buying opportunity, although a decisive move below RM3.92 (R2) would be highly negative.

Source: Kenanga Research - 11 Jul 2017

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 27, 2024

Created by kiasutrader | Nov 27, 2024

Created by kiasutrader | Nov 27, 2024