Daily Technical Highlights - (MBSB, MAGNA)

kiasutrader

Publish date: Wed, 12 Jul 2017, 04:40 PM

MBSB (Close position @ RM1.24). Recall that previously, we issued a “Trading Buy” recommendation on MBSB (report dated 21-March), after the share had staged a multi-month consolidation breakout. However, following that, the share performed poorer than expected, falling into an extended period of consolidation. With the share dropping a further 3.1% (4 sen) yesterday to close at RM1.24, the previous technical reading no longer seems to be intact. All key indicators are displaying mild downtrends, with the MACD crossing below its Signal and zero line. Currently, upside appears fairly limited, with a strong resistance being identified at RM1.36 (R1). Beyond that, expect another resistance further up at RM1.52 (R2). Support levels can be identified at RM1.20 (S1), with another at RM1.10 (S2) further below.

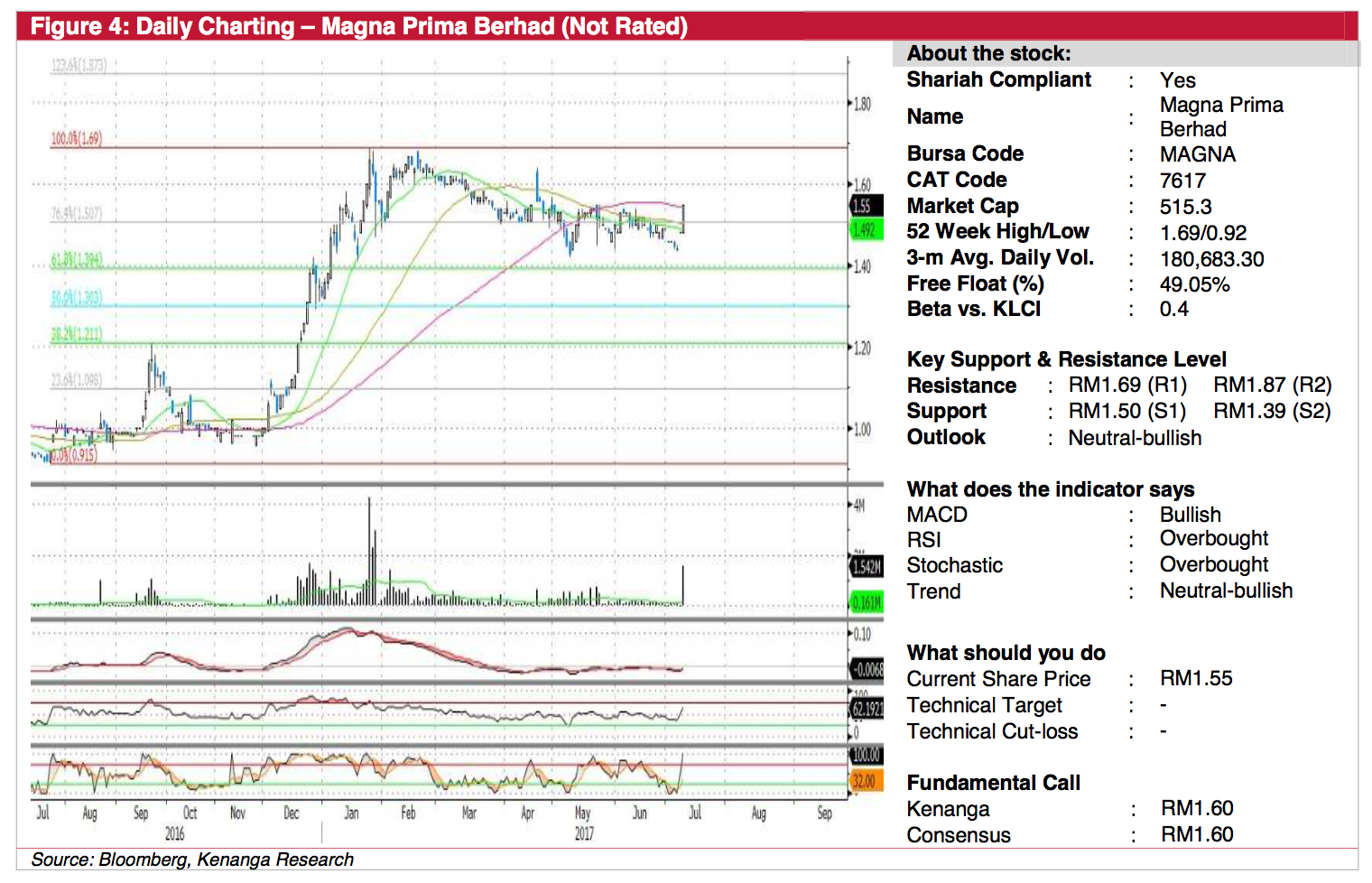

MAGNA (Not Rated). MAGNA caught our attention yesterday after it jumped 7.0 sen (4.7%) to close at RM1.55, with exceptionally high trading volume - 1.5m shares traded hands yesterday, as compared to its daily average of merely 161k shares. Indicator-wise, yesterday’s price action brought an uptick to all key indicators, with the MACD just crossing above the Signal line, creeping near towards the zero-line. From here, follow-through momentum would bring the share closer towards its all-time high of RM1.69, with a resistance range of around RM1.63-1.69 (R1). Breaking beyond that, the next resistance is placed at RM1.87 (R2). An immediate resistance-turned-support can be identified at around RM1.50-1.51 (S1), with another lower support at RM1.39 (S2).

Source: Kenanga Research - 12 Jul 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 27, 2024

Created by kiasutrader | Nov 27, 2024

Created by kiasutrader | Nov 27, 2024